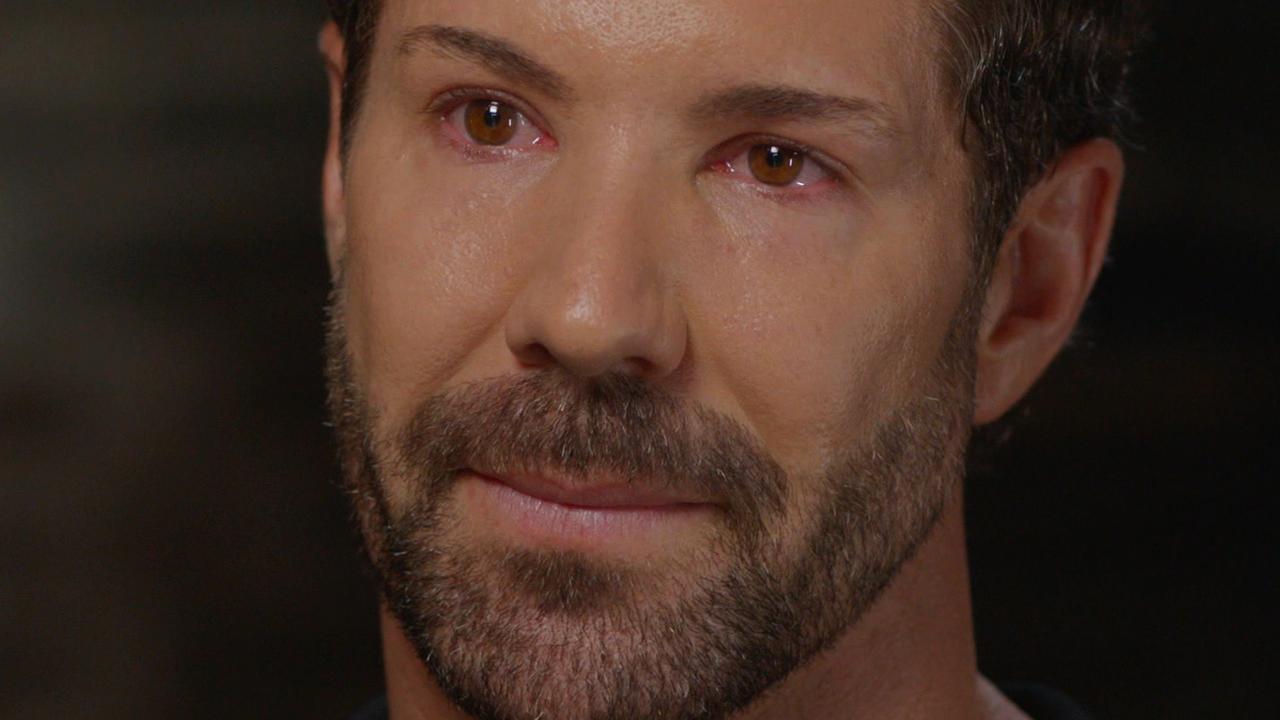

Australia well-placed to weather global recession, but ‘pockets of stress’ in housing market: APRA chair Wayne Byres

Australia’s financial system will weather a potential global recession but there are ‘pockets of stress’ in the housing market, outgoing prudential regulator chair Wayne Byres says.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s financial system will weather a potential global recession and any debt market ructions well, but there are “pockets of stress” in the housing market, outgoing prudential regulator chair Wayne Byres says.

Mr Byres, who is stepping down from the role at the end of the month, said the Australian Prudential Regulation Authority was watching global developments closely, and was not complacent to risks facing the local economy.

“We’re a small boat in a big ocean and if world financial markets are unstable and volatile, we’ll get tossed around and maybe take some water on ourselves,” he said on the sidelines of a FINSIA event in Sydney.

“But we shouldn’t assume just because there are problems overseas, they’ll be replicated here … In the broader economic context actually we’re still growing as a country, unemployment is still incredibly low, our inflation is not as high as other countries.

“The financial system is much, much stronger today than it was say going into the GFC, bank capital is higher … it’s more liquidity, better funding profile.”

Mr Byres noted APRA had stress tested the financial system against “some pretty big shocks”, and while there would be adverse impacts here if the world economy confronted a deep recession, it would not undermine the stability of Australia’s financial system.

Addressing questions about the housing market and how borrowers would fare following six interest rates hikes this year, Mr Byres said that would create “pockets of stress” for some cohorts.

Mr Byres said the regulator was happy with its interest rate serviceability buffer at 3 per cent, after raising that threshold from 2.5 per cent late last year. Banks add that 3 per cent to a borrower’s mortgage rate to assess their ability to repay in a rising rate environment.

“I feel comfortable with where it (the buffer) is at present, we’re not thinking that it needs to be raised again,” Mr Byres said.

Mr Byres’ address on Wednesday marked his last as APRA chair, following eight years in the role.

He told attendees Australia was navigating an environment of rising interest rates and falling house prices, the latter of which could be viewed as positive for affordability but would hurt some borrowers.

“Both are occurring sooner, and at a faster rate, than most people anticipated a year ago,” he said. “Borrowers with only a small equity buffer and/or high levels of leverage relative to their income will be particularly challenged. Borrowers currently on very low fixed rates face a significant repayment shock in the future.”

Mr Byres said while the common equity tier one capital of Australian banks was more than a quarter of a trillion dollars, banks should not rush to release provisions put aside for loan losses during the pandemic.

“Capital is illusory unless balance sheets are fairly marked, and assets are provisioned accordingly. At present, with a deteriorating economic outlook, the release of provisions from bank balance sheets is perplexing and warrants particular scrutiny,” he added.

Mr Byres labelled the nation’s $3.3 trillion superannuation system a “national asset” and said 95 per cent of it worked well to deliver for members. He admitted, though, that the federal government’s performance test to measure funds could be improved, in light of a review slated to start soon.

Asked about whether he would have done anything differently at APRA with the benefit of hindsight, Mr Byres said: “I don’t think there are too many things I would actually change.”

Mr Byres stressed that a prudential regulator’s work was concentrated behind the scenes.

“Most of APRA’s work goes unseen and unremarked. That is as it should be,” he said. “A good prudential supervisor is like the referee of a football match: she or he will feel happy if the after-match reporting praises the skill of the players and flow of the game, with the quality of officiating largely unnoticed.”

Mr Byres said the regulator operated under confidentiality provisions and within prudential standards, meaning it wouldn’t often pursue actions through the courts.

But APRA faced stark criticism from the Hayne royal commission for not being a tough regulator. A 2019 assessment of the regulator found while it was “highly respected” there were a spate of issues to address.

“The main conclusion of this review is that APRA’s internal culture and regulatory approach need to change … The panel observes that APRA’s tolerance for operating beyond quantifiable financial risks has been low.

“APRA appears to have developed a culture that is unwilling to challenge itself.”

Mr Byres highlighted the Commonwealth Bank prudential inquiry as an instance where APRA took a strong approach to compliance and governance shortcomings. That followed anti-money laundering and counter-terrorism finance breaches by CBA, culminating in a $700m fine from Austrac in 2018.

CBA was also forced to hold an additional $1bn in capital as a result. That amount has recently been reduced to zero.

Speaking about the task ahead for his yet to be appointed successor, Mr Byres said: “I have spoken today about themes that have been a constant during my time in office.

“Each will undoubtedly remain important for my successor, albeit jostling for attention with newer issues which, during my time as chair, have now become mainstream: risk culture and incentives; digital finance and crypto assets; cybersecurity; and climate risks.”

More Coverage

Originally published as Australia well-placed to weather global recession, but ‘pockets of stress’ in housing market: APRA chair Wayne Byres