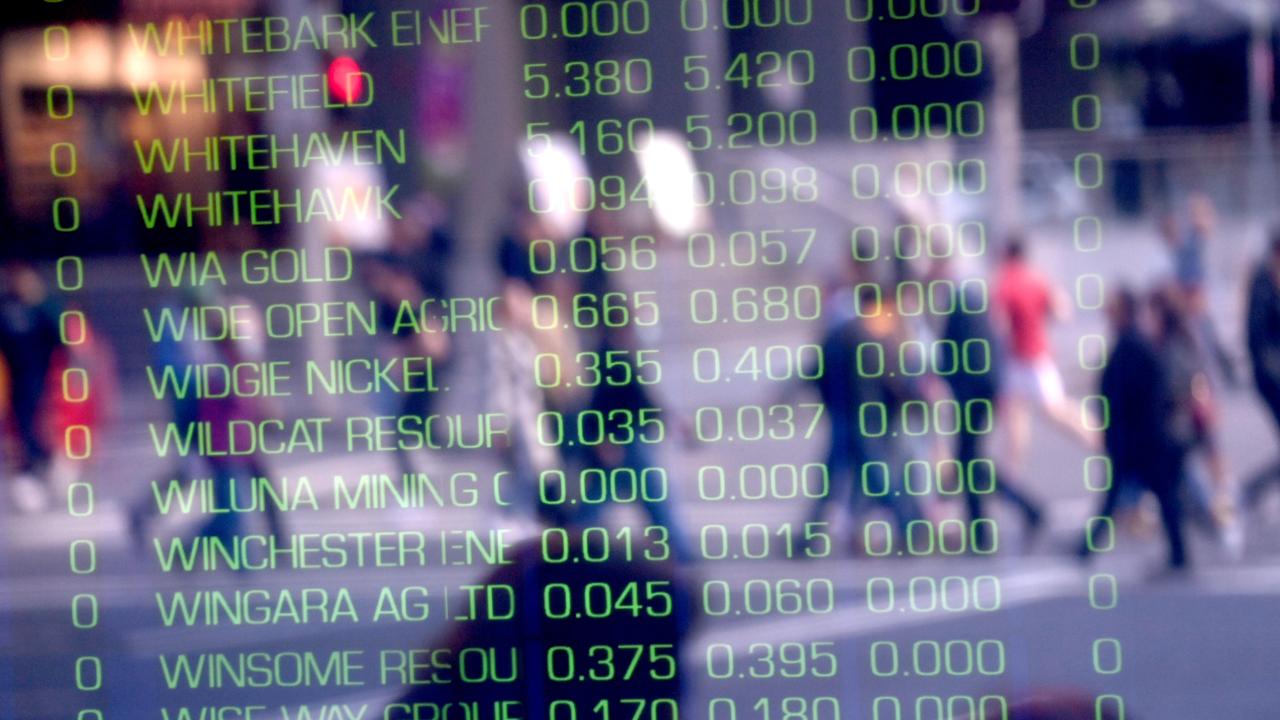

Benchmark S&P/ASX200 index hits record intraday peak before pulling back

ASX investors have put the fact half of Australia’s population is in lockdown to one side, analysts say, pushing a key index to a record intraday high.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The Australian sharemarket finished flat, with gains for materials stocks offsetting losses across the majority of the local bourse, as investors shrugged off the nation’s Delta variant crisis.

Wall Street gave a positive lead, with all three major indices climbing to record highs, as upbeat earnings results and signs of an economic revival fuelled investors’ risk appetite, Ord Minnett said.

After hitting a new intraday record high of 7417.6 points, the S&P/ASX200 closed just 0.1 points lower at 7394.3, while the All Ordinaries Index eased 0.4 points to 7670.5.

CommSec analyst Steve Daghlian noted it followed two record closing highs on Thursday and Friday.

“Investors have really put to one side the fact that half the country’s population is currently in lockdown, the virus concerns wear on and we’re continuing to get terrible or concerning numbers out of Sydney and also Victoria,” Mr Daghlian said.

“With each passing day, it makes it more and more likely we’re going to get an extended lockdown. Sydney is expected currently to end this Friday but it’s not looking good.”

In the mining sector, Lynas Rare Earths was a strong performer, jumping 10.58 per cent to $7.11 after releasing its June quarter activities report, which showed a rise in revenue compared to the previous quarter.

Gold miner Silver Lake Resources went the other way, dropping 8.05 per cent to $1.48.

“Earnings season has seen the materials sector moving in every direction,” OMG chief executive Ivan Tchourilov said.

“Trading volume is expected to rise as more reports are released.”

He noted other strong performers in the sector included Alumina, up 5.25 per cent at $1.70, and graphite miner Syrah Resources, up 4.63 per cent at $1.35.

Oz Minerals put on 3.9 per cent to $22.04, Rio Tinto rose 2.37 per cent to $130.11, BHP firmed 1.25 per cent to $51.91 and Fortescue improved 0.67 per cent to $25.42.

Plus-size women’s fashion group City Chic leapt 6.65 per cent to $5.77 after announcing it had inked a deal to acquire online marketplace Navabi.

The company also provided a trading update, saying its unaudited full-year underlying earnings before interest and tax had surged 60 per cent.

City Chic said its trading for the current financial year had so far beaten expectations, with strong US and UK performance outweighing the impact of temporary store closures in Australia due to lockdowns.

Embattled casino giant Crown Resorts slumped 5.19 per cent to $9.50 as the second phase of the Perth royal commission kicked off, with the state government extending the due date for the final report from November to March so the findings of the Victorian investigation on October 15 could be fully considered.

“And of course last week Star withdrew its takeover for the group, so Crown shares were down for the eighth straight day,” Mr Daghlian said.

Property group GPT shed 2.74 per cent to $4.62 after withdrawing its full-year funds from operations and distribution guidance due to uncertainty around the duration of lockdowns and the impact that will have on its retail portfolio.

“That could well be a very big theme in August when many companies are going to be quite cautious in providing any type of guidance and also when it comes to dividends, it could be a similar story,” Mr Daghlian warned.

Budget apparel retailer Best & Less made a strong ASX debut, leaping 11.11 per cent to $2.40 following a $60m IPO for which there was “significant excess demand”, the company said.

Despite lockdowns causing about 10 per cent of its potential store trading days to be lost, the group, which also owns Postie stores in New Zealand, says it still expects to meet the full-year net profit forecast in its prospectus.

Consumer staples were mixed, with Coles adding 0.28 per cent to $17.66, while Woolworths retreated 0.5 per cent to $39.32.

Mr Tchourilov said Insurance Australia Group lifted 2.24 per cent to $5.02 on the back of last week’s preliminary full-year results and 2022 guidance release, which flagged a reported net loss of $427m for fiscal 2021, largely driven by $742m in natural disaster claim costs.

“S&P believes IAG to be a victim of one-off factors and sees no major change to underlying performance,” he noted.

ANZ inched two cents lower to $27.67, Commonwealth Bank inched two cents higher to $99.14, National Australia Bank backtracked 0.38 per cent to $25.94 and Westpac slipped 0.36 per cent to $24.62.

The Aussie dollar was fetching 73.42 US cents, 53.38 British pence and 62.34 Euro cents in afternoon trade.

Originally published as Benchmark S&P/ASX200 index hits record intraday peak before pulling back