Australian investors surf $16bn Nvidia wave as AI chipmaker’s value soars

Billionaire James Packer is among those holding almost $16bn worth of shares in the $2 trillion AI chipmaker. Find out who else has taken a big punt.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australian funds have more than $US10bn ($15.7bn) worth of shares in the world’s hottest stock, Nvidia, and Macquarie, Alphinity and James Packer’s Consolidated Press Holdings are holding some of the largest stakes in the AI chipmaker.

Macquarie has the largest direct bet with 4.17 million shares as of December 31, gaining a cool $US1.2bn in just two months, according to public records compiled by Bloomberg. Its total stake is worth $US3.3bn, the data shows.

Nvidia shares this month reached an all-time high of $US823.94 each after it posted better-than-expected results and a $3.2 trillion valuation last week. It said demand for its processing chips was still outweighing supply, cementing bets its meteoric rise would continue.

Sydney-based Alphinity Investment Management is the second largest Australian holder of Nvidia stock, according to the data. The fund has 1.2 million shares worth $US974m, after it more than tripled its holding from 482,570 shares at the end of June 2023, according to the records.

A string of superannuation funds such as Aware Super, Rest Super, Hesta, Unisuper and IFM are shown as top holders in the Bloomberg list. Index-hugging managers such as Betashares also made the list.

But Mr Packer’s holding $352m worth of Nvidia shares is a standout, after Consolidated Press Holdings jumped on the AI bandwagon late last year with bets that also included a $US223.5m stake in Meta, the owner of Facebook.

In total, Australian funds owned 13 million shares at the end of December, when the stock was trading at about $US490 each. That holding had grown 6 per cent from the 12.4 million total holding at the end of September.

In aggregate, the Aussies have made $US3.8bn in paper gains in the two months since the end of December.

“Nvidia is the big winner from the shift to what’s called accelerated computing,” said Nick Griffin, founding partner and chief investment officer at Munro Partners.

Munro has been a long-term student of the Californian company and holds about 365,000 of its shares, up from 99,000 when the Melbourne-based manager first brought in, Mr Griffin said.

That is a big bet. It currently accounts for close to 10 per cent of its assets under management, up from about 3 per cent in December 2022. The windfalls from the chipmaker this year alone have already contributed about a third of Munro’s portfolios’ returns.

The surge in corporate demand for AI is fuelling the need for powerful graphics processing units (GPUs) from Nvidia. Tech companies are using these GPUs to build the physical infrastructure that supports AI applications.

“The simple bet on Nvidia is just what proportion of data-centre demand goes to accelerated computing versus just regular computing,” Mr Griffin said.

“And Nvidia has been moving up this S-curve of adoption as more and more data centres move to accelerated computing.”

Nvidia shares have gained 60 per cent this year, after more than trebling in 2023 (up 239 per cent). And the more consumers use AI applications in their everyday lives, the higher the demand for Nvidia products will be.

“This is not the path of your typical company,” Morningstar equity strategist Brian Colello said in a note to clients this week.

“The business has transformed remarkably in just a few quarters,” he said. The company sells its product to some of the world’s biggest technology companies that are spending big for artificial intelligence capabilities.

“We don’t think this is an area where (companies) are going to skip out on development and risk falling behind.”

Other notable names in the top 60 Australian holders include Loftus Peak, Perennial, Pengana, Plato, Fiducian, Northcape, Fidante, Platinum and Yarra Capital Management, the Bloomberg data shows.

In one of the most anticipated earnings reports of all time, Nvidia last week posted triple-digit revenue and earnings growth.

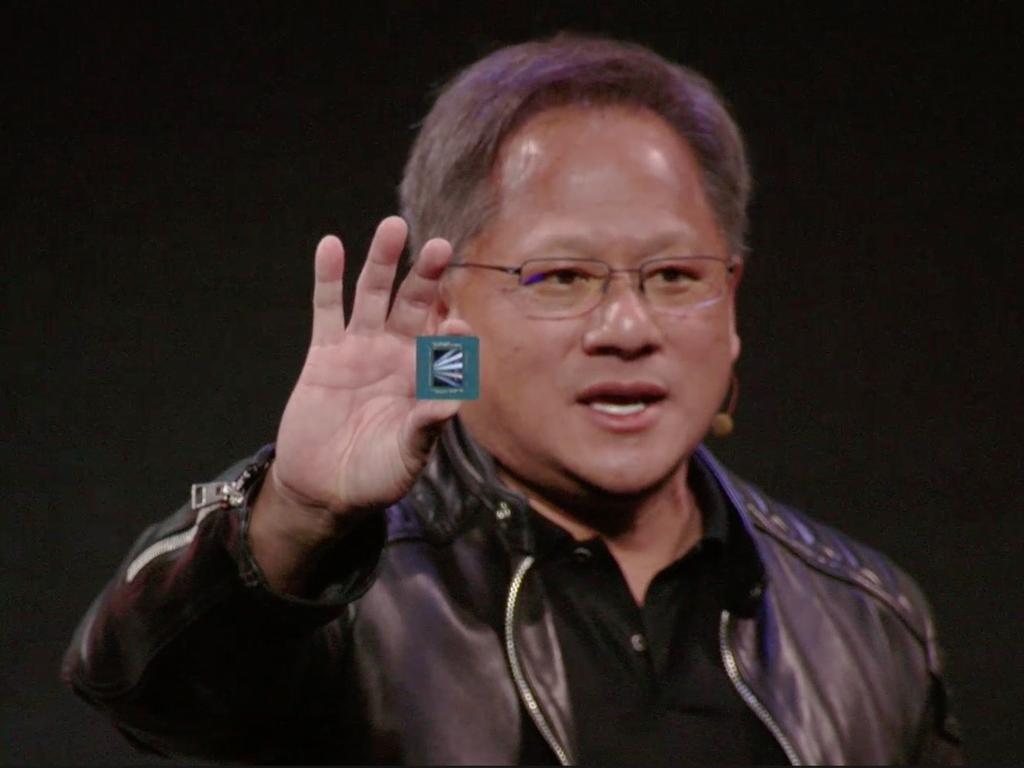

The chipmaker’s founder and CEO Jensen Huang said accelerated computing and generative AI had “hit the tipping point” as demand was “surging worldwide across companies, industries and nations”.

The enthusiasm is helping drive a new rally in the so-called “Magnificent Seven” tech giants, which also include Apple, Microsoft, Alphabet, Amazon, Tesla and Meta.

More Coverage

Originally published as Australian investors surf $16bn Nvidia wave as AI chipmaker’s value soars