Charles Goode warns of stockmarket risks and says it’s crucial to engage with boards on climate change

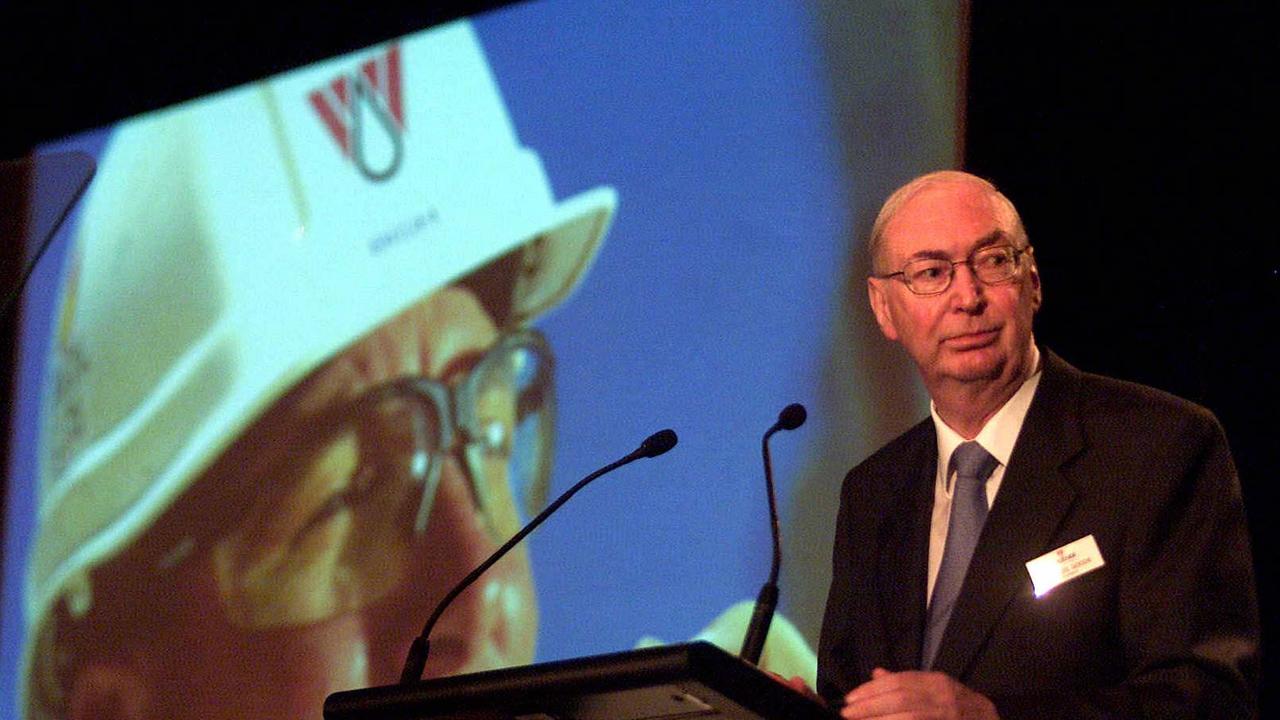

Veteran investor Charles Goode says a number of risks threaten the continued rise of equity prices, while he prefers to engage with companies on climate change rather than dump stock and exit.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Investment veteran Charles Goode has warned of several risks that could threaten the continued rise of the Australian share market, ranging from a new strain of Covid-19 to the investor frenzy around tech stocks, with stagflation also rearing its head through global economies.

The Liberal Party stalwart and former ANZ and Woodside Petroleum chair has also waded into the climate change debate fought not only at the boardroom table but also among the nation’s largest institutional investors seeking to influence company policy, saying he believed in engagement with companies instead of selling out.

Mr Goode said he supported the philosophy of “engage rather than exit” when steering a company to better understanding and enacting climate change protocols.

“The impact of climate change and ESG (environment, social and governance) is receiving more attention in the investment community,” Mr Goode told shareholders at the annual general meeting on Wednesday for ASX-listed investment company Australian United Investment, the $1.24bn investment fund he chairs.

“Companies are increasingly providing shareholders with environmental reports; scenario plans of how various climate conditions could impact their performance; commitments to emission reduction targets; and the inclusion of environmental key performance indicators in their remuneration criteria.”

Mr Goode, one of Australia’s most experienced company directors, said shareholders were actively campaigning and lobbying boards, especially around climate change and where industry groupings a company might be a member of is slow to embrace climate action.

“Shareholders are putting forward resolutions to focus the board’s attention on climate change and are challenging some companies as to whether they should continue to be members of their industry associations, where that association is not adequately embracing climate change.

“We are in the investor camp that engages in discussion with companies on their climate policies and actions rather than sell our shares to a shareholder who is presumably less concerned on such issues. We are in the ‘engage rather than exit’ category of investor.”

Turning to the broader economy and outlook, Mr Goode said the share market has had a good rise over the past year and Australian United’s portfolio had benefited from that.

“The year has benefited from quantitative easing, low interest rates and unprecedented government expenditure to cushion the impact of Covid-19, and the associated lockdowns, on the economy.”

However, Mr Goode said he saw four broad risks to the continued rise in markets.

“First, a new variant of Covid-19 closing down the economy. Second, rising international tensions in the East Asia/Pacific region. Third, an investor frenzy developing in the high technology sector leading it to be significantly overvalued and leading to a correction.

“Fourth, the economies of the world entering into a period of stagflation.”

Stagflation, when economies experience high inflation and weak growth, was generally considered to be caused by a supply shortage, Mr Goode said, and remained a risk given Australia entered the pandemic with weak productivity and a lack of reform.

“The argument then goes on that supply shortages mean higher input prices to businesses which then respond by cutting output or raising their prices. Higher prices squeeze households and lead to stronger demands for higher wages which in turn raise input costs and so the circle goes on,” he said.

“We entered the current period with weak productivity growth prior to Covid-19 and a lack of a zest for reform.

“We are now in danger of higher input prices from rising energy prices, higher shipping costs, supply disruptions as we are seeing in semiconductors, skill shortages in labour arising from restrictions on immigration and increased costs from environmental considerations compliance requirements and increased regulations.

“Stagflation therefore arises as a real risk.”

Australian United shares were up 0.9 per cent at $9.98 on the ASX on Wednesday afternoon.

Originally published as Charles Goode warns of stockmarket risks and says it’s crucial to engage with boards on climate change