Budget 2022: Chalmers’ choice – Go big. Go hard. Go Labor

For all the work the Treasurer has done in softening the electorate up for the coming economic storm, he has simply failed to seize the moment.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Jim Chalmers has missed his one and only political window to tackle Australia’s big economic issues, with an easy spending budget that does little to kick-off fundamental reform.

For all the hard work the Treasurer has done in softening the electorate up for some tough economic love as the storm clouds rapidly closing in, he has simply failed to seize the moment.

This means Australia is now stubbornly stuck on a path of budget deficits as far out into the future as can be seen.

Chalmers has left his predecessor’s debt pile virtually untouched, despite a windfall in company tax and commodity prices, with gross debt pushing up to $1.2 trillion or more than 43 per cent of GDP by 2026 with global borrowing costs surging.

Confronting inflation, cutting debt and the notion of financial discipline has been cast aside as Chalmers advanced centrepiece projects from a $15bn fund designed to pick industry winners to $20bn lending facility for the energy transition while helping to deliver an (unfunded) aspiration of one million low-cost homes.

Even spending on planning for a new high-speed rail agency has again found its way back into the budget papers.

The first budget of a new government should do all the heavy-lifting on the reform front. And with issues like the Ukraine war, global inflation and recessionary forces building in China, Europe and the US, Chalmers has rightly got more reasons than any first term government deliver pain in this budget.

This would leave the Albanese government more options if the global downturn is worse-than-expected and some scope to over deliver when it faces the electorate in two budget cycles from now.

Hidden time bomb

While the budget is big on warning about all the major baked-in spending pressures that are coming in the next decade from NDIS, debt-servicing, health and defence, the answer to these significant challenges is largely silence.

The real hidden time bomb on future budgets now comes in the form of unfunded Commonwealth superannuation liabilities. A reset for higher interest rates sees this figure blowing out to nearly $300bn by 2026 and a whopping $523bn by 2060. The Peter Costello-chaired Future Fund, set up to offset the liability, won’t be able to cover it all – particularly if markets are forecast to remain rocky for the medium term.

Chalmers insists his first budget begins the task of financial repair while ensuring he works in step with the Reserve Bank and doesn’t add to inflationary pressure. Although it is not making RBA governor Philip Lowe’s job any easier with deficits set to grow into the next four years.

This year’s budget deficit of $35bn has come in lower than the pre-election forecast, then climbs to a deficit of $38.7bn next financial year as Australia’s growth slows sharply.

Good housekeeping would should cap government spending somewhere below 1.5 per cent GDP so as not to add to inflation.

Next year’s deficit represents 1.6 per cent of GDP, increasing to a peak of 2.4 per cent by 2025.

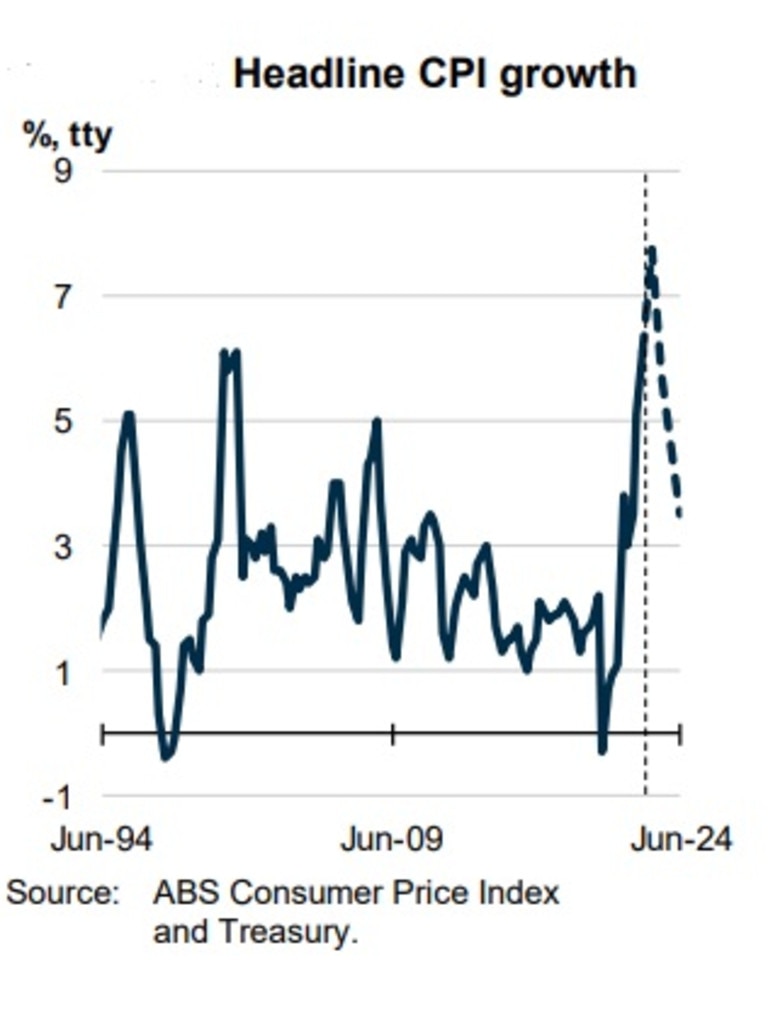

This supports Chalmers suggestion that inflation will stay higher for longer. Markets are pricing in the cash rate to peak close to 5 per cent by May next year, although economists are slightly more dovish with a terminal cash seen at 3.35 per cent during the March quarter. Higher inflation expectations coming from the budget could push interest rate expectations slightly higher.

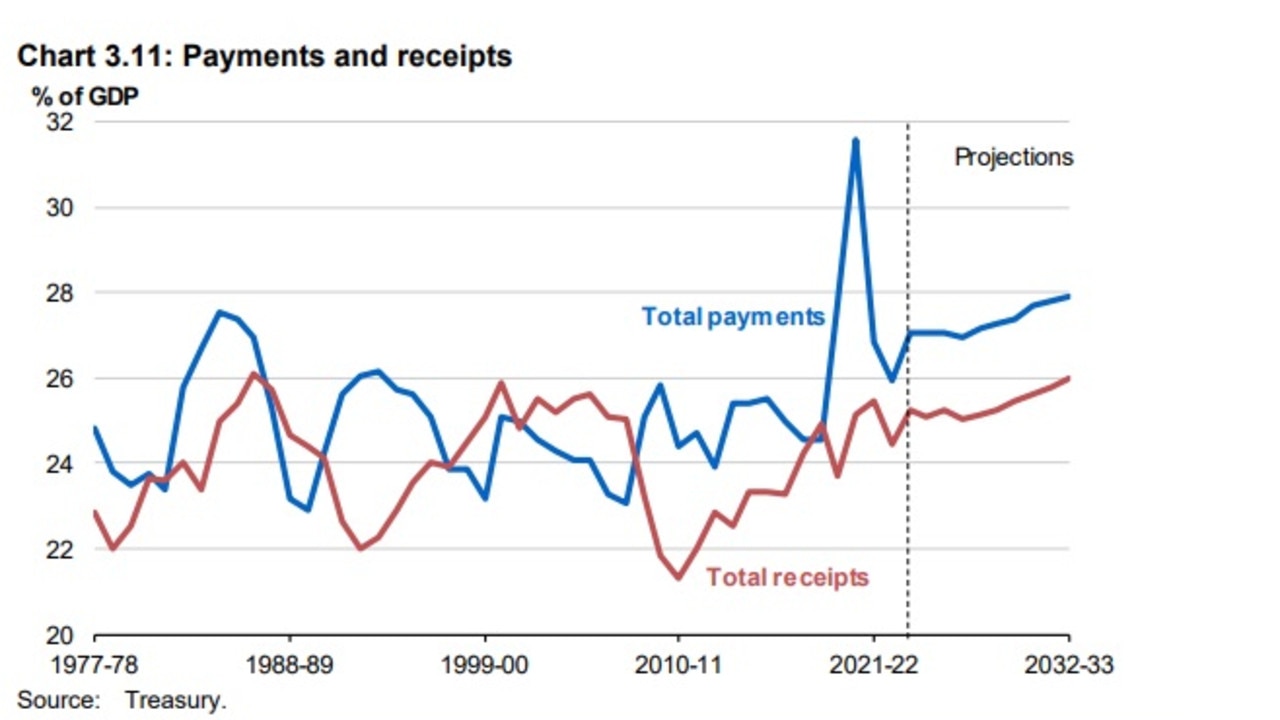

Tax receipts have been revised up by $144.6bn over the four years to 2026, but spending over the same period – excluding new policy measures – are set to rise by more than $92bn. These so-called fiscal jaws will move around with an election pushing spending higher further while a slower-than-expected economy will cut receipts.

Expenses as a per cent of GDP will be 27.4 per cent by 2025, compared to 27.1 per cent today.

The spending pressures spurred on by inflation will continue to build over the medium term with payments ultimately on track to grow faster than the economy.

Ratings agency Moody’s on Tuesday night said the budget would continue to support the nation’s AAA credit rating, but cautioned: “As revenue strength wanes it will be important that spending, particularly relating to long-term policy issues including the National Disability Insurance Scheme, health and defence, are managed effectively”.

Productivity hit

Worrying for business is that productivity growth – the key driver of the nation’s wealth – has been downgraded even with all the investment in skills including $1bn in TAFE funding and getting more females into the workforce through cheaper childcare.

Productivity has been slowing in Australia since the mid-2000s. It has averaged around 1.5 per cent over the past three decades, but only 1.2 per cent over past 20 years. Treasury says the slowdown is broad based across most industries and follows other advanced economies, suggesting there are trends in competition, technology or availability of skilled workers at play.

The lower productivity growth assumption has real world implications, slicing 1.75 per cent from GDP in a decade’s time which in term reduces the size of tax base in the face of demands on spending.

The Chalmers budget has been delivered as corporate Australia is trying to make sense of the mixed economic signals. Big businesses have emerged from the August reporting season in strong shape and for the most part companies are cashed up and have plans to invest. Many are sending tens of billions of surplus funds back to shareholders in the form of dividends or share buybacks.

Households on the other hand are significantly more nervous and are feeling the pinch from super-sized RBA interest rate rises. The widely watched Westpac Melbourne Institute consumer sentiment index remains anchored in deeply pessimistic territory, reaching the lows hit during the initial phase of the Covid pandemic.

The closely-watched NAB quarterly business survey released last week show business conditions remain strong across the board with business confidence also returning to be back above average. Leading indicators including capex intentions remain very strong and forward orders also remain robust.

However, companies say they straining under higher costs specifically around energy and sluggish supply lines are adding to pressure. Wage cost growth remains the biggest issue impacting business confidence while those with international operations are worried about recessionary forces building in the northern hemisphere.

Treasury is forecasting business investment to grow at 6 per cent in 2023 – led by non-mining investment, although moderate to 3.5 per cent a year later.

Chalmers will establish a $15bn National Reconstruction Fund over coming years which redirects spending across a number of legacy smart manufacturing programs looking to promote co-investments across seven key areas from critical minerals, hi-tech manufacturing, green energy to defence manufacturing.

New ACCC boss Gina Cass-Gottlieb has already scored an early win with corporates are on notice they are set to face tougher penalties for breaches of competition and consumer laws. Maximum penalties for corporations will increase to $50m per breach from $10m or the bigger measure of 30 per cent of annual turnover.

Elsewhere, Telstra should see funds directed its way for a more than $700m program to improve telecommunications in regional Australia including rolling out of mobile base stations to improve highway and underserviced community mobile coverage.

The $3 trillion superannuation sector was largely left untouched, but expectations are building that the industry funds will provide some of the cash to pay for the cheaper housing building blitz. Multinationals continue to be targeted in a tax crackdown and are forecast to deliver an additional $1bn in revenue over coming years.

Australia will again become one of the few western economies to avoid falling into a recession with domestic economic growth forecast to slow from 3.25 per cent this financial year to just 1.5 per cent in financial 2024. This represents a downgrade of 0.5 of a percentage point in just three months and down 1 full percentage point from April, underscoring how little room for error Chalmers has in his promises to strengthen the nation’s accounts.

johnstone@theaustralian.com.au

Originally published as Budget 2022: Chalmers’ choice – Go big. Go hard. Go Labor