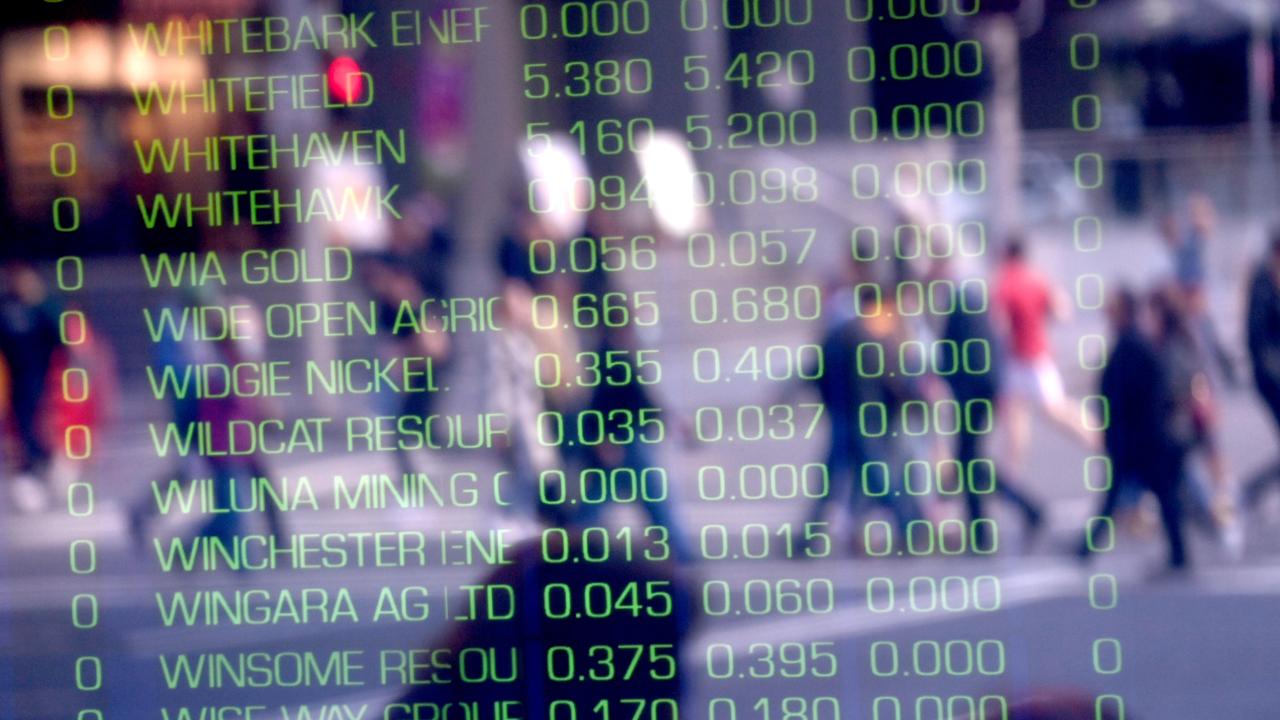

NSW rescue cash gives Australian sharemarket short-lived, last-minute boost

The ASX finished barely changed after a cash rescue package for Covid-stricken NSW provided a short-lived, last-minute boost.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The Australian sharemarket closed barely changed on Tuesday after fading from a strong start, bouncing up a few points in the final moments of trade as the Prime Minister announced a cash rescue package for Covid-stricken NSW then promptly sinking again.

The S&P/ASX200 finished 1.4 points softer at 7332.1 while the All Ordinaries Index firmed 7.3 points to 7612.2.

CommSec analyst Steve Daghlian said the rocky session followed Wall St hitting fresh record peaks overnight and the ASX starting the week firmly in the green on Monday.

“We’ve had a choppy, somewhat directionless few weeks in Australia and this is after hitting a record high in the middle of June,” Mr Daghlian said.

“Since then, we’ve been faced with a number of challenges including Sydney entering a lockdown, which is now in its third week, and it doesn’t seem likely to end any time soon.”

OMG chief executive Ivan Tchourilov noted the benchmark ASX200 index had climbed up towards 7380 points early in the session before pulling back around the time the NSW Premier announced 89 new locally acquired cases in the state.

“The uncertainty around how long NSW and namely Sydney will be in lockdown is weighing on our market, as this has the potential to substantially derail the economic recovery,” he said.

The big four banks were mixed, with ANZ slipping 0.54 per cent to $27.82, Commonwealth Bank giving up 0.79 per cent to $98.39, National Australia Bank inching two cents higher to $26.24 and Westpac shedding 0.75 per cent to $25.33.

Mr Tchourilov said his company’s clients had piled into CBA, with the stock being the most bought during the session.

“CBA will be reporting their full-year profit and dividend figures in August and it’s widely expected to increase its return to shareholders compared to this time last year,” he said.

“Lending has been strong across a number of sectors, especially housing, which should see them report an increase in their bottom line and give them capacity to increase their dividend.

“All things remaining equal, this should see them continue to be supported leading into this announcement.”

In company news, global meal kit delivery giant HelloFresh sought to buy Youfoodz so it could expand into the ready-made meals arena, offering 93 cents per share, which has been backed by the board and RGT Capital – the biggest shareholder in Youfoodz with a 57.4 per cent stake.

The $125m deal represents an 82 per cent premium to Youfoodz’s closing price on Monday of 51 cents and sent its shares rocketing by 77.45 per cent to 90.5 cents.

But it’s a loss for those who piled into the initial public offering in December, given they paid $1.50 and their shares have traded well below that level since.

Mr Tchourilov noted the early investors would be disappointed, crystallising a loss of about 40 per cent.

Aerial imaging company Nearmap leapt 14.36 per cent to $2.27 after announcing better than forecast unaudited preliminary full-year results, largely driven by its North American business, with boss Rob Newman saying it had been “an unprecedented year with record performance delivered in a challenging economic environment”.

The audited results will be released on August 18.

Explosive maker Incitec Pivot jumped 5.76 per cent to $2.57 after announcing changes to its manufacturing model from a global to a regional management structure, saying that would ensure appropriate oversight and support while international travel restrictions remained in place.

Almond grower Select Harvests surged 16.03 per cent to $7.53 after reporting a record 2021 crop.

“Record almond shipments and the worsening Californian drought have led to a recent price appreciation,” managing director Paul Thompson said.

“Demand for almonds, both in their natural form and as a value-added food ingredient, in products such as plant based milks and yoghurts, continues to grow.”

A poor performer was Platinum Asset Management after reporting a $167m plunge in funds under management, sending its shares tumbling 8.26 per cent to $4.22.

Among the miners, Rio Tinto firmed 0.6 per cent to $128.36, BHP gave up 0.69 per cent to $50.70, Fortescue appreciated 2.11 per cent to $25.18 and OZ Minerals retreated 2.16 per cent to $21.74.

In the energy sector, Santos slid 0.42 per cent to $7.05, Woodside Petroleum subtracted 1.45 per cent to $23.11 and Oil Search declined 0.52 per cent to $3.83.

The Aussie dollar was buying 74.92 US cents, 53.93 British pence and 63.15 Euro cents in afternoon trade.

Originally published as NSW rescue cash gives Australian sharemarket short-lived, last-minute boost