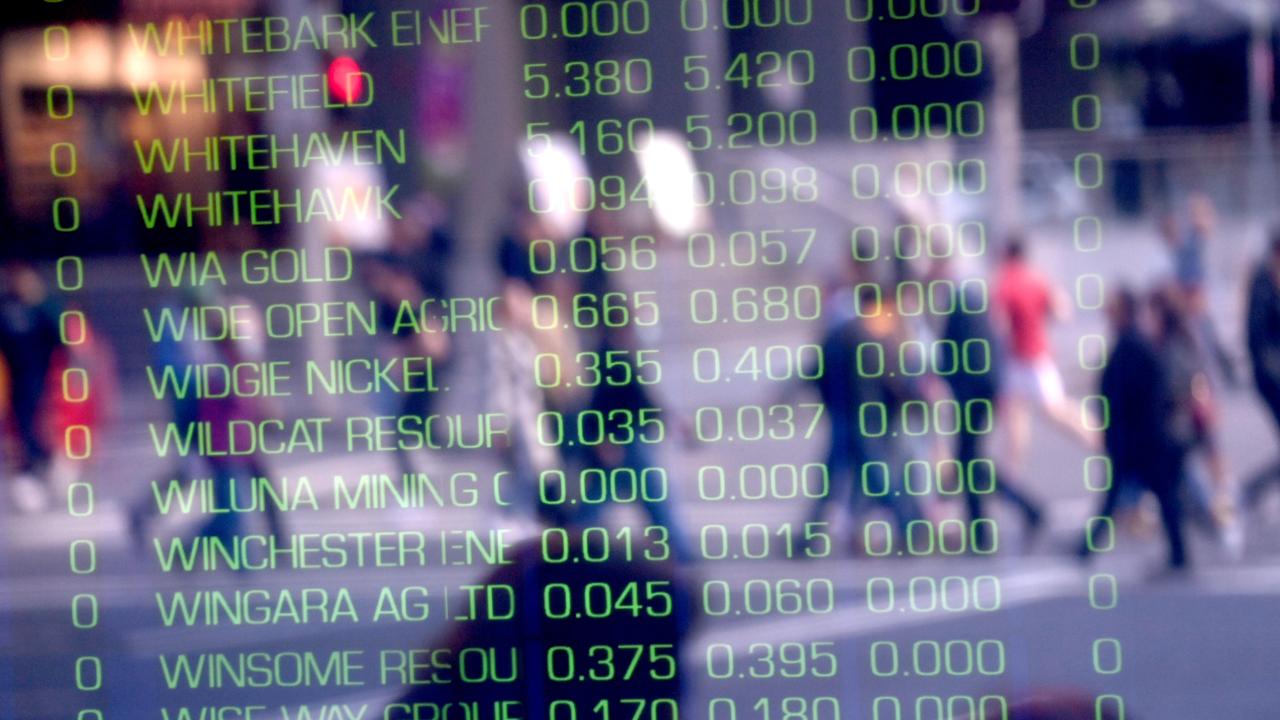

Australian sharemarket recoups most of Friday’s decline, with miners, property, banks among winners

The ASX recouped most of Friday’s losses despite giving back some of its early gains, with miners the standout performers.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The Australian sharemarket gave back some of its early gains but finished well in positive territory on Monday, with mining stocks the big winners.

Wall St provided a strongly positive lead, reaching record highs on Friday.

On the local bourse, the benchmark S&P/ASX200 index closed 0.83 per cent higher at 7333.5 – recouping most of Friday’s 0.9 per cent decline – while the All Ordinaries Index gained 0.79 per cent to 7604.9.

CommSec analyst Steve Daghlian said the ASX200 was about 1.1 per cent higher at its best level in morning trade then faded.

The ASX had not been “able to take things to the next level” after record highs about three weeks ago, with the length of Sydney’s Covid lockdown and whether that would slow down Australia’s economic recovery weighing on investors’ minds, Mr Daghlian said.

“It’s just the uncertainty of how long it’s going to last,” he said.

All eyes were on the highly infectious Delta variant and the pace of the nation’s vaccine rollout, Mr Daghlian said, with the most awaited economic news this week being jobs figures on Thursday.

Materials stocks were the top performers.

Among major iron ore producers, BHP advanced 3.17 per cent to $51.05, Fortescue gained 3.3 per cent to $24.66 and Rio Tinto strengthened 1.75 per cent to $127.60.

“Iron ore has stayed around or above $US200 per metric ton since these companies last reported, giving them plenty of scope to reward shareholders with juicy dividends, which they’ll announce in the coming weeks,” OMG chief executive Ivan Tchourilov said.

“Fortescue particularly is looking at yield of well above 10 per cent grossed up, which is exceptional in this record low interest rate environment.”

In the lithium sector, Mineral Resources jumped 4.22 per cent to $59.59, Pilbara Minerals rose 2.69 per cent to $1.53 and Galaxy Resources lifted 2.94 per cent to $3.85.

There were also gains among property stocks, with Shopping Centres Australasia Property Group firming 1.67 per cent to $2.43 and Goodman Group putting on 2.16 per cent to $21.80.

Banks were also in the green.

ANZ added 0.43 per cent to $27.97, Commonwealth Bank appreciated 0.59 per cent to $99.17, National Australia Bank was 0.54 per cent higher at $26.22, Westpac rose 0.59 per cent to $25.52, Bendigo and Adelaide Bank improved 1.27 per cent to $10.34 and Bank of Queensland was up 1.12 per cent at $9.01.

Life insurance business OnePath Life is paying back up to $35m to customers it used “egregious” pressure sales tactics on between 2010 and 2016 when it was owned by ANZ, the Australian Securities and Investments Commission said.

The biggest corporate news was Bunnings, Kmart, Target and Officeworks owner Wesfarmers lobbing a $68m takeover offer for the group behind Priceline, Australian Pharmaceutical Industries.

The proposal has already won the backing of API’s biggest shareholder Washington H Soul Pattinson, and Wesfarmers managing director Rob Scott said the acquisition would provide an attractive opportunity to enter the growing health, wellbeing and beauty sector.

Shares in API soared 19.65 per cent to $1.37 – just below the bid price of $1.38 cash per share – while Wesfarmers was 0.5 per cent higher at $58.29.

“There’s a lot of M&A activity happening at the moment, which is a good sign for the market as a whole. A number of sectors are consolidating as larger companies are swooping on good quality strategic assets, some of which are trading much lower versus pre-pandemic levels,” Mr Tchourilov said.

Industrial services provider Aerison made a positive ASX debut, rising 2.5 per cent to 20.5 cents.

Another company in the same sector, NRW Holdings, surged 11.97 per cent to $1.73 after announcing a miner had exercised an option to buy one of its subsidiary’s mining equipment at the Boggabri coal mine in NSW, with proceeds earmarked to reduce debt.

Drone detection and disruption company DroneShield issued a positive quarterly report, saying counterdrone expenditure was rapidly rising globally, with the Australian government continuing to increase in its local defence capability.

DroneShield shares put on 3.03 per cent to 17 cents.

Consumer staples were weaker, with Coles slipping 1.19 per cent to $16.65 and Woolworths easing 0.16 per cent to $38.01.

Market heavyweight and biotech giant CSL put on 1.3 per cent to $279.06.

The Aussie dollar was fetching 74.77 US cents, 53.81 British pence and 62.96 Euro cents in afternoon trade.

Originally published as Australian sharemarket recoups most of Friday’s decline, with miners, property, banks among winners