Cbus’ influence on national housing policy ‘needs to be exposed’

It’s clear Cbus, under the ownership of the disgraced CFMEU, has been a key adviser to this government in developing its housing policy. We should be told why.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Superannuation is a compulsory savings scheme enacted by the parliament. The major beneficiaries of this scheme are the super fund operators, their owners and the many service providers.

The parliament’s interest in a scheme it enacted that provides significant tax incentives and locks away a material sum of workers’ income is understandably strong.

Last year the Senate established an inquiry into retirement incomes to examine issues such as housing, governance of the scheme and how insurance claims are handled. We have conducted a range of hearings and already completed two reports on superannuation for housing deposits and superannuation for mortgage offsets.

For some months, the Senate planned to bring Cbus before the Senate Economics Committee alongside prudential regulator APRA, Housing Australia and various other superannuation funds.

For reasons unclear to me, Cbus went to great lengths to avoid appearing before the committee. Cbus even wrote to the committee saying it was “prudent that we await the completion and publication of (an APRA) review before we appear at a public committee hearing”.

There are three main issues of public interest that must be examined.

First, Cbus is the only super fund to have publicly committed its members’ money to Labor’s Housing Australia Future Fund. Its chair, Wayne Swan, promised $500m in a commitment he made as chair – not chief investment officer.

Given the HAFF is the centrepiece of the government’s failed housing supply policy, the Senate has questions on the interaction between Cbus and the HAFF.

Second, Cbus remains under the ownership of the disgraced CFMEU. The parliament has put the CFMEU into administration but the union maintains a 21 per cent ownership stake of the Cbus super fund. The CFMEU also maintains three board seats on the fund.

The CFMEU is the party that helped drive the housing disaster where apartment buildings face a 30 per cent CFMEU tax. Why Labor thinks the people who helped create the housing crisis can solve it is beyond me.

Third, corporate cop ASIC is now alleging Cbus failed to properly administer and pay insurance claims for bereaved families. We specifically included the latter point in the terms of reference for the inquiry as it seemed the super funds were not doing the right thing by their members based on the data from the Australian Financial Complaints Authority.

I am not surprised about the insurance claims handling allegations and have asked ASIC about it at Senate Estimates on multiple occasions.

The Senate will continue to fulfil its constitutional role by investigating these matters, just as it has in relation to issues facing consulting firms and airlines.

The real question is why has Jim Chalmers been so keen to defend and help Cbus.

There are two key developments that trouble me when it comes to the Chalmers-Swan-Cbus cabal.

First, the Treasurer has filed an unfounded public interest immunity claim for Cbus.

In 2023, the Senate ordered Chalmers to disclose correspondence between his office and Cbus. Chalmers raised a public interest immunity claim, suggesting that the disclosure of the documents would damage Cbus’s commercial interests.

The Senate order was made alongside a Freedom of Information request for the same information that I lodged in my personal capacity.

While certain heavily redacted documents were released under FOI, most were exempt from disclosure as “commercial-in-confidence” by Chalmers.

The Information Commissioner reviewed this FOI decision and found that Chalmers’ refusal to disclose the documents was unfounded. The commissioner stated: “I do not accept that the remaining material would cause detriment if it were disclosed. The remaining material does not contain specific commercial information about the fund, rather it sets out its concerns about the operation of a particular area of superannuation regulation.”

The commissioner forced the disclosure of correspondence between Cbus officials and the Treasurer’s office, revealing that Cbus had been secretly campaigning for super funds to be exempt from including stamp duty in their fee and cost reporting for property investments.

In other words, Cbus was lobbying to hide investment fees from its members, and Chalmers wanted to keep it a secret.

Thank goodness for the Information Commissioner, who found these documents contained no commercially sensitive information.

Nonetheless, Chalmers was willing to make unfounded claims in response to the Senate order and FOI, which initially kept these documents out of the public eye.

Second, Chalmers appointed Cbus to a paid government committee on housing, which was only discovered through FOI requests. Correspondence released under FOI last week revealed that in December 2022, Housing Australia, then NHFIC, offered to pay a Cbus official to participate in an advisory panel to design the Housing Australia Future Fund.

It is clear that Cbus has been a key adviser to this government in developing its housing policy.

Cbus and Swan have been so important to Chalmers that the Treasurer was prepared to make unfounded public interest immunity claims. I am pleased Cbus belatedly accepted our invitation to the Senate hearing.

For better or worse, the nation is heavily invested in superannuation. The Senate’s job is to keep a close watch without being obstructed by any vested interest.

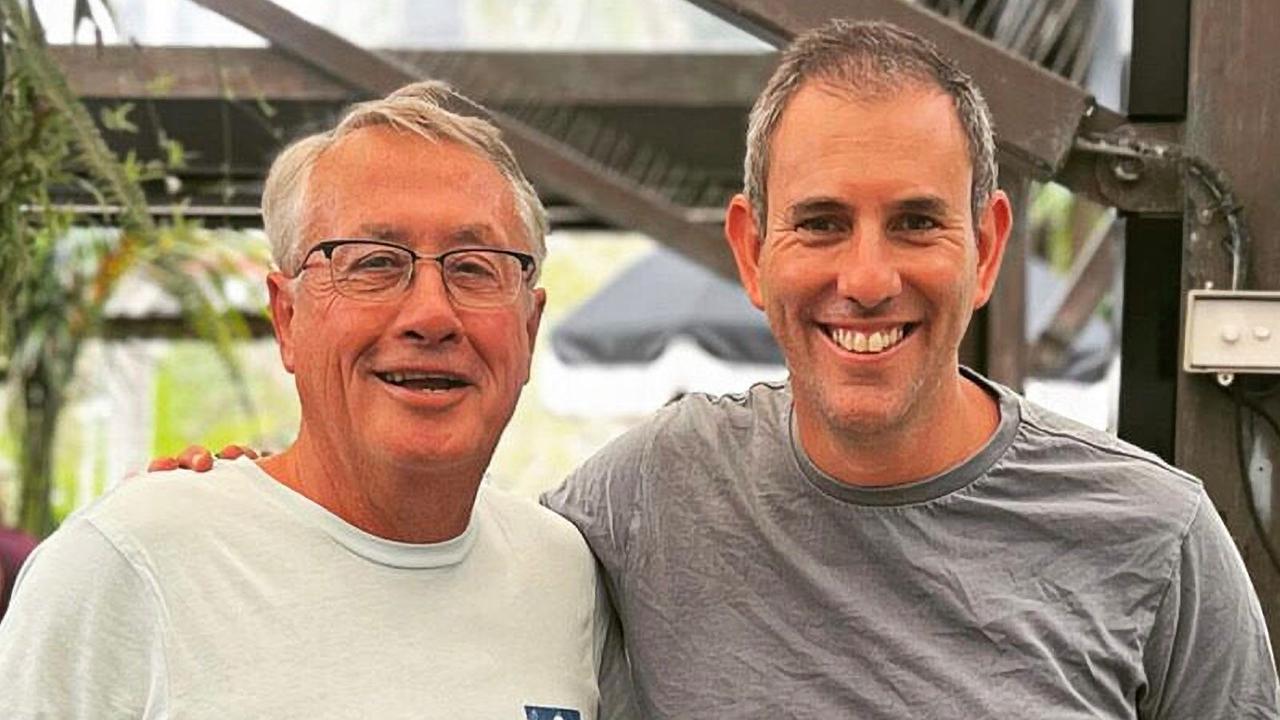

Senator Andrew Bragg is the Coalition’s spokesman on home ownership.

Originally published as Cbus’ influence on national housing policy ‘needs to be exposed’