Ampol boss says green diesel will drive change before EV trucks hit the road

The Ampol boss reckons the challenging economics of the EV shift means miners will need to find other answers to power big trucks

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s biggest petrol refiner is taking the green shift seriously, but it is also betting on a need for a more practical approach.

Under chief executive Matt Halliday, Ampol is going all in on sustainability. The company that generates most of its income selling petrol, is embracing change. It is rolling out one of the nation’s biggest EV charging networks to help it hit its own net zero carbon emissions targets in less than 20 years, including end-of-decade goals. It is also working on how to bring hydrogen into reality for heavy transport.

However one of Ampol’s biggest near-term plays is around manufacturing biofuels that use organic feedstock such as oilseed or sugar cane waste or even animal waste, rather than crude.

And as a supplier of fuel to big miners the move but is built around the assumption there will still be a role for liquid fuel in the current fleet of industrial engines for years to come and keeps a form of diesel in the system.

Halliday has quietly linked up with Japanese oil refining heavyweight ENEOS in recent months to refine up to 500 million litres of green aviation and diesel fuels annually using Ampol’s Lytton plant outside Brisbane.

The aviation industry is racing to lower emissions while biodiesel made from the venture will be aimed directly at Ampol’s big mining customers. ENEOS is also eyeing an export option to send the green fuels back to Japan. The Queensland government has chipped into the venture, which to help lower production costs in the start-up phase.

Despite the mining industry talking up the electrification of its giant hauling trucks and other specialised machinery, Halliday believes the transition is going to take longer-than-anticipated.

Fleet replacements will take years, particularly with every large miner putting in orders for the new trucks.

Andrew Forrest’s Fortescue has some of the most ambitious plans working with the UK’s Williams Advanced Engineering to develop a drive train for a full battery powered haulage fleet. Forrest wants to eliminate diesel fuels by the end of the decade. Rio Tinto too is aiming to slash its carbon emissions by 50 per cent and is also hoping to trial several battery electric trains next year.

However the EV battery technology for heavy trucks and trains is still at an early phase and recharging a battery that weighs tons can still take hours. Regenerative charging – where a truck recharges while rolling – is an option but testing is at an early stage. On a busy mine site the efficiency of haul trucks are often clocked in minutes, particularly if the truck is driverless and relies on high-end robotics.

All this means that in the race to hit net zero as well as 2030, miners could risk blowing out their also important cost curve, which is where investors are quick to market them down.

Halliday says biodiesel can help miners meet their carbon emission goals at a fraction of the cost while using their existing fleets. This also gives them room to progressively roll out electric trucks on a site.

Halliday still expects EV or even hydrogen-powered truck revolution is coming, but “the economics continue to push out”.

“I think that the main players are becoming more realistic about the risks and complexity of the challenge,” Halliday tells The Australian. “It pushes the timetable out and pushes people toward transitional solutions”.

Depending on the feedstock biofuels can reduce greenhouse emissions by as much as 80 per cent compared to conventional diesel. In aviation where there are limited alternative fuel sources, sustainable fuel is seen as the only realistic option currently on the table. Second-generation biofuels use waste products as feedstock rather than rely on harvesting agricultural crops.

The risk to miners is around replacing their entire mechanical support supply chain when their fuel infrastructure is already in place.

The Ampol boss says he needs to transition his business over time from “traditional fuels to electrons” to support his customers through the transportation shift.

Here Ampol is rolling out a national EV charging network with plans for more than 300 sites across Australia. It is about to open its flagship EV fast changing site in Pheasants Nest, on the Hume Hwy outside of Sydney. It is moving on destination chargers that can be installed at shopping centres, workplaces and even homes.

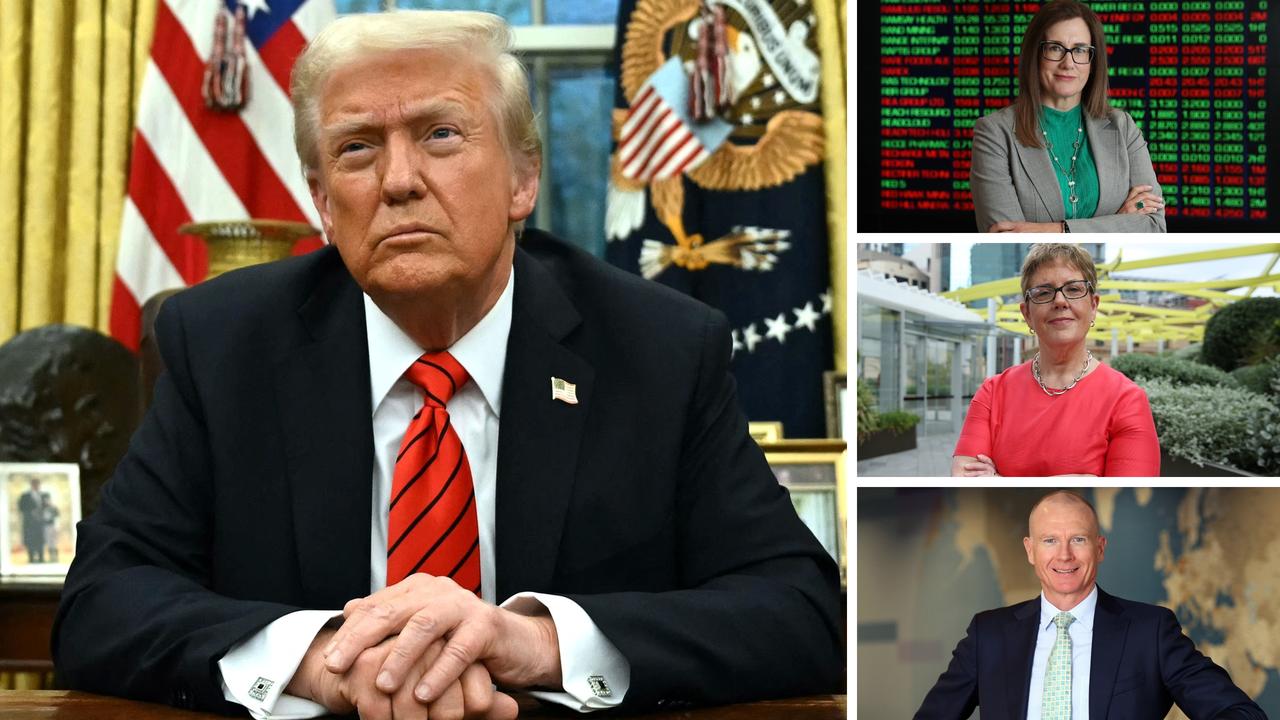

CEOs make their mark

Australia’s biggest listed companies are undergoing significant generational change with nearly half of the chief executives of the top 20 listed companies having been in place for less than three years. Five of these executives are yet to notch up a year.

The average CEO tenure of the ASX 20 is a little over five years and three months, although the addition of Goodman Group boss Greg Goodman who has been in the role for nearly 25 years skews the numbers. Take him out and the average drops to a little over four years.

Even when CEO appointments are internal and tick all the boxes for a smooth handover, restructuring often follows as the new boss moves to put their mark on the business, refine the strategy, or shut down pet projects. Many CEO newbies are keen to deliver early wins for investors to set themselves up for the longer term.

The most volatile time for shareholders is when an external candidate is appointed a CEO. Here restructuring is likely to be more significant with the outsider bringing a new perspective as there’s a bigger risk of a strategy reline.

Even so, two of the most significant structural changes in recent years came from internal appointments. Wesfarmers CEO Rob Scott had only been in charge for four months when he launched the $17bn spin-out of supermarket giant Coles. The move unwound much of the high stakes acquisition of his predecessor.

BHP’s Mike Henry had only less than two years in the seat when he signed off on a mega deal to fold the miner’s oil and gas assets into Woodside in a near $40bn deal. In the process he changed BHP forever. As a side note Woodside’s Meg O’Neill had only been in the role for five months to sign off on the most radical restructuring of the energy major in decades. ANZ internal appointment Shayne Elliott sold off billions of Asian-based banking assets, many acquired by his former boss.

Whether an appointment is internal or external the exit of a long time CEO usually prompts turnover among top executives ranks, as some see the cycle right to sign off, or look for career opportunities elsewhere.

New boss

Among the top 50 companies, some 13 bosses have been in place less than a year. These include CSL’s Paul McKenzie (since March), Fortescue Mining’s Fiona Hick (February), Telstra’s internal appointment Vicky Brady (September) and Coles’ Leah Weckert (two weeks), also an internal appointment.

Others include APA’s Adam Watson and Xero’s Sukhinder Singh Cassidy.

More change is coming with Transurban boss Scott Charlton flagging his retirement by the end of the year after nearly 11 years in the role, with a search currently underway with two internal candidates regarded as in the running. Earlier this month Qantas named the airline’s finance boss Vanessa Hudson will take over from chief executive Alan Joyce who has been in the job for more than 14 years. Both appointments are likely to spark a round of internal upheaval.

And what about the long termers in the top 50? WiseTech founder Richard White has been CEO for 28 years; Greg Goodman has been in place for 24 years, while Sonic Healthcare’s Colin Goldschmidt has just passed 30 years as chief executive.

Among the big four banks, ANZ’s Elliott has held the role for 7 years and 4 months. It is expected that Elliott will remain to see through the first phase of the Suncorp acquisition, which remains under regulatory scrutiny. As a rule of thumb bank bosses in Australia generally turn over after eight years.

CBA’s Matt Comyn has been there for nearly five and a half years. Prior to Comyn, Ian Narev was there for seven years, although his term wasn’t renewed and Ralph Norris for six years. David Murray held the post for 13 years, including seeing CBA through listing.

Both Ross McEwan (NAB) and Peter King (Westpac) have notched up nearly three-and-a-half years.

Elliott recently told The Australian he is still motivated and excited about the future.

“Succession is something that the board is interested in and we talk about in a robust way. My job is to build really strong internal bank candidates so the board has a choice -We have a really good team in place,” Elliott says.

johnstone@theaustralian.com.au

Originally published as Ampol boss says green diesel will drive change before EV trucks hit the road