Trump Organisation ordered to pay $2.3m in criminal fines for tax fraud

Donald Trump’s family business to pay the maximum possible penalty for 17 counts of tax fraud including falsifying business records.

Donald Trump’s family business was sentenced to pay $1.6 million (AUD$2.3m) in criminal fines following its tax-fraud conviction for using an off-the-books compensation scheme to pay some employees in perks, such as cars, rent-free apartments and cash.

A New York jury in December found two Trump Organization entities guilty of a total of 17 criminal counts, including tax fraud, conspiracy and falsifying business records. State Supreme Court Justice Juan Merchan, who presided over the trial, imposed the penalty at a hearing Friday.

The fines were the maximum allowed under the law, Justice Merchan said. He ordered the defendants to pay within 14 days.

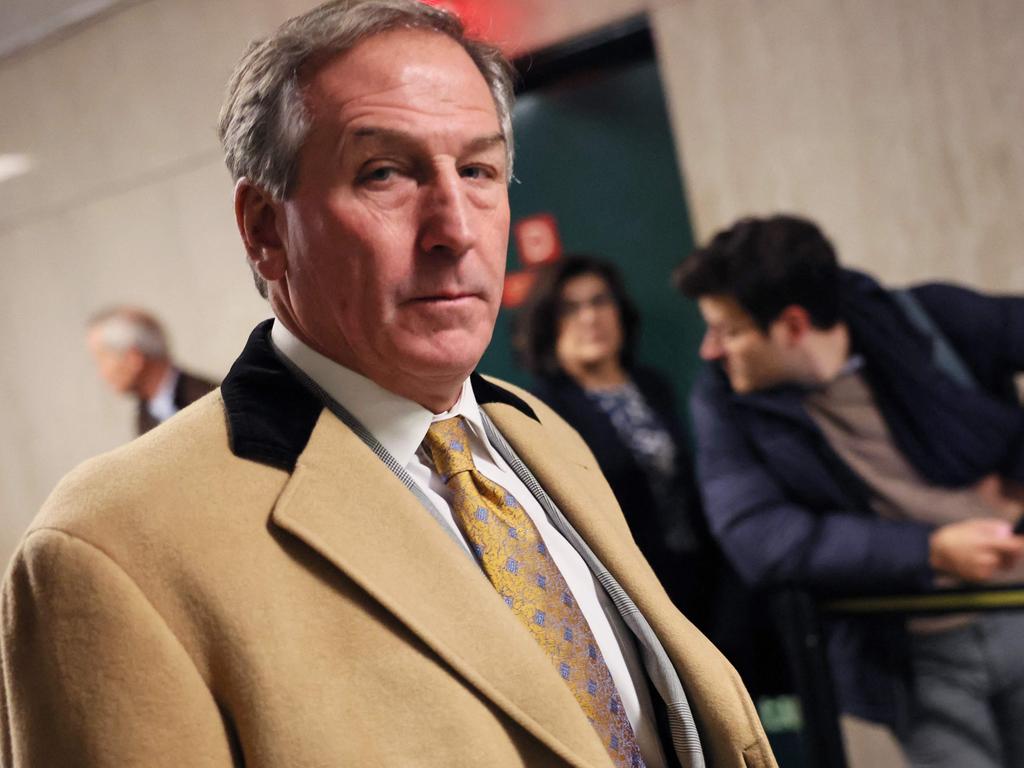

Outside the courtroom, Manhattan District Attorney Alvin Bragg said the maximum was insufficient. “Our laws in this state need to change in order to capture this type of decade-plus, systemic and egregious fraud, ” he said.

Susan Necheles, a Trump Organization lawyer, said the company planned to appeal. “Much of the conduct, virtually all of it, was reviewed by an accountant,” she said, asking the judge for a lower fine.

At trial this fall, prosecutors from the Manhattan district attorney’s office argued that longtime company finance chief Allen Weisselberg, who pleaded guilty to participating in the scheme, committed tax crimes not only for his own benefit, but to save money for his employer. Mr. Weisselberg, 75 years old, testified as a prosecution witness as part of his plea deal, and his account was central to the district attorney’s case. He told jurors that he and other company employees evaded paying taxes on some income because they were compensated in benefits in lieu of salary increases.

Mr. Weisselberg was sentenced Tuesday to five months in jail followed by five years probation and is serving his sentence at New York City’s Rikers Island jail complex.

The Trump Organization’s lawyers argued that Mr. Weisselberg engaged in tax fraud because he was motivated by greed and didn’t commit his crimes to help the company.

Mr. Trump wasn’t charged in the case, but his name surfaced frequently during the trial, with prosecutors alleging the tax-fraud scheme had been sanctioned by the former president.

After the verdict, Mr. Trump said the case was unprecedented and involved no monetary gain to the two entities.

A Trump Organization spokeswoman on Friday said the company had done nothing wrong. “These politically motivated prosecutors will stop at nothing to get President Trump,” she said.

The tax-fraud charges were an offshoot of a broader investigation into Mr. Trump and his company that began under former Manhattan District Attorney Cyrus Vance Jr. Mr. Vance’s office in 2019 subpoenaed documents from the Trump Organization about hush money paid to adult-film actress Stormy Daniels over an alleged sexual encounter with Mr. Trump, which he denied. The probe shifted to examine whether Mr. Trump and his company falsely valued assets to gain tax, loan and insurance benefits. Mr. Trump has denied those allegations, which are now the subject of a pending civil case brought by New York Attorney-General Letitia James.

Mr. Vance authorised his prosecutors to seek an indictment of Mr. Trump toward the end of his term, but Mr. Bragg, the current district attorney, later told those prosecutors not to seek charges, one of the lead prosecutors said in a resignation letter last year.

“I felt when I left the office that the investigation should be continued,” Mr. Vance said in an interview. “I was disappointed it was not.” Still, he said, the verdict in the tax-fraud case was consequential. “I expect other cases may flow out of this,” he said.

Mr. Bragg, in an interview, said prosecutors could move on with the rest of their investigation into Mr. Trump, his company and its executives now that the sentencing was over. His prosecutors — largely a different team than Mr. Vance’s — are reviewing evidence with fresh eyes, he said, and having the trial prosecutors working on the investigation daily would be helpful.

“They know the Trump Organization very well, know the players inside and out,” he said. Mr. Bragg said his office had been careful to keep its broader probe quiet, but now that the trial was over, prosecutors were free to take more visible investigative steps.

The office has recently reached out to people involved in the hush-money aspect of the probe, according to people familiar with the matter, raising the prospect that prosecutors could revive a long-dormant angle of the inquiry.

Dow Jones

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout