ASX falls 1.3 per cent in October

The ASX closed down 0.25 per cent as supermarket giants Coles and Woolworths announced weaker than expected sales.

The ASX closed down 0.25 per cent as supermarket giants Coles and Woolworths announced weaker than expected sales.

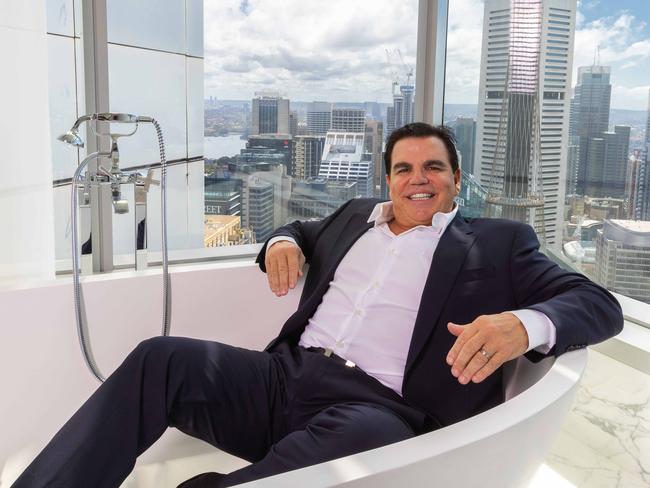

Sydney Roosters chairman and billionaire Nick Politis is set to expand his property portfolio with an offer for pubs and shopping centre group Eumundi that its board deemed too good to refuse.

The ASX closed down 0.8 per cent as investors factored in the unlikely chance of getting a rate cut following fresh inflation data on Wednesday.

The ASX hits a four-week low before rebounding. Gains in tech, consumer discretionary, property and financial stocks are offset by falls elsewhere. Investors pile into Mineral Resources after Rinehart’s $1.13bn deal. JB Hi-Fi, Wesfarmers and Coles rise on positive updates.

The S&P/ASX 200 index closed down 0.8 per cent at 8180.4 points after hitting a three-week low after disappointing inflation figures and a profit warning from Woolworths. Annual headline inflation drops to 2.8 per cent. Trimmed mean CPI of 3.5 per cent meets estimates. CBA scraps call for RBA rate cut in December.

The ASX closed up 0.3 per cent for the third straight day, as investors wait for clarity from global markets.

The troubled miner has rejected claims it may have breached ASX rules around market disclosures over tax issues involving its managing director Chris Ellison.

The local sharemarket rose slightly, led by property and tech stocks. Qantas and Premier Investments hit records. Myer spikes up after $864m apparel brands deal with Premier as Solomon Lew scores a board seat.

Australia’s economic deterioration has led to a sharp increase in ASX-listed zombie companies who are barely staying afloat, according to KPMG.

The ASX doesn’t appear to have a concrete plan to bolster the dwindling pipeline for initial public offerings in Australia, as listings sink to their lowest level since 2012.

The ASX chair acknowledged shareholder anger over a disastrous technology project that sparked a first strike over executive pay at the market operator’s AGM in Sydney.

Eureka Group claims its rent hikes are pegged to the federal government’s rental subsidies and pension increases, after admitting rent hikes of up to 14pc had been excessive.

A major ASX-listed retailer that owns iconic brands such as Katies, Rivers and Millers has gone into voluntary administration.

The exchange operator must fundamentally change if it wants to stay relevant. Hopefully this upheaval is the start.

The sharemarket was flat on light volumes as investors awaited key inflation data. Mosaic Brands enters receivership with KPMG appointed. ASX Limited hit by first strike against remuneration report.

The local bourse is set for a low-key start to the week, as investors wait on inflation data that will play a major part in when the RBA decides to move on interest rates.

Melbourne investment banker David Williams is hoping to turbocharge Rate My Agent’s profits via a new deal that delivers more social media tools to real estate agents.

The deal finally brings to an end Ian Malouf’s long-held ambition to build a huge waste-to-energy plant in Sydney’s Eastern Creek.

Australia’s only ASX-listed music company holds plenty of ambition, taking on every element of the lucrative industry in a bid to reach 1 billion fans.

The ASX is due to lodge a response with the Federal Court in under three weeks to damning allegations that it misled investors, amid little sign that settlement deliberations are underway.

Original URL: https://www.theaustralian.com.au/topics/asx/page/13