Can Andrew Forrest really build another Fortescue again?

The green energy shift is well underway and Andrew Forrest is making an all or nothing bet on rebuilding Fortescue.

When Elizabeth Gaines finishes up as chief executive of Fortescue on Wednesday afternoon, the $60bn iron ore miner really is about to step into the unknown.

With a search for a replacement CEO pushed down to the bottom of Fortescue’s priorities for now, Gaines, who flagged her retirement last December, is the last link the market has on a tangible mining business that digs up ore, puts it on a train and ships it to markets into Asia.

Now Fortescue is aiming to become a world leader in a green hydrogen using technology that is still under development, difficult to store, and yet to be tested commercially. It is targeting the first sales as early as two to three years from now.

For investors, it all comes down to whether they are prepared to back Fortescue founder Andrew Forrest to do it all again.

Forrest, who owns a third of Fortescue, likes to make the comparison that the company is at the same moment of nearly two decades ago to disrupt the Pilbara iron ore stranglehold of BHP and Rio Tinto.

The full implications of Rio’s then-recent acquisition of North Ltd was just becoming clear as it reset the power balance in favour of the two iron ore miners, with Japan and China’s steel mills suddenly becoming price takers.

The billionaire who will step into the role as executive chairman for now says that back in its early days Fortescue was the David to the Pilbara Goliaths.

“We had no grounds, hardly any capital and certainly no way of getting anything we did find to market. Understandably the task was written off as impossible. You can be forgiven for thinking the same about now,” he says. “Fortescue will once again be the catalyst for change.”

There is no doubt Forrest’s ambition early this century was bigger than Fortescue’s balance sheet by a magnitude. Forrest had to think on his feet and this initially involved an attempt to force open access to the rail lines of the bigger rivals, but legal challenges ultimately forced Fortescue to build its own rail network.

By 2004 Fortescue had firm plans to develop a $2bn iron ore mine, rail and port facilities in Western Australia. It was at the start of its journey but had the backing of Chinese steel mills as customers as well as investors and was about to sign off on a definitive feasibility study.

That same year it had specific project milestones in place including a project financial close by 2005, construction by mid-2005 and a plan for first iron ore deliveries between 2006 or 2007. It was in May 2008 that the first iron ore was loaded onto a ship, marking just five years between a business plan being sketched out and 180,000 tonnes of ore being sent to customers.

The difference back then was Forrest did not set out to reinvent the wheel or sell into an entirely new market for his product.

His plan was to do what his rivals BHP and Rio Tinto were already doing – albeit from a standing start – and in the process he was increasing the supply of iron ore and the steelmakers of China were all too willing to support him.

Today Forrest wants to deliver 15 million tonnes of green hydrogen to market by 2030, with technology that is still being developed. Broader markets for green hydrogen still don’t exist today but they will soon, particularly as Europe looks to cut its dependence on Russian gas.

This is the sweet spot of where he wants to position Fortescue, that is, at the centre of future demand from customers for a clean, green energy while capturing a slice of the boom in green investing from big global pension funds.

Forrest acknowledges the challenge today is “much, much bigger” but the scale of Fortescue is much bigger too.

Green hydrogen promises to replace fossil fuels by using renewable energy to split water into its two basic elements – hydrogen and oxygen – which then can be used as an energy cell to power transport or used to fuel heavy industrial processes including steelmaking.

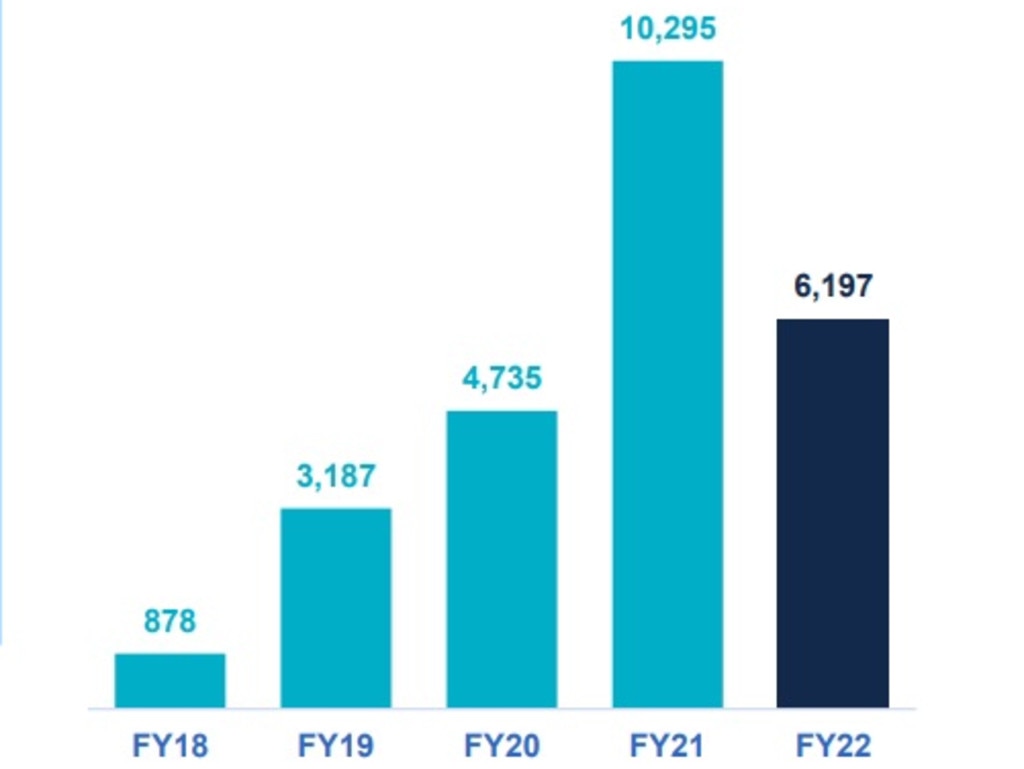

And the capital outlay for this is set to be enormous. Fortescue’s green energy arm Fortescue Future Industries has a capex budget of $US700m ($1.02bn), on the back of last year’s $US534m. Customers of hydrogen also need to spend billions to adapt to the technology which adds to the initial costs of the transition.

Forrest says Fortescue will be the first major heavy industrial company to pull off the massive challenge of pivoting to green hydrogen while keeping his iron ore cash machine running without a hitch – if things go smoothly.

Meanwhile, the ink is still drying on the Belinga iron ore exploration project Fortescue has signed with the Gabon government in west Africa and committed $US90m in spending. For any company this would be a big potential growth project, to accelerate an entry into Africa, while Rio Tinto also looks to be moving ahead with its Simondu resources bid in Guinea.

In the last financial year Fortescue shipped a record 189 million tonnes of iron ore and its cash costs of $US15.91 per tonne was close to market leader BHP and ahead of Rio Tinto.

Net profit was down 40 per cent to $US6.2bn with the average spot price of iron ore down from the previous bumper year. Forrest is targeting slightly higher output this year.

For now machine is running well, but some see the company as overpriced if the longer-term iron ore price pulls back below $US100 a tonne. And a hungry Fortescue Future Industries investment spread will continue to pressure cash flow.

Capital expenditure has been guided at between $US2.7bn to $US3.1bn this coming year, with as much as a third of this going to Fortescue Future Industries.

A new green boss

A lot is riding on the shoulders of Mark Hutchinson, the British born, University of Queensland commerce graduate who rose through the ranks of US industrial giant GE to run the conglomerate’s massive European business.

He is the one who is under pressure to deliver on the hydrogen supply agreements in a commercial form that Forrest has spent the past 18 months signing.

With the power vacuum left from Gaines’ retirement, Hutchinson is stepping into the void to become the operational face of Fortescue even though his remit has nothing to do with running the cash engine of iron ore.

Hutchinson says his career at GE was essentially 24 years of training to deliver and build up Fortescue Future Industries. He sees his mission as twofold – developing technology to eliminate emissions in Fortescue’s own mining business and then making green hydrogen in such a scale to deliver to customers around the world.

GE is all about efficient process and then the ability to deploy management ideas to improve productivity. At Fortescue Hutchinson will be required to build and deliver – quickly – and retain some of GE’s culture of discipline around project delivery.

Several green mega projects are on foot including the feasibility of converting the Gibson Island ammonia plant to being powered by green hydrogen, while the construction of FFI’s green energy manufacturing plant in Gladstone is underway with first production eyed for 2023.

He says the scale in front of Fortescue is enormous and the opportunity is there for Australia to become the Saudi Arabia of the green energy world.

Forrest wants to use the cash generated from iron ore to “commercially destroy global warming” and create an even stronger global business. Shareholders will need to make their minds up soon whether they are along for the second time, because Fortescue is changing right before us.

johnstone@theaustralian.com.au

Originally published as Can Andrew Forrest really build another Fortescue again?