‘Chasing debts hard’: Warning for Aussies who copped a tax bill last year

If you’re one of the many Aussies who were hit with a surprise bill after lodging your tax return last year, we have some bad news for you.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Aussies who were hit with a surprise bill last year after lodging their tax return have been issued a stark warning ahead of the end of the financial year.

From July 1, people will be able to start lodging their tax return and, if last year is any indication, for the next few weeks social media is going to be flooded with Australians complaining about what they did or didn’t get back.

Aussies who recieved an unexpected tax bill last year may be in for another rude shock, with tax lawyer Harry Dell revealing many people could see the same thing happen again.

“Most people who received surprise tax bills last year will probably get them again, unless they have found the cause and fixed it,” he told news.com.au.

There are multiple reasons someone may receive a tax bill.

One reason may be your employer not withholding your HECS-HELP repayments, which means that, at tax time, you are left with a big chunk of money you need to pay towards that debt.

The Medicare levy surcharge threshold, which is $90,000 for individuals and $180,000 for couples, is another area where people tend to get tripped up.

Mr Dell said people can get stuck with bills because they are just over threshold, don’t include their partners income when lodging their return or have the wrong private health cover.

He said that not budgeting for capital gains tax is another area people need to look out for.

“This could be crypto, shares, or anything, as amounts aren’t withheld for tax like your salary and wages,” he said.

Last year, countless Aussies were left fuming after lodging their tax returns, expecting to receive a nice cash boost, only to find out that they owed the Australian Taxation Office money.

Many of them then took to social media to vent their frustrations and lash out at the ATO.

“Right, how the f**k do I owe the ATO $2000 when I gave them $48,000. The government is f**king every c*** like aways,” 23-year-old worker Tyrone said in a viral video at the time.

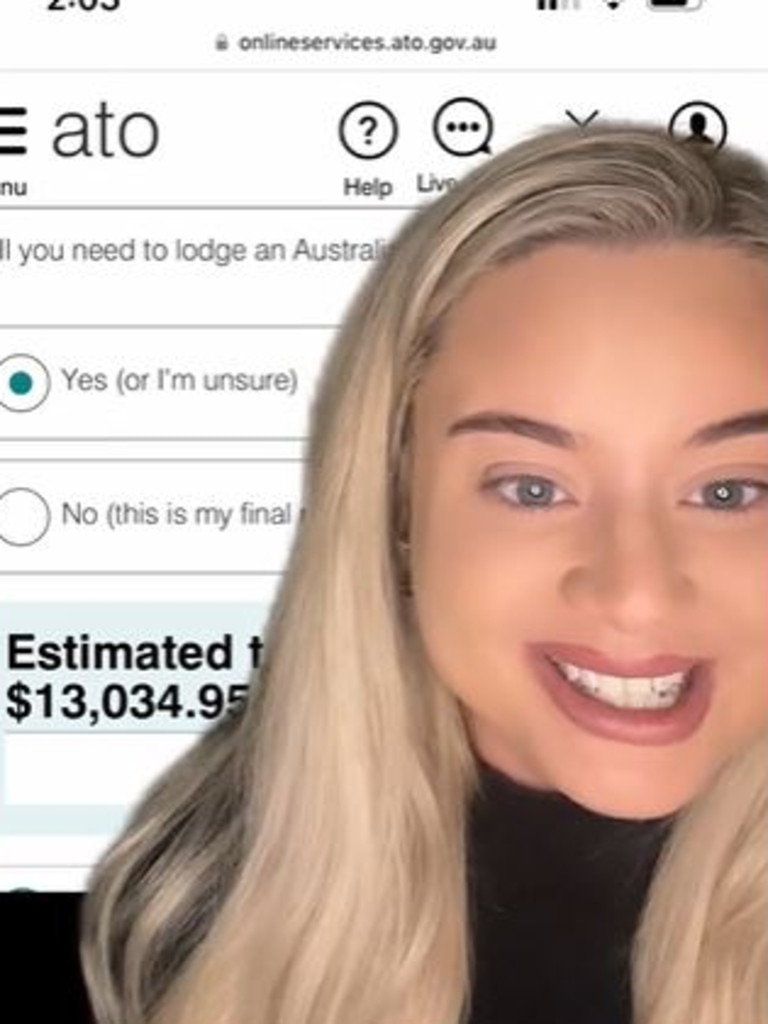

Gold Coast woman, Marina, also lashed out online after being hit with a whopping $13,000 tax bill, despite claiming she had paid $48,000 over the previous 12 months.

“So I have paid like 48 per cent tax on some of my pay cheques and apparently I owe them $13,034.95. Merry f**king Christmas babe. Good on you. I am f**king shaking,” she said.

“I am so glad I paid nearly $50,000 in tax and that is how I get repaid. Like I actually want to scream.”

For people who lodge their returns this year to find they owe money to the ATO, Mr Dell said their priority needs to be finding out why they have been hit with a bill.

“The Pay As You Go Withholding system is designed so you overpay a little and get a refund at the end of the year – without any deductions,” he said.

“If you can’t see why enough wasn’t withheld, get a professional to explain your tax return and what caused the surprise bill.”

He also urged people to claim all the deductions they are entitled to and to ensure they are including the correct information on their return.

ATO ‘chasing debts hard’ this year

Mr Dell warned that the ATO’s attitude towards tax returns in 2024 is “much less forgiving” than previous years.

“Much less leniency for mistakes, and less likely to waive interest and penalties, and chasing debts hard. Get professional help early if you think you need it, accountants will be very busy this year,” he said.

New data, commission by Officeworks, found that 26 per cent of young Aussies aged 18-29 are worried about owing money to the ATO this year, compared to just eight per cent of people over the age of 65.

Of this age group, almost two in five plan on completing their own tax returns this year to save money.

Despite this, 87 per cent say they are just as confused or more confused than last year about completing their tax return.

Aussies who work from home have already been issued a stern warning, with remote working expenses one of the key areas the ATO is cracking down on this year.

Workers have been warned not to “double dip” when submitting their tax return, with ATO Assistant Commissioner Rob Thomson saying WFH expenses are one of the areas that people are most likely to get wrong.

He said that, while these mistakes are often genuine, there are also cases where they are “deliberate”.

Last year, more than eight million people claimed a work-related deduction, with around half of those claimed for working from home.

There are two different ways employees can calculate their work from home deductions: the fixed rate and the actual cost method.

Mixing up these methods is what often leads to people ‘double dipping’, whether they realise they are doing it or not.

“One thing we’re focused on this year is making sure that people don’t double dip, so they don’t claim things like their internet or their phone expenses separately if they’re using that fixed rate method,” Mr Thomson told the ABC, adding that the other area of focus is record keeping.

“People need to keep a record of all the hours they’ve worked from home for the whole year.

“Now that can be a time-sheet, that can be a spreadsheet, that can be a diary, whatever the person wants that works for them.”

Originally published as ‘Chasing debts hard’: Warning for Aussies who copped a tax bill last year