ANZ in huge profit plunge but ratings agency applauds bad loan provisioning move

ANZ has posted a profit plunge due to higher provisions against bad loans as borrowers struggle with the financial hit of COVID-19.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

ANZ has posted a full-year profit plunge after increasing its provisions against loans going bad as borrowers struggle to recover from the economic fallout of the global health crisis.

The bank’s cash profit for 2019-20 was $3.7 billion, down 42 per cent from $6.4 billion for the previous financial year.

“This decrease was primarily driven by full-year credit impairment charges of $2.74 billion, which increased from prior year due to the impact of COVID-19 and a first-half impairment of Asian associates of $815 million, also related to the pandemic,” ANZ said on Thursday.

S&P Global Ratings said both the provisions and consequent earnings hit were broadly in line with its expectations.

The ratings agency said the provisions positioned the bank well to absorb the credit losses that COVID-19 would likely inflict.

“We maintain our view that the bank’s capital position is likely to remain strong,” it said.

Total loan deferrals have fallen to $71 billion, down from their peak in June of $125 billion.

Australian home loan deferrals have reduced to $51 billion, with about 20 per cent of households extending their deferral period by a further four months and less than 1 per cent transferred to hardship.

Wealth management group Ord Minnett noted “ghosting” did not appear to be a material problem, with only about 3 per cent of customers on deferral not responding to attempts at contact.

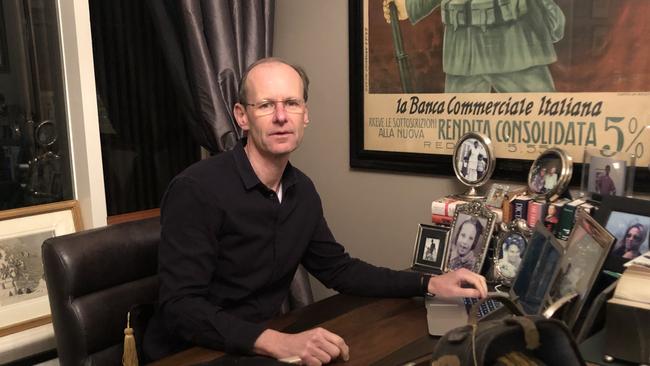

ANZ chief executive Shayne Elliott said the bank had entered 2020 in robust condition.

“We have a strong balance sheet with record levels of capital and liquidity as well as provisions for potential future losses,” Mr Elliott said.

“Events of the last 12 months make it difficult to predict the course of the next year.

“What I do know, however, is we are in excellent shape to navigate whatever challenges emerge.”

He defended ANZ’s new climate change statement, which was released as part of the full-year results presentation, and read the bank would “engage with 100 of our largest emitting customers, focusing on energy, transport, buildings, and food, beverage and agriculture” while increasing lending support to renewables and lower-carbon gas.

Some media coverage suggested that meant ANZ would shift support away from farmers.

“I want to assure you that this is absolutely not the case,” Mr Elliott said.

“ANZ’s climate change statement is focused on the top 100 carbon emitters and will have no impact on the bank’s farmgate lending practices.

“We remain firmly committed to supporting Australia’s farmers and producers, now and into the future.”

Originally published as ANZ in huge profit plunge but ratings agency applauds bad loan provisioning move