US risks debt default as soon as July: budget office

The US be unable to pay its bills as soon as July, if legislators fail to resolve a gridlock and raise the federal borrowing limit, Congressional Budget Office estimates have revealed

WASHINGTON: The US be unable to pay its bills as soon as July, if legislators fail to resolve a gridlock and raise the federal borrowing limit, Congressional Budget Office estimates revealed on Thursday (AEDT).

The forecast by the nonpartisan office serving US congress comes as Republicans threaten to block the usually rubber-stamp approval for raising the nation’s credit limit, if Democrats do not first agree to steep future budget cuts.

“If the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will be exhausted between July and September 2023,” said the CBO.

The latest estimate provides another benchmark on top of the Treasury Department’s expectations.

The US hit its $US31.4 trillion ($US 45 trillion) borrowing cap last month, prompting the Treasury to start measures that allow it to continue financing the government’s activities.

The Treasury earlier said its cash and “extraordinary measures” would probably last until early June.

“If the debt limit is not raised or suspended before the extraordinary measures are exhausted, the government would be unable to pay its obligations fully,” the CBO warned on Thursday.

“As a result, the government would have to delay making payments for some activities, default on its debt obligations, or both.”

But the date when measures are exhausted remains uncertain as the timing and amount of revenue collections and spending could differ from projections, the CBO said.

In particular, if collections fall short, the Treasury could run out of funds before July, the office added.

For now, the Treasury’s tools and regular cash inflows would allow it to finance the government’s activities “until the (northern ) summer without an increase in the debt ceiling, a delay in payments, or a default,” the CBO said.

The White House accuses Republicans of taking the economy “hostage” to posture as fiscally responsible.

Democratic Senate Majority Leader Chuck Schumer said: “We’re continuing to speak to how bad it would be to allow the nation to default.... It’s going to affect every American family badly.”

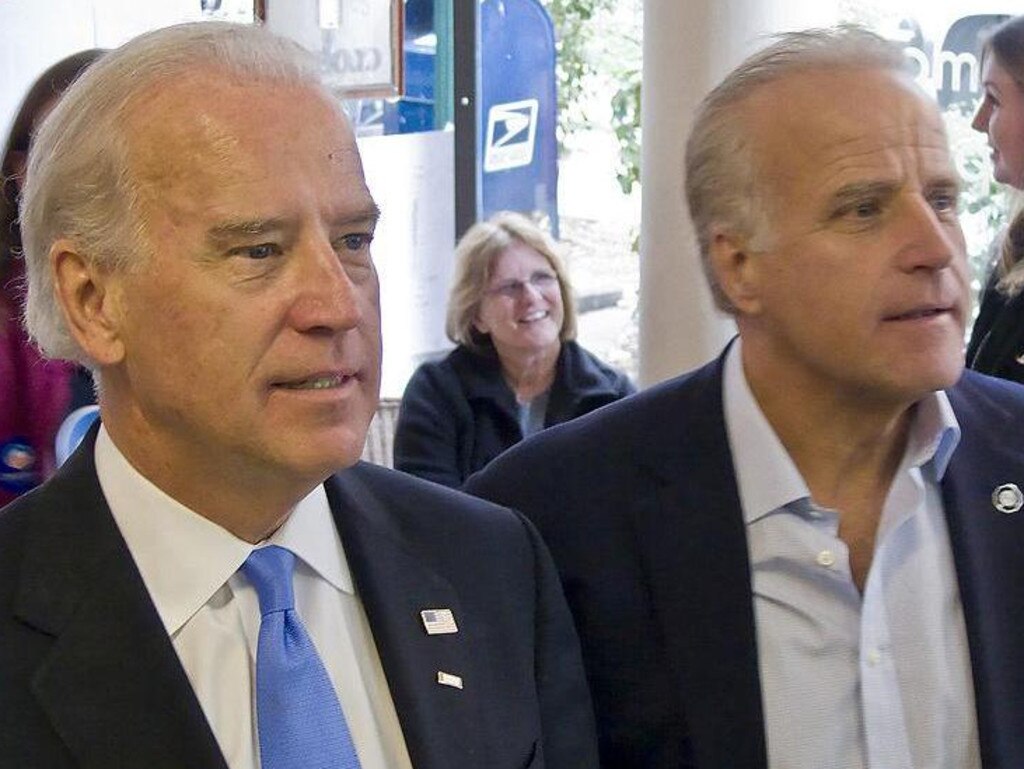

At the start of the month, Republican speaker of the House of Representatives Kevin McCarthy said talks with President Joe Biden on the debt ceiling went well.

But both sides have yet to reach a deal.

It is hard for either party to say where they can find significant reductions unless they go into areas like Social Security, Medicare, Medicaid or other government-subsidised healthcare –which are usually politically untouchable.

In a separate report released on Thursday, the CBO said it projects a federal budget deficit of $US1.4 trillion for 2023.

This amounts to 5.3 per cent of gross domestic product and is set to reach 6.9 per cent of GDP in 2033 – a level exceeded only five times since 1946.

And the shortfall is set to hit $US2.7 trillion in 2033.

Meanwhile, the debt-to-GDP ratio is expected to rise each year, hitting a record high of 118 per cent by 2033, said the CBO.

“Debt would continue to grow beyond 2033 if current laws generally remained unchanged,” the report said.

This comes as the growth of interest costs and mandatory spending outpaces increases in revenues and the economy.

Newly enacted legislation also adds to deficit predictions, noted CBO director Phillip Swagel.

The rise in mandatory spending is driven by growing costs for Social Security and Medicare, he added.

“The cumulative deficit over the 2023-2032 period that we now project is $US3 trillion larger than we projected last May,” Swagel said.

The CBO raised its deficit estimate for 2023 and projections over the next decade, in part to account for legislation enacted after the May 2022 forecast.

“Those changes included significant increases in outlays for mandatory veterans’ benefits and increases in outlays for discretionary defence programs,” it said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout