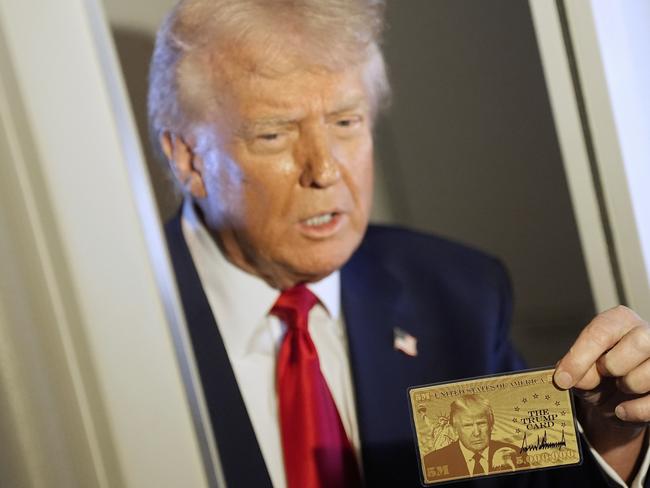

ASX soars on latest Trump announcement

The ASX 200 continues its relief rally on Monday following the latest back down from US President Donald Trump.

The ASX 200 continues its relief rally on Monday following the latest back down from US President Donald Trump.

Older Aussies say their biggest fear is running out of money in retirement, as cost of living continues to put pressures on household budgets.

The Australian sharemarket market will likely remain volatile even after the ASX saw a $116bn rise in one day.

The Australian economy is vulnerable to a recession larger than the global financial crisis on this simple act by China.

A sell-off has smashed the ASX 200 on Monday, but experts warn the local bourse still has further to fall.

Australians are likely to spend up big over the Easter holidays, as the price of household favourites skyrocket.

Trump’s aggressive tariff policy may have shaken global markets, but superannuation members have been urged to do one thing to avoid ‘locking in losses’.

The ASX 200 is a sea of red on the opening, and the Aussie dollar has plunged below 60 cents, as investors continue to sell-off on fears of a global recession.

Anthony Albanese says Australia has been in contact with the White House, as he says the global chaos from the Trump tariffs is concerning for Aussie super.

Nationals leader David Littleproud Australia should use its relationship with the United States to help lobby against Donald Trump’s global tariffs.

There could be a silver lining for struggling mortgage holders, as experts sound the alarm on US President Donald Trump’s aggressive tariff pledge.

The one-man shop praised for selling the “best” Korean fried chicken in Australia has announced it will close in May.

The fallout from US President Donald Trump’s tariff policy continued to send shockwaves through the market, wiping out more than $50bn on the local market.

Australian mortgage holders could get larger and more frequent rate cuts off the back of the Trump tariffs, but an industry expert warns “be careful what you wish for”.

Original URL: https://www.thechronicle.com.au/business/breaking-news/page/3