Donald Trump in line for a $3.5 billion windfall from his stake in Truth Social

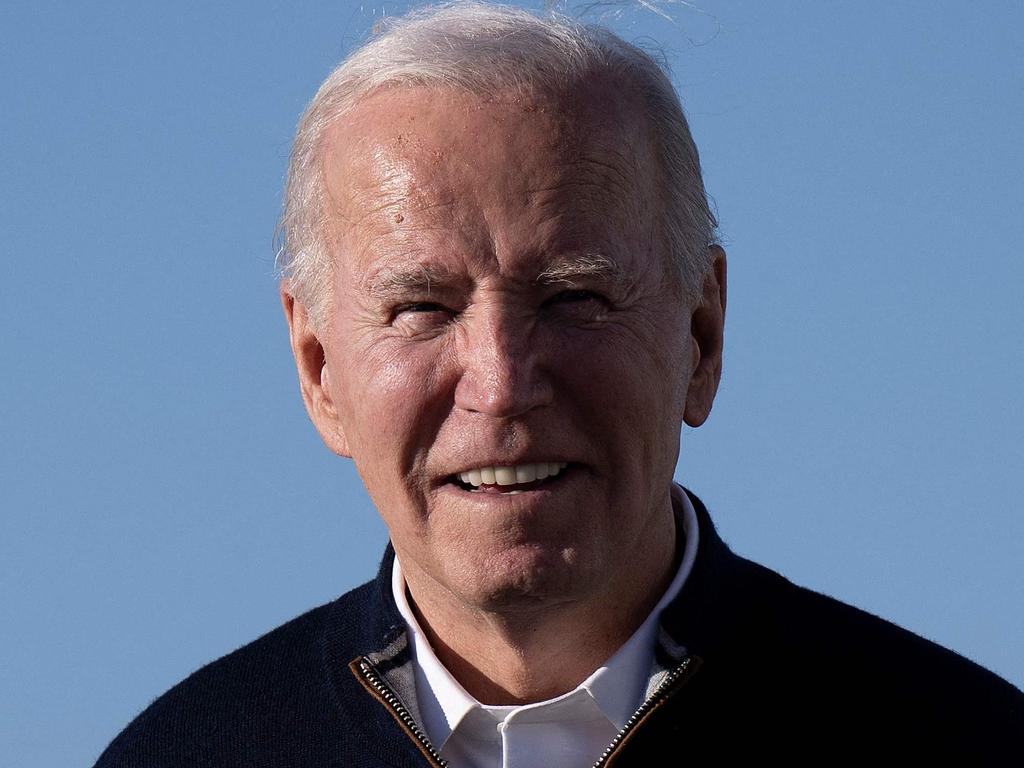

Donald Trump’s social media company has lost millions, but it is now set to make billions at a crucial time for the financially stressed former president.

Donald Trump’s stake in his social-media company could soon be worth nearly $3.5 billion, giving the former president a potential windfall that could ease his financial pressure and boost his political campaign.

Trump’s winning lottery ticket would come from Truth Social, the struggling social-media platform he launched in 2021. After a twisted path that included tens of millions of dollars in losses and insider-trading convictions, the platform could be worth billions of dollars because the former president’s supporters have bid up the shares of its merger partner.

Truth Social’s parent is set to go public by combining with a special-purpose acquisition company, or SPAC. Thousands of small investors have been buying the SPAC’s shares to express their support for Trump.

Those investors are expected to approve the merger Friday morning. Trump’s company could replace the shell company in the stock market as soon as Monday. The new ticker would be DJT, Trump’s initials.

The deal is as stunning as it is unusual. Truth Social was created by Trump after he was bounced off other social-media platforms. The platform has failed to catch on with users and its financial performance has been dismal. The platform has logged about $5 million in sales since its launch three years ago and burned through the roughly $40 million it raised from convertible notes.

That hasn’t mattered as long as shares of Digital World Acquisition Corp., the SPAC aiming to merge with Truth Social, are soaring. The stock rose 18 per cent to nearly $43 Wednesday, implying a valuation of roughly $6 billion for Truth Social. Trump would own about 60 per cent of the public company.

“There seems to be an unwritten agreement between tens of thousands of traders that the more political momentum Trump has, the more the stock should trade higher,” said Julian Klymochko, who manages a SPAC-focused fund at Accelerate Financial Technologies.

“It’s more of a political statement and a quasi betting tool on the election.”

The potential windfall comes at a crucial time for Trump. On Monday, Trump faces a deadline to obtain a bond to guarantee payment of a $454 million civil-fraud judgment against him. His campaign is lagging behind President Biden’s in cash, weighed down in part by Trump’s legal bills.

The outcome of the vote and Trump’s ultimate payoff are still uncertain. Friday’s vote could still be postponed, though it is in the financial interest of everyone involved to approve the deal. The company has previously struggled to get shareholders to organise the army of individual investors to vote on other decisions that were in their interest.

Trump would have to hold the shares for six months before selling, meaning he can’t touch the cash until the end of September. He could request a waiver to sell his stake or borrow against it, regulatory filings show. It is unclear if insurers that would back the bond would accept these shares.

Over the six months, Truth Social could continue to struggle. Though the company could get several hundred million dollars from the deal, it has failed to become a competitor to bigger platforms. Trump has been reinstated on both X – formerly known as Twitter – and Facebook.

The expectation that Trump would dump his shares as soon as possible could also tank the stock price.

The DJT ticker is the same stock symbol that Trump had for his ill-fated casino company, Trump Hotels and Casino Resorts. The company was valued at nearly $800 million in 1996 before shares collapsed and it filed for bankruptcy in 2004. Trump’s lavish pay package, even as the stock fell, drew the ire of many investors.

Also called a blank-check firm, a SPAC like Digital World is a shell company that raises money and trades publicly with the sole intent of merging with a private firm to take it public. Such deals exploded in 2020 and 2021 as alternatives to traditional initial public offerings for buzzy start-ups – before essentially disappearing in recent years.

After regulators and investors approve a SPAC deal, the company going public replaces the SPAC in the stock market.

Dow Jones