Sea of red as Aussie share market falls on final full trading day of 2024, dollar falls to lowest yearly close

The Australian share market has endured a shocker final full day of trading for 2024 – with all but one sector closing the day lower.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The ASX sharemarket was a sea of red in a broad market sell off during the final full day of trading for 2024.

The benchmark ASX 200 index declined by 26.80 points or 0.32 per cent to close trading on Monday at 8235.00 points.

Despite the falls, the index recovered from its afternoon trading when it was down by 0.8 per cent at 2pm.

The broader All Ordinaries fell 24.10 points or 0.28 per cent to close trading on Monday at 8496.00 points.

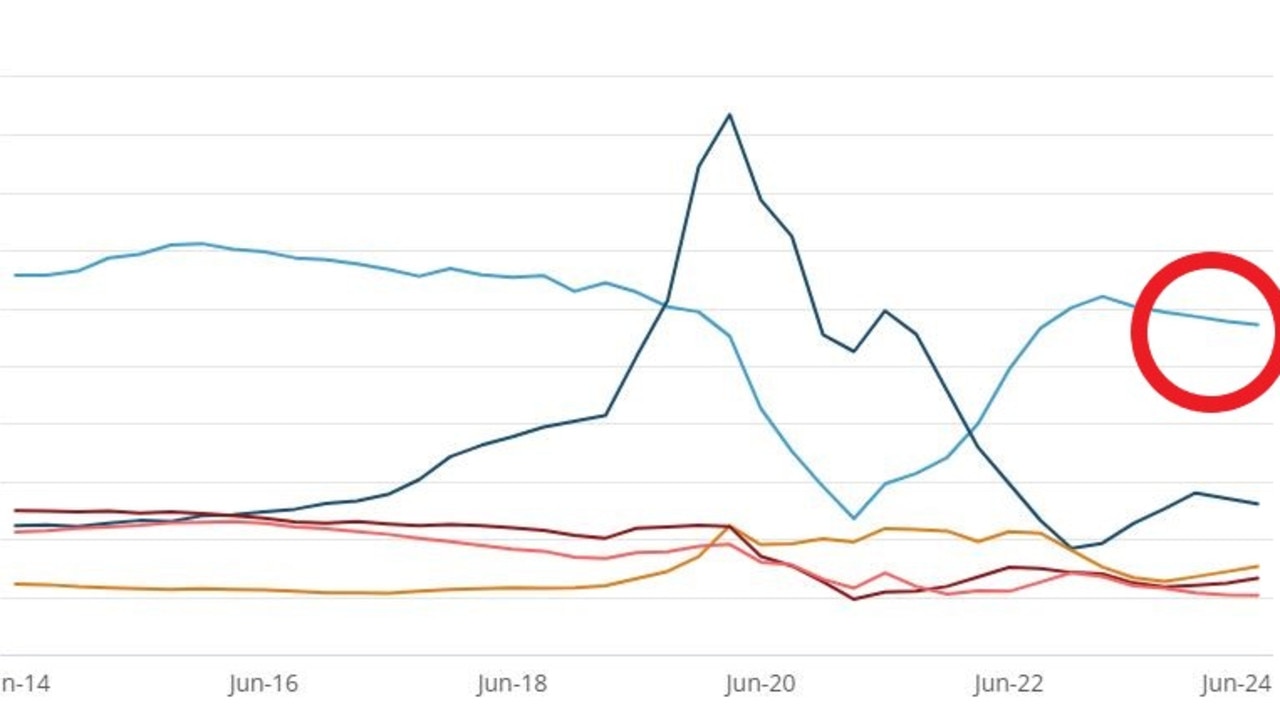

IG market analyst Tony Sycamore said the Australian dollar is poised to have its lowest yearly close since the covid pandemic, crumbling 9 per cent from 68.10 US cents at the start of 2024.

By the time of close on Monday, the dollar was buying US $62.45 cents.

“The downturn in the AUD/USD can be attributed in large part to offshore factors, including Donald Trump’s election victory, which is expected to lead to US fiscal expansion characterised by increased spending and tax cuts, “ Mr Sycamore said.

“This, in turn, is likely to result in stronger US growth, higher inflation, and, subsequently, higher interest rates, all of which contribute to a stronger US dollar,” Mr Sycamore said.

In a broad market fall, 10 of the 11 sectors closed the day lower.

Australian real estate investment trusts were the worst performing, down 1.8 per cent, while utilities, financial and industrials also fell by more than 0.65 per cent each.

All four of the major banks fell, with CBA underperforming the market, down $1.13 or 0.72 per cent to finish the day at $155.08. Westpac fell 0.34 per cent to $32.55, while NAB slashed 0.48 per cent during trading to finish at $37.40. ANZ was the strongest performing but still fell 0.17 per cent to $28.77.

“Banks, financials and tech were all weak, but it looked like the machines were running the market today, as they sold,” Bell Potter analyst Richard Coppleson said.

“There was no real buying, so once they got a trend going, it was easy for them to move stocks around.”

Meanwhile energy stocks were the best performing, rising by 1.18 per cent to be the only sector which traded in the green. Energy stocks are now up 3.55 per cent over the last five days.

Major rises included oil and gas exploration companies including Karoon Energy, which is up 3.46 per cent to $1.34 to be the best performing share on the ASX 200. Santos energy traded 1.68 per cent higher, while woodside also had a strong day up 0.95 per cent during Monday’s trading.

It was also a good day for Australia’s coal miners with the likes of Whitehaven Coal up 2.50 per cent while New Hope Corporation grew by 0.20 per cent.

The Falls in the Australian market follows weakness out of Wall Street with the Magnificent seven all trading down on Friday.

The S & P 500 dipped 1.1 per cent while the Dow Jones fell 0.8 per cent. The tech-heavy Nasdaq was the worst performing shedding 1.5 per cent in a single day’s trading.

Originally published as Sea of red as Aussie share market falls on final full trading day of 2024, dollar falls to lowest yearly close