‘Don’t want to work forever’: No-boomer super fund aimed at helping young Aussies

A share trading app has launched its own superannuation fund, with a blunt message for those born before 1970.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

A new superannuation fund wants to help younger Australians skip the high fees and complex nature of superannuation, but there’s a catch for older Aussies.

Pearler Super launched its fund on Monday, saying it caters for younger members only, as “there are enough funds out there catering to ultra-high balances and those needing retirement income”.

Pearler allows members to exclusively invest in exchange traded funds (ETFs), meaning it can scrap investment management fees other funds charge. Pearler charges members an admin fee of 0.438 per cent and a brokerage fee of 0.11 per cent.

ETFs work a bit like buying a basket of assets such as shares or bonds, allowing an individual to invest in many securities in one trade. They often come with lower fees and like traditional stocks are traded on the ASX.

Pearler co-founder Nick Nicolaides told NewsWire there was a disconnect between younger Aussies who invested in ETFs and those who were looking at maximising their superannuation.

“With super, it is almost hidden away and we found despite our investors getting their heads around ETFs, these very same people didn’t feel the same level of confidence over their superannuation,” Mr Nicolaides said.

“We thought why are people so interested in share investing and not getting as in depth and into the discussion around their superannuation?”

Mr Nicolaides said the “no boomers” fund was more about solving a problem for younger Australians than a display of anti-boomer rhetoric.

“If you take a casual interest in what is written about superannuation, most articles are written about how the superannuation industry can deal with retirement,” he said.

“It makes sense that it gets the most attention because it is an immediate problem now.

“But at the other end of the spectrum, the industry and the media recognise that engagement in super is lacking in younger people. If we don’t fix that, then today’s younger people will find themselves in the same boat in 20, 30 years time.”

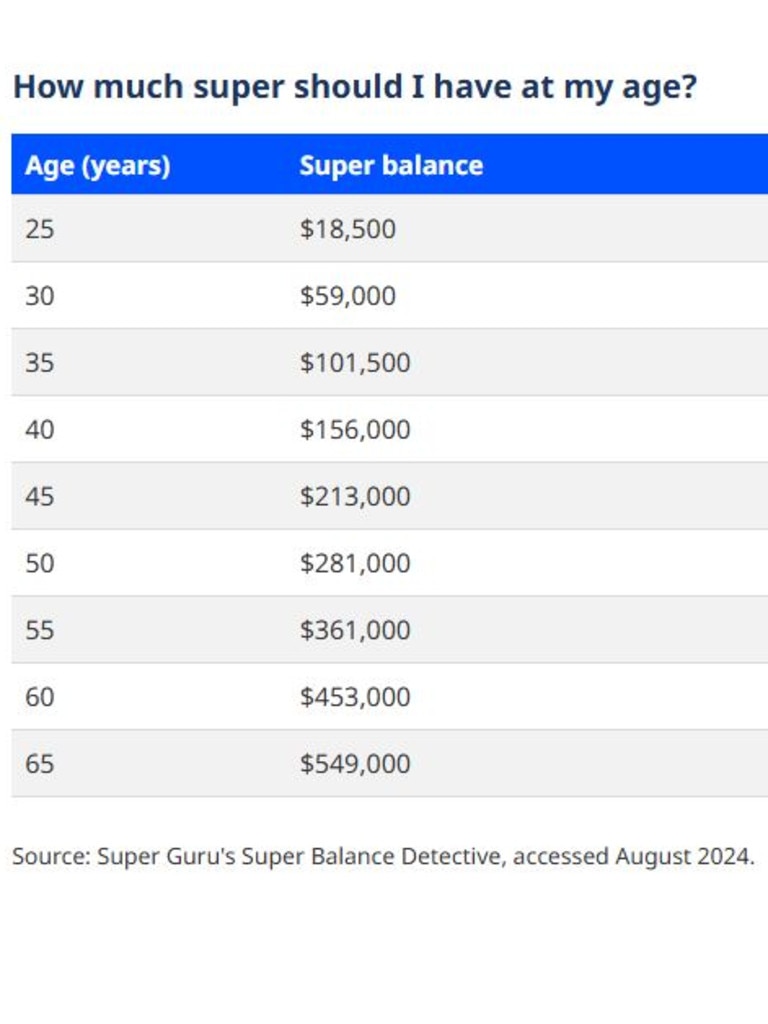

According to the Association of Super Funds Australia, to achieve a comfortable retirement a couple needs $690,000 in superannuation by the time they reach 67, while a single person will need $595,000.

But many younger Australians are well behind how much they need to achieve a comfortable retirement.

Australian Taxation Office stats for the 2021 financial year showed that Australian males aged 25-29 had an average of $25,981 in super, while females had $23,429.

Meanwhile, 30-34-year-old males had an average of $56,344 and females $46,286, both below how much they would need by the age of 30 to live comfortably in retirement, according to Super Guru.

Mr Nicolaides said Australians faced unique challenges, with the high cost of living and housing putting pressure on households.

“The challenges facing young people are ‘I don’t want to work forever, I don’t want to rent forever’ and the third one is less explicit but ‘I don’t want a get-rich-quick scheme to achieve the other two’,” he said.

The new superannuation product will let members choose between 40 different ETF products. Depending on the risk and diversification of each ETF, Pearler will allow superannuation members to add between 5 to 100 per cent of their superannuation into each of these ETFs.

Originally published as ‘Don’t want to work forever’: No-boomer super fund aimed at helping young Aussies