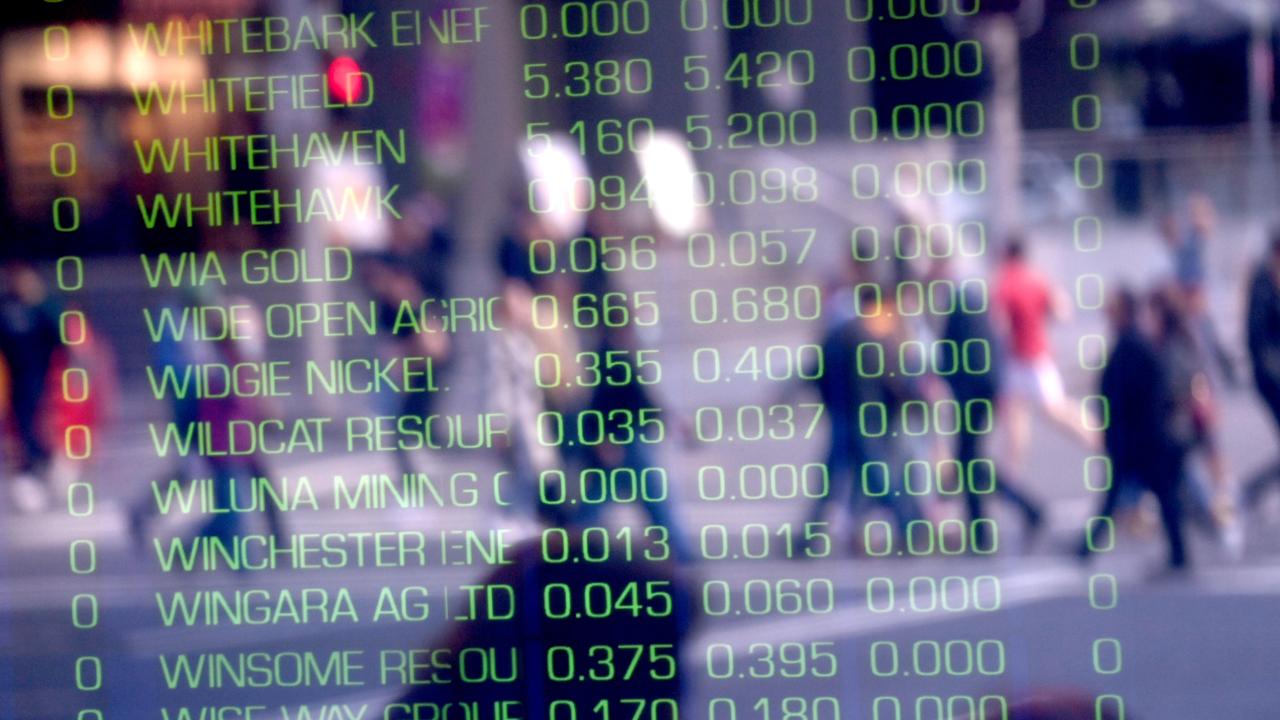

Australian sharemarket pulls back after recent record-breaking rally following negative Wall St lead

The ASX closed firmly in the red, ending its dazzling recent record-breaking rally, following a negative lead from Wall St.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The Australian sharemarket pulled back on Wednesday after climbing to fresh record highs multiple times over recent trading sessions, with losses across nearly all sectors following a negative lead from Wall St.

The S&P/ASX200 closed 0.7 per cent lower at 7379.3 while the All Ordinaries Index fell 0.71 per cent to 7649.6.

CommSec analyst Steve Daghlian noted the benchmark ASX200 index had been pulled back below the key 7400-point mark.

“Once again we’re following the direction of American markets, which very much recently have been setting the tone,” Mr Daghlian said.

“However, what is impressive locally is that the market of course did hit a record high on Monday and Tuesday – we’ve had four gains in six days.”

Greater Sydney’s Covid lockdown was extended to August 28 after a record 171 new local cases were recorded.

CBA sent its previous economic forecasts to the shredder due to the lengthy lockdown and slow vaccine rollout, now warning a 2.7 per cent contraction in the September quarter was “a fait accompli”.

“It is the inevitable consequence of shutting down large parts of the economy,” CBA economists wrote.

They don’t expect a meaningful rebound until November but forecast strong gross domestic product growth of 3.3 per cent next year, after a 3.6 per cent increase in 2021.

Treasurer Josh Frydenberg told the ABC the federal government would do its best to avoid a recession – two consecutive quarters of contraction – and NSW recovering from its Covid crisis would be critical.

CBA also predicts a significant fall in employment over the next few months, tipping about 300,000 job losses in NSW, and has upped its year-end unemployment rate expectation of about 4.5 per cent to 5.2 per cent following a peak of 5.6 per cent in October.

The bank expects the jobless rate will be 4.5 per cent at the end of 2022.

CBA also pushed out its call for the Reserve Bank to return the cash rate to normal, from current historic lows, from November 2022 previously to May 2023.

CBA shares fell back below $100, giving up 1.4 per cent to $99.30.

ANZ slid 0.6 per cent to $27.74, National Australia Bank backtracked 0.27 per cent to $25.91 and Westpac shed 0.93 per cent to $24.56.

Diversified financial stocks were mainly in the red, OMG chief executive Ivan Tchourilov said, with ASX darling Magellan Financial Group dropping 3.39 per cent to $50.46 while Netwealth Group slumped 6.66 per cent to $15 on the back of underperformance in its June quarterly business update released earlier this month.

In major economic news, the consumer price index – the main measure of inflation – rose by 0.8 per cent in the June quarter, while the annual rate of growth lifted from 1.1 per cent to 3.8 per cent – the fastest pace since September quarter 2008.

“In the upcoming profit reporting season, investors will want to see how ASX-listed companies are grappling with margin pressures from rising costs and supply chain disruptions,” CommSec chief economist Craig James said.

In the travel sector, Flight Centre decreased 0.34 per cent to $14.47, Qantas declined 1.07 per cent to $4.64 and Webjet slid 0.62 per cent to $4.85.

Rio Tinto booked record half-year financial results, with net earnings rocketing 271 per cent to a staggering $US12.3bn ($A16.7bn) on the back of “exceptional market conditions”.

“Government stimulus in response to ongoing COVID-19 pressures has driven strong demand for our products at a time of constrained supply, resulting in a significant spike in most prices,” new chief executive Jakob Stausholm said in a statement from London, after the ASX closed.

The company declared a total interim dividend of $US5.61 ($A7.62) per share, representing 75 per cent of underlying earnings.

Earlier, the miner announced it would spend $US2.4bn ($A3.26bn) on the big Jadar greenfield lithium-borates project in Serbia to scale up its exposure to battery materials.

Shares in the mining giant eased 0.19 per cent to $132.22 while rival BHP retreated 1.67 per cent to $52.47 after announcing it had launched a takeover offer for Canadian nickel, copper, platinum, palladium and chromite miner Noront Resources.

Morgan Stanley said transactions such as this would likely enrich BHP’s project pipeline, addressing some investors’ worries that the miner did not have enough organic growth optionality.

Power transmission business Spark Infrastructure jumped 5.39 per cent to $2.74 after a takeover bid from a consortium led by a global private equity giant and Canadian pension fund was lifted to $2.95 per share, which Spark said was worth exploring.

The previous bid of $2.80 per share was swiftly knocked back, with Spark saying it undervalued the company.

Nickel Mines tumbled 11.06 per cent to $1.04, which Mr Tchourilov attributed to an “underwhelming” quarterly activities report.

Packing company Pact Group Holdings leapt 9.4 per cent to $3.84 but didn’t make any announcements.

“Investors appear to be expecting a favourable quarterly update,” Mr Tchourilov said.

The Aussie dollar was fetching 73.56 US cents, 53.01 British pence and 62.24 Euro cents in afternoon trade.

Originally published as Australian sharemarket pulls back after recent record-breaking rally following negative Wall St lead