Business needs to start planning for President Trump 2.0

Donald Trump’s Super Tuesday sweep puts him a big step closer to the White House. Boards need to start taking him seriously.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Donald Trump’s sweep of Super Tuesday should be a wake-up call for Australian business: start planning for President Trump 2.0.

Even those businesses that don’t have direct exposure to the US boards need to start war gaming what a second Trump presidency is going to mean for global trade and supply chains, energy markets, as well as the potential for geopolitics to be turned upside down.

Even with the legal cases piling up, businesses should be taking Donald Trump seriously.

They left their run much too late in the 2016 election and many were caught off guard when the property mogul up-ended Washington.

Trump took a big step closer to the White House after securing the majority of the US states holding Republican primary votes on Super Tuesday. The wins increase pressure on his only rival, the former South Carolina governor Nikki Haley, to pull out, meaning Trump is almost certain to clinch the Republican nomination.

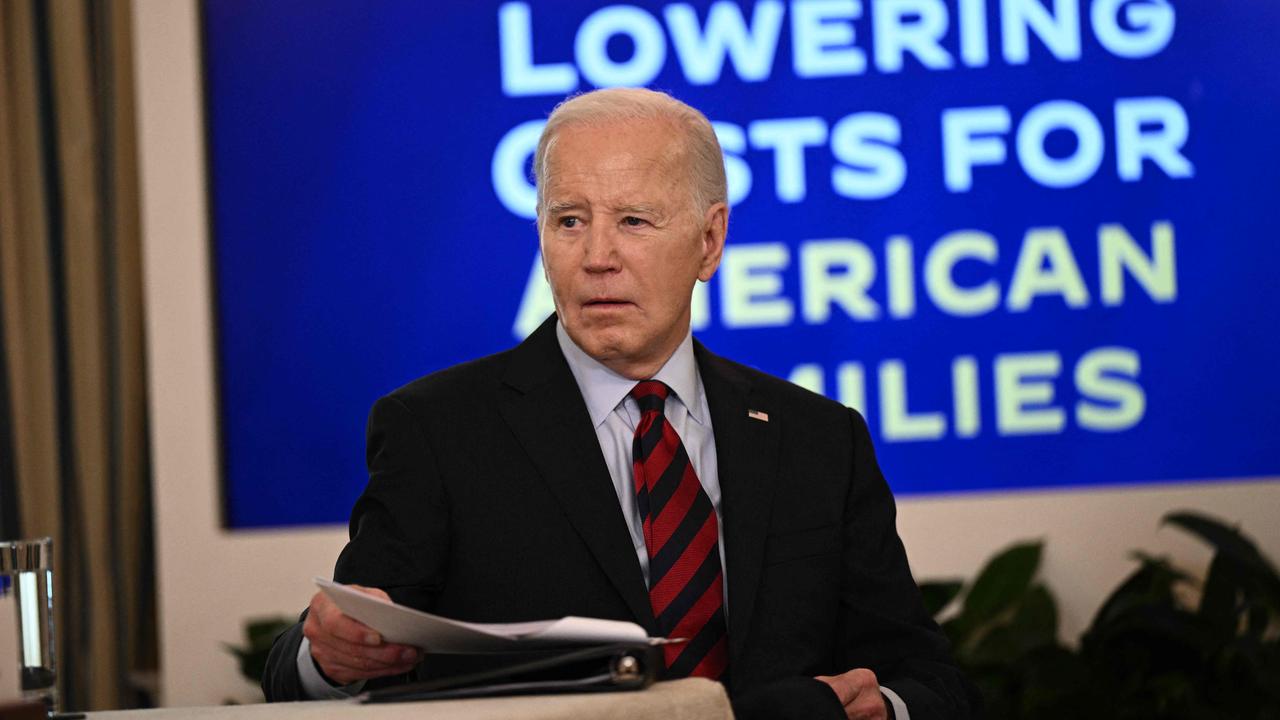

Results from delegation-rich state California were yet to be finalised, but early counting put Trump miles ahead there as well. In Democrat primaries Joe Biden too had won many of the 15 states through the day.

This paves the way for a rematch between Biden and Trump. So far voter surveys have the Republican kingmaker gaining the edge.

One well connected chairman of a major ASX-listed company said on Wednesday that he has told his management team to assume “a flat probability curve” of a Trump presidency after November’s vote.

“I think he’s going to win,” he said of Trump. This means to start planning now.

Key for business will be to look past the campaign rhetoric and get right into the themes.

Most of all, Trump will be driven to make a lasting mark on the world stage.

Like Trump’s previous time in the White House, the relationship between the US and China will be the defining theme and could again reroute global trade flows.

The thawing of relations under Biden could be quickly frozen under Trump. Australia, which counts China as its biggest trading partner by a significant margin, will again find itself caught in the middle.

Trump’s final year in office coincided with the Covid-19 pandemic and this marked the lowest point between US and China relations, and by rising confrontation. Resuming where he left off would be a hit to global supply chains and potentially have implications for global growth.

At the extremes, this could force some US companies to choose between the two countries.

Four years on since Trump was last in office, Taiwan and the security of the South China Sea is a more pressing issue than ever. Even so, China’s economic position is much weaker than four years ago, with a deeply stressed property market and a slowdown in consumer spending. This week. Beijing set down its GDP growth target for the calendar year of “about 5 per cent”, although economists doubt this figure will be met.

The arc of Trump’s entire presidency was “America first” and that was about bringing manufacturing, security and trade power back to the US. Trump hammered this theme into US CEOs and they should be prepared to spend more money at home.

Biden worked to reopen communication with China, culminating with two meetings with Chinese President Xi Jinping – first in Bali and then in San Francisco. Biden sought to keep the channels open, as well as finding areas to co-operate.

Still, Biden has got the ball rolling on critical minerals’ independence from China and is trying to develop onshore processing of lithium and other strategic minerals used in everything from batteries to wind turbines.

Europe will no doubt be left reeling from a Trump presidency, with US military aid to Ukraine in doubt. So too will be Trump’s commitment to NATO. Beyond the rhetoric including encouraging Putin to invade its neighbours, Trump is provoking Europe’s powers to spend more on defence.

Energy markets got a shock from Russia’s initial invasion. Gas prices could surge again and this will be felt here in Australia. Already, European businesses have been eyeing Australia as an investment destination. Last month France’s Saint-Gobain made a $4.3bn bid for CSR, citing a property construction market here outpacing the OECD.

Trump too is likely to drive faster growth from the stalling US economy, even if this comes at the expense of another inflation breakout.

Growth will be a boon for Australian companies like BlueScope Steel, Amcor, Transurban and James Hardie which all have large operations there.

Others like warehouse Goodman Group or Treasury Wines should get a boost; so too should QBE, a big provider of crop insurance. Australia’s industry super funds have sizeable infrastructure and property investments.

Still, a growth spurt could drive a wedge between the White House and the US Federal Reserve that might try to keep interest rates higher for longer. This will be one to watch for stock investors.

BHP and Rio Tinto, joint partners in the Resolution Copper Mine, in Arizona would most certainly get the fast-track for a green light for the massive project that is stalled over legal challenges from local landowners opposing it.

Trump has previously expressed support for the mine that could provide up to 25 per cent of US copper demands. Hard rock mining projects in the US are notoriously difficult to get approved, and no new mines have been commissioned since the global financial crisis. More than $US2bn ($3bn) has been spent on pre-development.

Energy policy will be a major battleground and Trump will move quickly to unwind Biden’s signature green energy push, the Inflation Reduction Act.

This is about directing investment in renewable energy. Trump would rather this move into conventional energy, and this means renewables will be taking a back seat. This could be negative for the likes of Macquarie Group, although the Australian investment bank is two steps ahead given its position as one of the biggest energy traders in the US.

Business too will need to start identifying the people that Trump surrounds himself with and are likely to take key roles in his administration. One name that keeps doing the rounds in Washington is Trump’s former national security adviser, Robert O’Brien, who has been floated as either a contender for vice president or Secretary of State.

There will be chaos in Washington again, markets will cheer, and Trump will want to hack into the size of the sprawling US bureaucracy.

Even if Trump ultimately falls short in November, businesses still need to be ready for the ultimate comeback.

johnstone@theaustralian.

.au

Originally published as Business needs to start planning for President Trump 2.0