Australia’s newest billionaires revealed in Richest 250

There’s a record 159 billionaires in Australia, including new names who have roared into the ranks of the wealthy elite.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

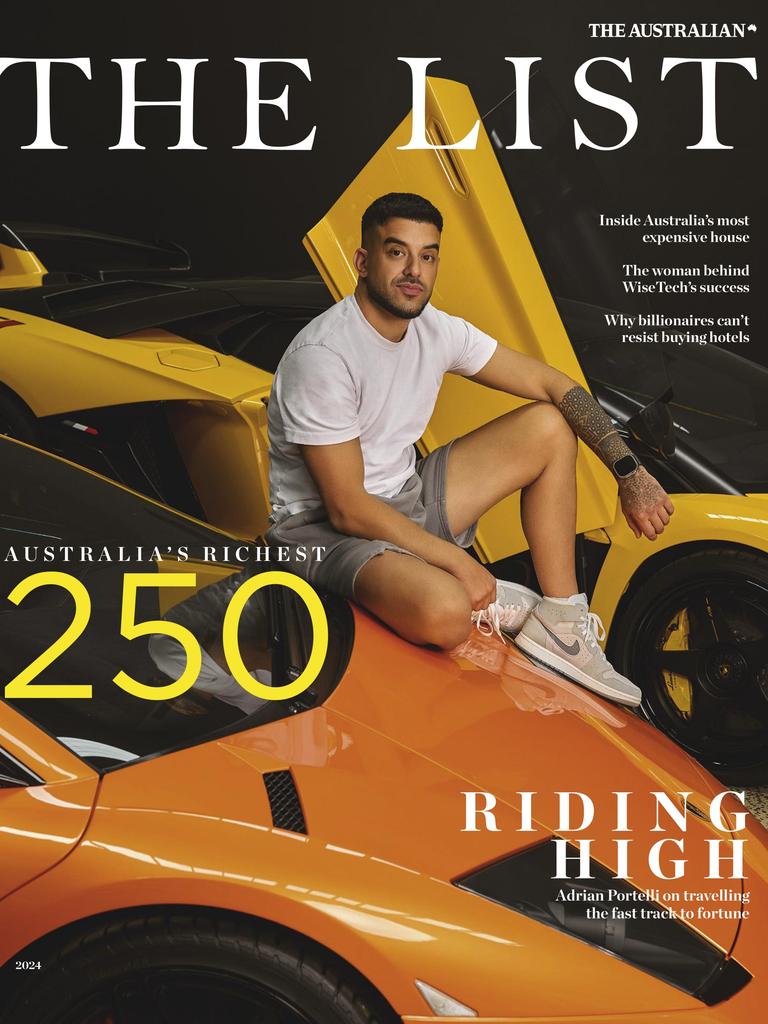

There’s a record 159 billionaires in Australia this year, including new entrants to the ranks of Australia’s wealthy elite such as Australia’s second-richest woman, Nicola Forrest, and “Lambo man” Adrian Portelli.

Names like James Packer, Gina Rinehart and Andrew Forrest will be familiar to many.

See the full Richest 250 list at richest250.com.au

But also joining as billionaires for first time in 2024 are cryptocurrency gambling tycoons, lithium mining magnates and the entrepreneurs behind familiar brands like Chemist Warehouse, Kennard’s Hire and 7-Eleven.

Nicola Forrest, $37.17bn (with Andrew Forrest)

Nicola Forrest arrives on The List this year due to the confirmation of her separation from husband Andrew Forrest, founder and executive chairman of Fortescue Metals Group.

Her new separate shareholding in Fortescue – it is held solely in her name while the rest of the Forrest family fortune is jointly held – accounts for her inclusion on The List, even though the duo’s wealth is combined.

They also have equal ownership of the private Tattarang business empire that spans cattle holdings, brands like RM Williams.

Sam Gance, $3.26bn (with Jack Gance)

The Gance brothers had already built on their initial pharmacy holdings in Melbourne’s northern suburbs with the successful Le Specs sunglasses and Le Tan sunscreen brands before going into partnership with Mario Verrocchi in the Chemist Warehouse chain in 2000.

Chemist Warehouse is now going public via a reverse takeover of the ASX-listed Sigma Pharmaceutical, with the Gance brothers emerging with a major shareholding in the combined business. Sam Gance, whose partner is Real Housewives of Melbourne star Janet Roach, joins The List based on his proposed stake in the merged entity in a deal that is planned to be finalised later this year.

Tim Heath, $2.15bn

He grew up in Victoria’s Warracknabeal and played poker at Melbourne’s Crown Casino before heading overseas. Now, his Yolo Group is based in Estonia, where it employs more than 1000 people and where Heath is soon to open a $100 million casino and hotel complex for high rollers. It will be his latest venture in gaming, which includes his gambling site Sportsbet.io. Heath started with an online poker website in 2013 that would become Bitcasino.io, a runaway success.

Chris Barlow & family, $1.95bn (with Russell Withers)

The 7-Eleven Australia convenience store business, which began with one store in the Melbourne suburb of Oakleigh in 1977, was sold by the Withers and Barlow families in November last year. It was bought by its Japanese parent group, Seven & I Holdings. Barlow is the nephew of Withers, who started 7-Eleven in Australia with his late sister Beverley Barlow. The two families still own the Australian chain of coffee brand Starbucks.

Dick Honan, $1.86bn

Documents lodged with the corporate regulator late last year shed some more light on the sheer size of Honan’s wheat processing and ethanol production empire.

Manildra’s revenue hit $2.3bn last year and the company, which employs about 1150 people, made a net profit of about $203 million, pushing Honan’s estimated wealth up considerably.

Craig & Ryan Sutton, $1.56bn

The huge Suttons car dealership business was established in the early 1940s by the late Frederick Sutton, grandfather of Craig and Ryan, who now operate the group after the death of their father Laurie last year. The business is mainly based in Sydney. . Revenue for Suttons reached $1.93 billion last year and it has more than $1.2 billion in property assets on its balance sheet.

Adrian Portelli, $1.30bn

Portelli rockets onto The List with a fortune based around the valuation of his LMCT+ rewards club, property holdings and other investments. A master of marketing and self-promotion, Portelli is best known for bidding at auction on properties sold on Nine Entertainment’s The Block TV renovation series. But Portelli has a highly profitable business in LMCT+, which has more than 100,000 subscribers, and property holdings along the eastern seaboard, stakes in drinks startups, and a collection of luxury sports cars.

Marnie Lewis-Millar & Shay Lewis-Thorp, $1.19bn

The daughters of late property developer Bernard Lewis control the family company that claims to be Australia’s oldest privately owned property development group. Lewis Land has developed more than 20,000 residential land lots since the business began in 1957, including carving canals on the Gold Coast and residential subdivisions in outer Melbourne and Sydney.

Peter Smaller. $1.18bn

Smaller owns one of the biggest privately held steel groups in the country, comprising 26 companies that supply, process and distribute steel products. Documents lodged with the corporate regulator show Southern Steel Group made a $113 million net profit from $1.85 billion revenue in 2023. The business traces its history back to 1947, when Southern Steel Supplies was established in Wollongong.

Nick Wakim, $1.10bn

Wakim is the founder and majority owner of privately held Phoenix Lithium, which is set to find a partner and capital to build a $US2 billion processing plant in California. He says it will be extracting and recovering about 64,000 tonnes of battery-grade lithium carbonate annually from 2030 onwards. Phoenix’s valuation accounts for most ofWakim’swealth, but he also made headlines buying about $150 million worth of Victorian property last year,including three mansions in Melbourne’s Toorak.

Neville Crichton, $1.22bn

Crichton has been reportedly looking for a buyer or at least a partial exit of his huge car dealership business, which has been growing rapidly in recent years. He has mulled over an ASX-listing for Ateco and been named in media reports as considering offers from cashed-up overseas buyers. For now at least, Crichton, who sold his first car at 13 to the prefect at his New Zealand high school, maintains ownership of Ateco, which made a $107 million net profit from $2.5 billion revenue.

John & Michael Borg, $1.12bn

Borg Manufacturing is a quiet Australian success story. In 1989, the brothers started a small joinery firm in their parents’ garage on the NSW Central Coast. Now the company employs more than 2200 people making cabinet doors, benchtops, panels, laminates and other board products. Its brands include polytec, Crossmuller, Australian Panels, reDirect Recycling and Direct Pallets. Revenue is closing in on the $1 billion mark and Borg Manufacturing made a $102 million profit last year.

Roger Fletcher, $1.09bn

Fletcher is an agriculture industry legend, taking the family business based in Dubbo in central west NSW and turning it into a global meat exporter. He even built his own train to take his processed lamb and sheep from Dubbo to Sydney’s Port Botany for export. Fletcher Group has an annual revenue of more than $1 billion and its latest accounts show a net profit of more than $100 million.

Dale Elphinstone, $1.09bn

Elphinstone has built an Australian success story from Tasmania’s north, where he started modifying Caterpillar equipment for use underground in the shed of his father’s Burnie farm in 1975. The Elphinstone Group today makes and modifies mining trucks and equipment, and also has a contract to manufacture turrets and hulls for the Australian Army’s new Huntsman howitzers.

Andy Kennard & family, $1.05bn

Kennards Hire produced another strong year in 2023, its 75th in operation. The business recorded an $85 million net profit from a record $629 million revenue, and paid owner Andy Kennard and his family a $155 million dividend. Kennard is the son of late founder Walter Kennard, who started the business in 1948 in Bathurst when a customer asked to borrow a concrete mixer from his supply and machinery store. Walter said he’d hire the mixer and a business model was born.

Robin Khuda, $1.03bn

Khuda is reportedly mulling over a plan to take his huge data centre business AirTrunk public in a move that could value the company at more than $10 billion and provide a big payday for majority shareholder Macquarie Asset Management. Khuda holds about 10 per cent of the business, which he started in 2015.

Bruce Gordon, $1.03bn

The financial accounts of Gordon’s regional television network WIN show it had revenue of about $200 million last year, down from $207 million in 2022. The company reported a net profit of $8.3 million, down 39 per cent on the previous year. Gordon has owned WIN since 1979, having had a long career in television and media, capped by a stint as vice president of international TV sales for Paramount in the US.

NEW BILLIONAIRES:

Nicola Forrest

Sam Gance

Tim Heath

Chris Barlow & family

Dick Honan

Craig & Ryan Sutton

Adrian Portelli

Marnie Lewis-Millar & Shay Lewis-Thorp

Peter Smaller

Nick Wakim

Neville Crichton

John & Michael Borg

Roger Fletcher

Dale Elphinstone

Andy Kennard & Family

Robin Khuda

Bruce Gordon