ASIC figures reveal 91 per cent increase in NSW construction failures

Insolvencies in NSW’s construction sector almost doubled in the past year alone, and many builders are warning that the tough times will continue.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Insolvencies in New South Wales’s construction sector almost doubled in the past year alone, and many builders are warning that the tough times will continue.

The construction industry in NSW recorded 981 corporate failures for the financial year to June 30, 2023 – a 91 per cent jump on 513 notched up for the same time the previous year, according to the latest ASIC insolvency statistics.

It is the highest number in the 10 years since ASIC started reporting industry-specific insolvency data.

Sydney-based luxury apartment builder EQ Constructions was among the largest construction collapses over the past 12 months, falling into administration in February with debts up $50 million.

Other NSW builders to fall over during that period include residential builders Ellingsworth Homes, Millbrook Homes and Ajit Constructions.

More recently, development and construction giant Toplace collapsed last week owing an estimated $200 million, with 20,000 home owners caught up in one of the country’s biggest building company collapses.

NSW accounted for 44 per cent of the construction failures across Australia in 2022-23, with the national figure up 72 per cent from the previous year.

Builders Collective of Australia president Phil Dwyer said builders were grappling with the biggest crisis to face the industry in his 40 years of experience.

“It’s never been this bad,” he said.

“Even when we go back to the ‘60s, ‘70s ‘80s and so on, when we used to have a recession every six or seven years, we never saw this sort of fallout from the industry.

“These fixed price contracts and numerous issues we can relate to Covid, the escalation of costs, supply chain problems and the increase in timber and steel have had a dramatic effect.

“We’re seeing an increase in the cost of building by about 30 per cent and none of these contracts can withstand that sort of increase.”

Mr Dwyer expects things to get worse before they get better, predicting more failures in the industry over the course of this year.

“The industry is slowing down - there’s no doubt about that,” he said.

“We had a stimulus package that everyone jumped on at 100 mile an hour, took on far too much work, and that’s what’s biting us now, and going to bite us in the next six or nine months.

“We’ve instilled a mindset into consumers around fixed price and making the builder stick to that. But they can’t do it - the margins that they’ve been working on are just horrendous.”

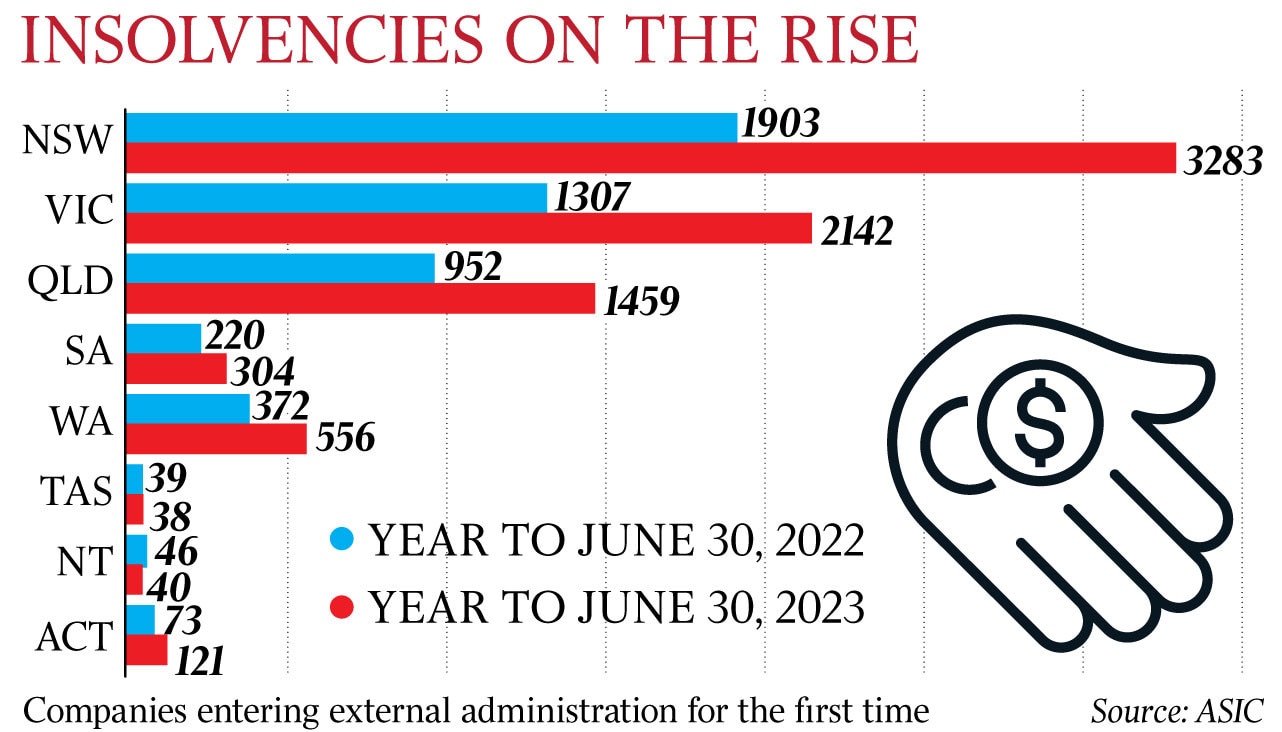

The ASIC data, released on Wednesday, showed overall NSW had 3283 companies enter external administration for the first time in the 2023 financial year, up 72 per cent on the previous 12 months, with Victoria in second place at 2142 insolvencies, up 64 per cent.

Overall, 7943 Australian companies across all sectors fell into administration, liquidation or receivership for the first time in 2022-23, up from 4912 in 2021-22, and the highest number of business failures since 2018-19.

The number of insolvencies dipped to as low as 4235 during the height of Covid-19 in 2020-21, when temporary measures were put in place by the Morrison government to protect vulnerable businesses from the economic shock of the pandemic.

However with the safety net removed, and the economy slowing in the face of rampant inflation and rapid fire interest hikes by the Reserve Bank, businesses in industries ranging from construction to hospitality and retail are in a battle for survival.

In NSW there was an 86 per cent increase in food and hospitality failures in 2022-23, rising to 521 collapses, as households continued to tighten their belts amid the cost of living crisis.

Oracle Insolvency Services managing partner Nick Cooper said the industry would be hit hardest as the ATO and other creditors ramped up their debt collection activities in the coming months.

“I think what we’re seeing at the moment is just the start of a huge wave of people with very serious problems,” he said.

“And it’s two-fold. It’s people who’ve got an accumulated ATO debt over the last couple of years, who haven’t done anything about it. But it’s also the people in the hospitality, building and other industries where they depend on discretionary consumer spending.

“They’re really going to feel the pinch for the next six months.”

More Coverage

Originally published as ASIC figures reveal 91 per cent increase in NSW construction failures