Big four banks, CBA, NAB, Westpac ANZ, profit near pre-Covid levels but outlook cloudy

Top four banks’ profit jumps close to pre-Covid levels, led by strong lending demand but the outlook is uncertain amid more rate hikes.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Strong volumes in mortgage and business lending helped the major banks return first-half profits to near pre-Covid levels, but analysts warn “the only real certainty is uncertainty’’ going forward.

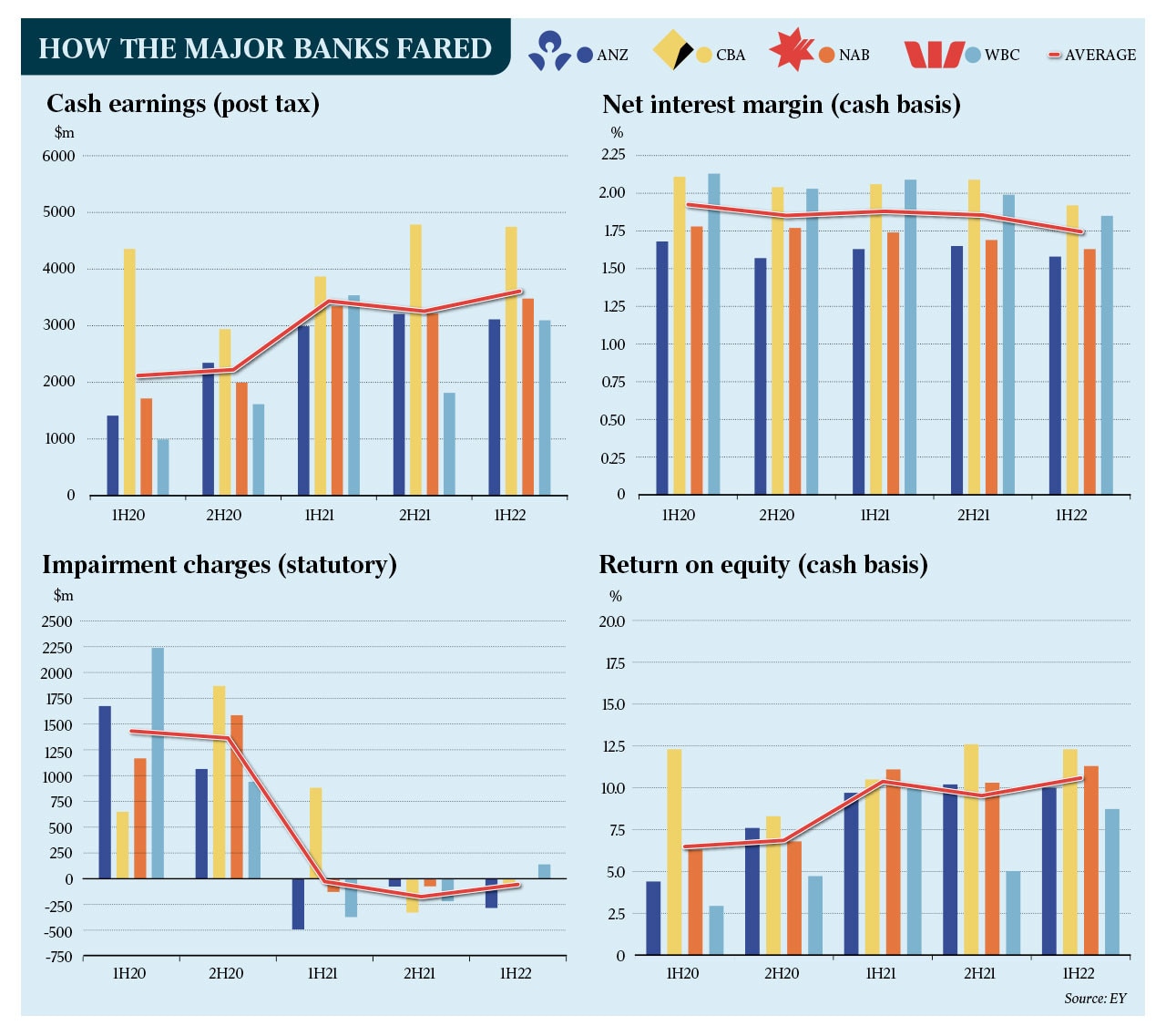

KPMG’s analysis of the results of the big four banks – Commonwealth Bank, National Australia Bank, Westpac and ANZ – shows they reported a cash profit after tax from continuing operations of $14.4bn, up 5.1 per cent on the previous corresponding period.

This is just 0.4 per cent below the result from three years ago, before the pandemic hit, with the underlying drivers of the strong result being “continued strong volumes in both mortgage and business lending”. The value of mortgage loans was up 2.5 per cent over the most recent half to $1812bn while business lending grew 4.8 per cent to $1077bn.

KPMG’s head of banking Steve Jackson said the banks had managed to restore their return on equity to the double digits, but “with uncertainty ahead, it will be interesting to see how they maintain their current momentum’’.

Both KPMG and EY note that the banks have little room to move on further cost-cutting, while the continued low interest rate environment has kept the pressure on net interest margins.

“For the majors, the average NIM dropped to 175 basis points, down 13 basis points from FY21,’’ KPMG’s report reads. “The industry-wide depressed NIMs have been the primary brake on the majors’ profit growth.’’

KPMG banking strategy lead Hessel Verbeek said the impact of the extended period of low interest rates was “deeply baked into net interest margins’’.

“The market dynamic has been dominated by the NIM decrease resulting from low lending rates in a very competitive market and strong demand for low-margin, fixed-rate mortgages,’’ he said. “This downward pressure has only partially been offset by lower funding costs from near-zero deposit rates.’’

Tim Dring, EY’s banking and capital markets leader, said margin headwinds would continue into the second half of the year, although the outlook was brighter because of the recent cash rate rise.

“While margin compression is likely to continue in the short term, the rising interest rate cycle should ease NIM pressures and lead to improved profitability for the banks over the medium term,’’ Mr Dring said. “However, ongoing economic risks point to continued uncertainty for the banking sector’s outlook.

“Last week’s higher than expected rise in the official cash rate by the RBA, and future expected rises, offer top line revenue growth opportunities and earnings upside.

“On the flip side though, rate rises coupled with strong inflation could also put pressure on asset quality and slow credit growth, and continued mortgage competition may also reduce margin upside for the banks.’’

PwC Australia said the banks had delivered the “cleanest result in years” with a general absence of significant charges relating to restructures and remediation, which cumulatively added up to $13bn since 2008. This was because the banks were now “simpler and smaller’’, with less material non-core businesses hanging off them, either in Australia or abroad

While the simplification was generally a positive, PwC’s banking and capital markets leader Sam Garland said it also posed the question of where growth would come from, given the highly-competitive traditional banking markets.

“We’ve been noting for some time that the traditional core of growth for the banks is increasingly competitive and the base of earnings has narrowed as a result of the ‘simplification’ over the past decade,’’ Mr Garland said.

“Lending growth has been unevenly shared among the major banks, particularly in mortgages, in which three non-majors have taken material share, with the resultant pressure on margins.”

There is general consensus that banks have already made the major gains as far as removing costs from their operations, with Mr Garland saying their “cost of living’’ was under pressure, “and the banks will have to work extremely hard and make investment choices to contain it’’.

KPMG’s Mr Verbeek said the banks had struggled to structurally reduce costs.

“While the overall outcome has been an almost flat cost trajectory for the majors, there are three things happening which are netting each other out,’’ he said.

“Inflation has driven up ‘run-the-bank’ costs, further growth and transformation costs have been added and meanwhile some cost reductions from efficiency programs have been realised.”

EY’s Mr Dring agreed, saying reducing the cost base would be challenging, “given traditional operations silos, complex legacy systems and the need to respond to ever-evolving regulatory requirements’’. He flagged that attracting and retaining talent would be problematic, with employees looking beyond salaries to “meaning and purpose’’ from their work.

The strong performance of the economy had contributed to strong asset quality, with KPMG noting that loan loss provisions of $218m over the half brought the level closer to pre-pandemic levels.

Mr Verbeek said interest rates changes would pull in both directions, but would take some time to flow through to performance.

Mr Garland said there was a “clear growth opportunity’’ in ’ core businesses such lending and deposits and keeping customers safe, but these areas will be “highly contested’’. The big question, he said, would be whether Australia’s banks were “thinking big enough, moving fast enough and executing well enough to respond and capitalise on the opportunity’’.

ANZ, NAB and Westpac’s half year reporting periods ended on March 31, while CBA’s ended on December 31.

Originally published as Big four banks, CBA, NAB, Westpac ANZ, profit near pre-Covid levels but outlook cloudy