ASX surges to have its best day in six weeks in trading on Thursday

‘Pretty positive’ reactions from news from the US Federal Reserve and local employment data led the Australian sharemarket to its best day in six weeks.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The Australian sharemarket traded higher throughout on Thursday, spurred on by positive news for upcoming rate cuts.

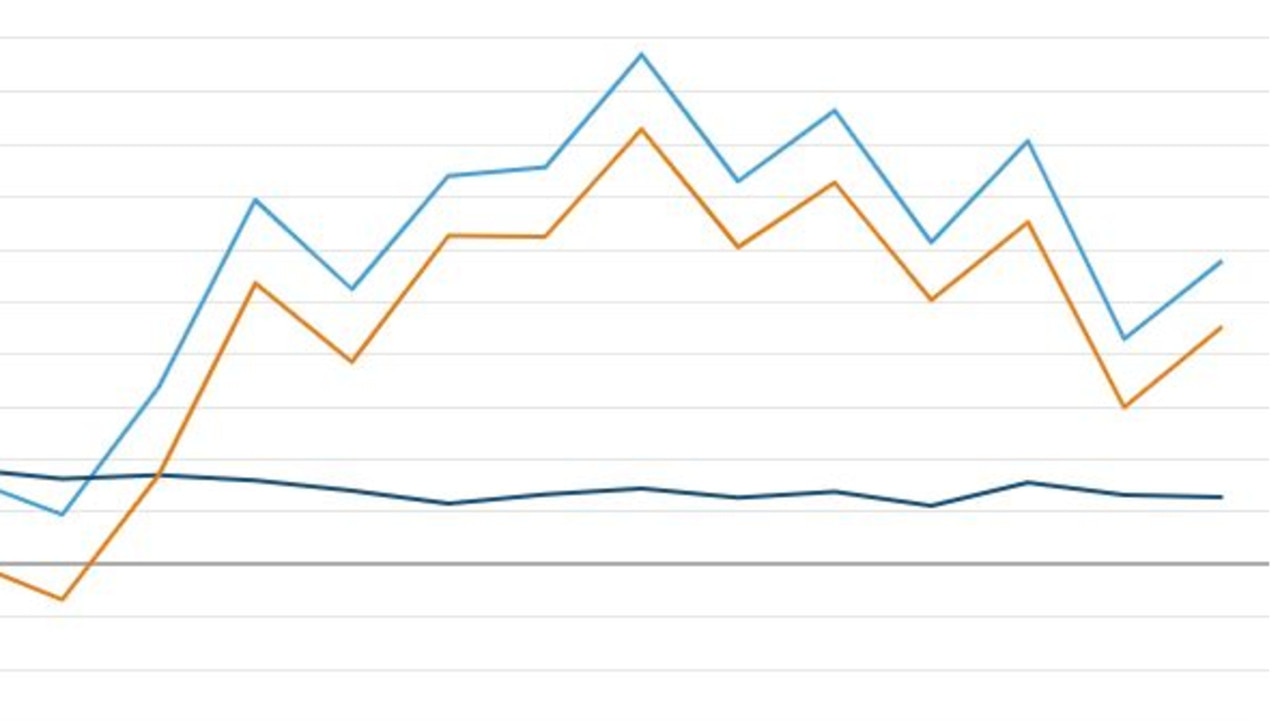

The benchmark S&P/ASX 200 index gained 90.60 points or 1.16 per cent, closing at 7918.90 points, while the broader All Ordinaries gained 93.60 points or 1.16 per cent, to 8148.90 points.

The Aussie dollar dropped 0.32 per cent to finish the day at US63.42 cents.

Overnight, the US Federal Reserve kept interest rates on hold.

Fed chair Jerome Powell also gave comfort to global stockmarkets, downplaying the risk of inflation caused by the US aggressive tariff policy, abating some concerns over the world’s largest economy.

But President Donald Trump opposed the rate hold, posting on Truth Social that interest rates should be cut.

“The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition (ease!) their way into the economy.”

On a positive day for the Australian market, nine of the 11 sectors were in the green with materials and utilities lagging behind.

“We would have had a better day if it wasn’t for the materials,” eToro market analyst Josh Gilbert said.

Weak iron ore prices caused the miners to fall.BHPdropped 1.08 per cent to $39.13, Fortescue sank 3.33 per cent to $15.94 and Rio Tinto retreated 1.01 per cent to $117.50.

Wall Street rallied overnight, giving the Australian stock market a jump out of the gate.

Dow Jones Industrial was up 383.32 points or 0.92 per cent to sit at 41,964.63 points on close, the S&P 500rose 60.63 points or 1.08 per cent to finish at 5675.29 and the tech heavy NASDAQ soared 246.67 points or 1.41 per cent to end trading on Wednesday night at 17,750.79 points.

The positive tone continued locally throughout the day with fresh job data revealing nearly 50,000 jobs were lost in February, although the jobless remained steady at 4.1 per cent, drastically undercutting expectations and raising the chances of an Reserve Bank of Australia cut in May.

The RBA monetary policy board will meet on March 31-April 1 and are predicted to hold rates.

“(Expectations) have gone from about a 60 per cent chance to close to about an 80 per cent chance now,” Mr Gilbert said.

“Obviously we don’t want to see unemployment slow down too fast and this is the right balance that we’re seeing today because … it remains pretty firm, but not to the extent that it’s going to give inflationary concerns.”

The technology and finance sectors drove the market up, with the tech darlings leading the charge.

WiseTech Global was up 2.51 per cent to $84.89, Xerogained 1.99 per cent to $159.40 and Megaport lifted 2.79 per cent to $10.69.

The nation’s Big Four banks pulled up the index as Commonwealth Bank advanced 2.21 per cent to $145.93, Westpacrose 1.62 per cent to $30.61, NAB increased 1.34 per cent to $33.09, and ANZclimbed 1.53 per cent to $29.16.

The biggest winner during Thursday’s trading was uranium miner Boss Energy up 8.43 per cent to $2.70.

Pharmaceuticals stocks also bounced with Mesoblastsurging 6.8 per cent to $2.20 and Clarity Pharmaceuticals finishing in the green up 6.8 per cent to $2.83.

The biggest loser was local bank Judo Capital Holdings down 6.20 per cent to $1.74.

Gold also continued its surge to a new record high on Thursday, with one ounce of the precious metal now costing investors $US3059 ($A4825.99).

Originally published as ASX surges to have its best day in six weeks in trading on Thursday