American banks in retreat from Australia as Chinese lenders surge

Australia’s traditional offshore banks are in retreat, with American lenders now holding the smallest proportion of the local market since the GFC, while Chinese banks are on the rise.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s traditional offshore banks are in retreat, with American lenders now holding the smallest proportion of the local market since the Global Financial Crisis, while Chinese banks are surging.

The latest Foreign Bank Tracker from law firm MinterEllison says 2023 was a strange year for Australia’s banking landscape, with the pullback of many incumbents and the first time since 2002 that no new banks entered the market.

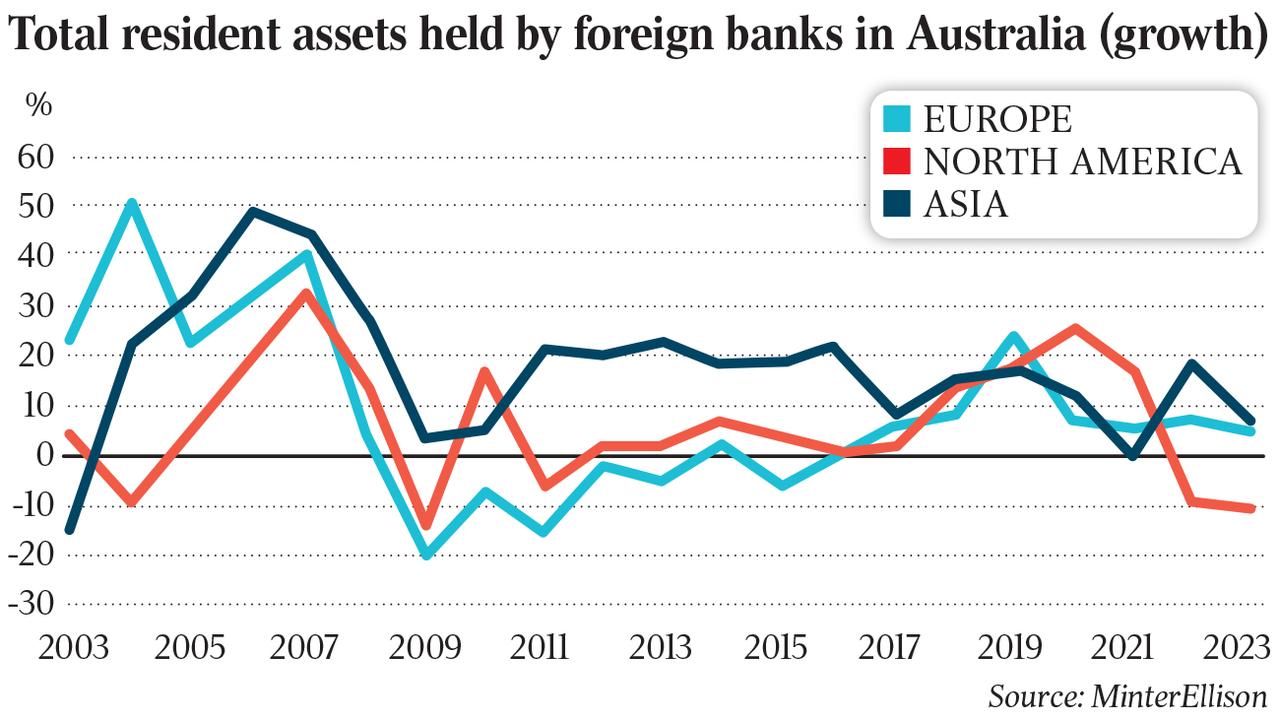

The report says American banks reduced their exposure to the Australian market for the second year running, with balance sheets falling $14.2bn and heavyweights JPMorgan Chase, Citi and State Street all pulling back.

European and Asian financiers grew their assets by a combined $15.9bn in 2023, according to the analysis of regulatory data.

MinterEllison partner Amela McPherson said the US retreat was “not unprecedented” with European banks taking a similar path in the wake of the Global Financial Crisis, reducing Australian assets for five years before turning a corner.

Ms McPherson said the data was “not a reflection on the confidence foreign banks have in Australia” but reflected tighter capital controls in a stressed market.

She told The Australian the uncertainty was a key factor in the pullback, noting banks were hesitant to deploy cash amid global economic and political volatility.

Asian banks are proliferating in the Australian economy, now outnumbering American and European lenders combined.

Assets held by Asia-based banks surged 6.8 per cent in 2023, after expanding by 18.7 per cent in 2022.

MinterEllison’s Foreign Bank Tracker says Chinese lenders surged ahead of their nearest rivals in the Asian bank pack, overtaking the Japanese incumbents whose balance sheets shrank by 2.8 per cent.

MinterEllison partner John Elias said European banks, which had traditionally led the offshore banking sector in Australia, were now “pulling in their horns”.

The Tracker covers bank balances in 2023, the last year former Swiss lender Credit Suisse reported its assets to Australian regulators before being taken over by Swiss rival UBS.

Mr Elias said the data showed an inflection point, representing the shift in trade towards Asian markets.

“We had this thesis about 10 years ago, with the Chinese banks, that they might develop over time,” he said.

European banks exposed to global trade, Wise Australia and Standard Chartered, saw assets surge.

Mr Elias said although the number of offshore banks in Australia had risen, with several considering applying for a formal ADI licence, it had been several years since a new challenger entered the market.

The last to join was Barclays, which re-entered Australia in 2021 after earlier withdrawing in 2016, the same time Spanish rival Santander pulled its operations after opening in 2012.

Mr Elias said he was surprised no banks had entered the market, but noted it probably reflected the “general unease 12 months ago”.

“I suspect it wasn’t the right time to be pushing forward on those expansions,” he said.

Mr Elias said he expected two or three Indian banks to enter the market in the coming years, but they were “pretty small players”.

“It’s probably reflective of the fact that typically banks come in following clients,” he said.

US payments and cash management company Block has been touted as a potential entrant to Australia’s banking landscape, with the company already playing a key role in local payments.

Mr Elias said he didn’t think the Australian market was “overbanked”. Despite the pullback from some in the market, the offshore banks were seeing growth rates “in excess of Aussie banks”.

“The foreign banks seem to be able to carve out a position, once they come here they actually are getting more than their fair share,” he said.

Originally published as American banks in retreat from Australia as Chinese lenders surge