Australian businesses set to feel brunt of latest Trump tariff plan

Australian businesses have been hit with a grim forecast for the year ahead, as US President Donald Trump implements his tariff plan.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

Australia’s economic soft landing is looking bumpier, as US President Donald Trump’s new tariffs regime threatens local businesses, a new report has found.

According to the latest CreditorWatch’s Business Risk Index, businesses are getting smashed by cost of living pressures and accumulated tax debts, with the Trump tariffs adding to an “uncertain” future.

This uncertain future follows CreditorWatch’s data showing a 47 per cent spike in year-on-year business payment defaults in February.

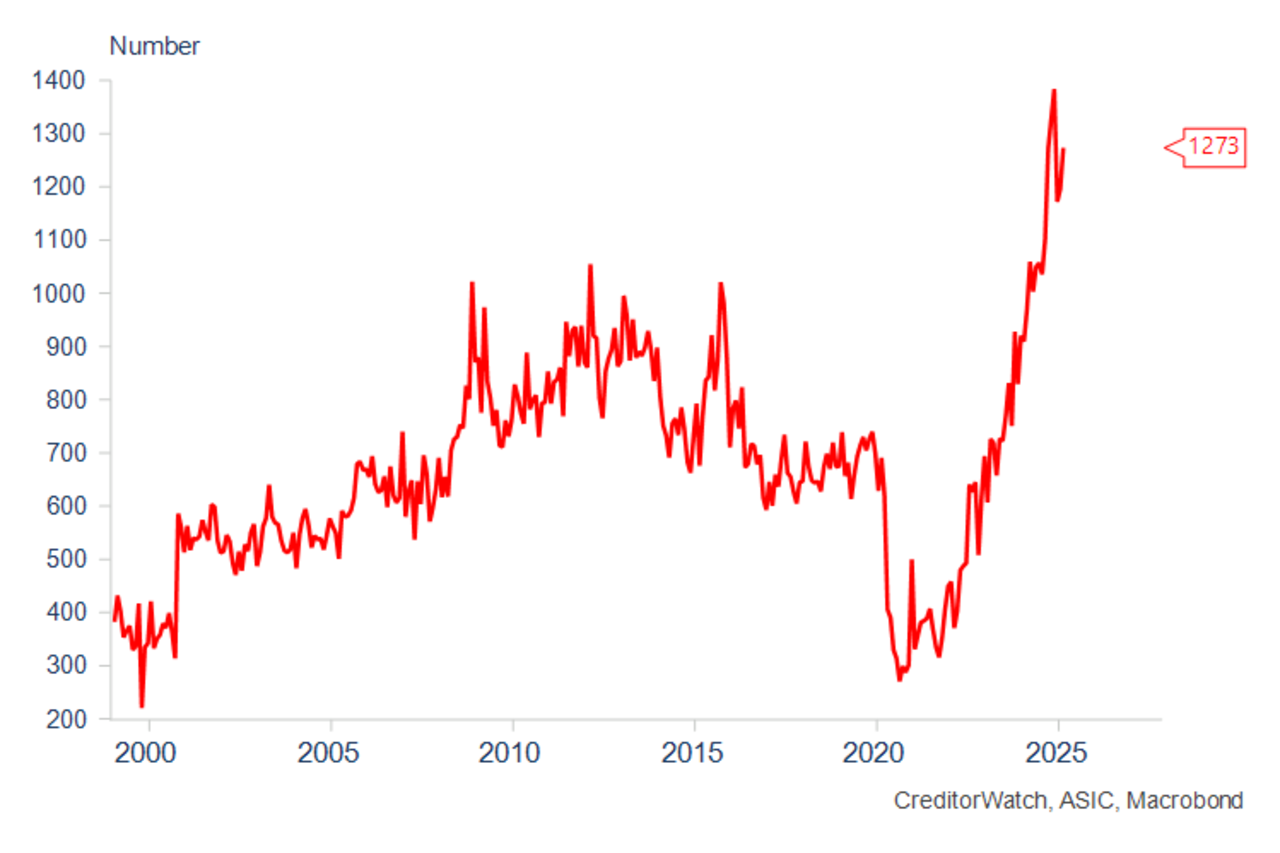

Insolvencies also rose in February after having dipped in December and January.

CreditorWatch chief economist Ivan Colhoun told NewsWire the “cost of doing business crisis” is set to continue.

“When you look at the macroeconomic data, it was looking a bit better at the end of the year, with the unemployment rate coming down and retail sales strengthening on tax cuts,” Mr Colhoun said.

“It looked like insolvency data was looking to level out in some industries, but now we have the uncertainties that come from the Trump tariff policies.”

CreditorWatch is now predicting Australia’s soft landing is likely to get bumpier, as businesses work through US tariffs.

A soft landing is achieved if politicians and central banks are able to slow inflation without triggering a recession, while a hard landing is a sharp and sudden decline in economy activity. Mr Colhoun did not predict the Australian economy to go all the way into a recession, but expected some economic impacts from the tariff policies.

The economist said the direct impact of expanding tariffs on goods including pharmaceuticals and beef would have a relatively small impact on the overall economy, albeit devastating for affected industries, likening it to the Chinese tariffs back in 2020.

Under the Chinese policy barley, beef lamb, wine, cotton, lobsters, timber and coal all faced tariffs, at a total estimated cost of trade of $20bn.

“Australia shipped around $15bn to the US last year. When China put tariffs on Australian goods, the economy didn’t fall into a complete heap from the direct impact of those tariffs,” he said.

“But the US is putting tariffs on some very big countries including China, Canada, Mexico and Europe, that’s where the indirect impacts are going to come through.”

“They are going to come through by affecting share prices, which will see companies start to reduce staffing, create uncertainty about future investment and it can lead to tariffed goods finding their way into the Australian market, making it worse for domestic competitors.”

Mr Colhoun said one of the sectors to be affected by the steel and aluminium tariffs would be construction, which is showing some signs of a turnaround due to falling costs.

But credit demand in the construction sector is being hindered by freestanding-house approvals, which have softened a little in recent months.

Reflecting some of the previous challenges impacting construction, construction insolvencies bounced back near record highs in February, while trade payment defaults recorded a new high for this cycle in February.

“The construction industry is a consumer of steel, so it is potentially helpful for the industry that has faced rising prices on many building materials over the last few years,” he said.

“There might be some cheaper steel as a result of the tariffs in the US, as it may change the attractiveness of exporting the steel to the US.

“This might mean the steel stays in Australia and prices fall a bit. It may mean that other steel producers can supply to Australian customers at cheaper prices.”

Mr Colhoun said the producers would obviously face increasing pressures if the price of steel fell.

Originally published as Australian businesses set to feel brunt of latest Trump tariff plan