Help! My partner is bad with money

First thing to know: Often money issues aren’t actually about money issues.

First thing to know: Often money issues aren’t actually about money issues.

Glen James is asked for a lot of advice about money. As a result, he deals out a lot of relationship advice.

Rather, he is a podcaster and champion of improving financial literacy.

‘My partner is bad with money… How do I talk to them about it?’ is one of the most common questions James, the host of My Millennial Money, is asked.

There's no silver bullet, and probably not even a quick fix. If this comes as a disappointment, this is the column you should be reading.

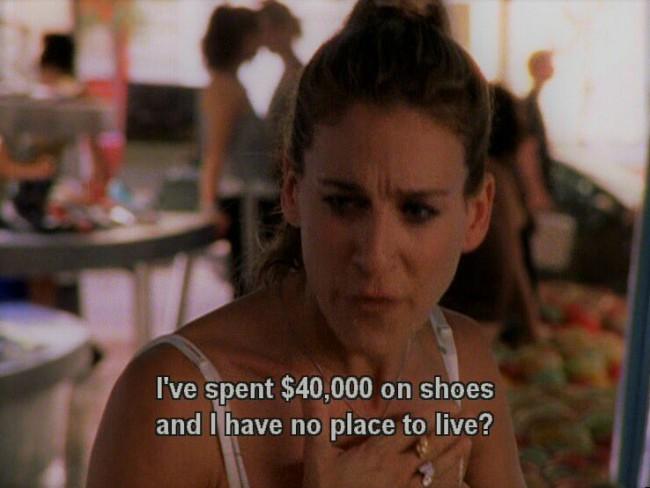

One person’s idea of justified spending could be viewed as totally deranged behaviour by their significant other. Sound familiar?

James has helped steer many couples through money woes, and we're here to help you too.

The good news is, with a little encouragement and common goals, big spenders and bad savers can be taught new tricks.

Agree on a system from the get-go

This isn’t always an easy thing to establish – especially if you met him/her on Hinge, and you still can’t tell whether things will fizzle out after the third date, or you’ll end up married with four kids and a cavoodle.

Still, James says splitting the dinner bill 50/50 is a safe bet to begin with. That way, no one ends up out of pocket if one person ghosts the other.

If things are progressing enough that dinner and drinks aren't all you’re splitting, it’s worth figuring out what you’re both comfortable with in terms of spending.

How we spend and talk about money can be infused with shame and taboo, so setting a candid tone can be challenging but is critical to communication.

“It’s good to discuss what’s important to each person and agree on a system that works for the couple. It could be as simple as taking turns, continuing to split things down the middle or, if you’re both comfortable with it, making an agreement to split based on salary.”

James also recommends ‘keeping the communication channels open’ and checking in with each other from time to time.

“Clarity is always kind."

Make it about the fun stuff

Saving habits are just as important as spending habits. If setting yourself (and your relationship) up for the future is something you’re worried about, one way to mitigate the worry is to put some common goals in place.

“Invite your partner to lean into conversations about money and lifestyle goals,” advises James, adding that placing emphasis on lifestyle can help make the chat feel a little more exciting, or, at the very least, like it’s about more than just money.

“Make the goals the hero of the conversation and then look at ways to achieve them together. Most ‘spenders’ can actually save money if they are buying into a goal.”

In terms of sticking to goals, James says leading by example can be valuable. Also, no one wants to be the one who doesn’t hold up their end of the deal.

“Not everyone will be into ‘money’. But they need to be into the relationship or lifestyle goals, which usually includes money.”

Don’t forget to check in

If you agree on regular check ins, conversations around money will feel a lot less abrupt. It is also important that you agree these check ins are safe spaces.

“One thing you can decide is that you are free to make any observations at these check-ins in a non-judgmental way,” says James.

If you’ve become concerned about something since your last check in, James recommends approaching the conversation with curiosity and kindness.

“It could be something as simple as, ‘hey, I’ve noticed you’ve been spending a lot lately – more than usual. It seems your spending is frantic and not planned, is everything okay, or am I looking into this too much?’”

If the schism between your spending and saving habits is widening, our clever friend candour needs to visit.

“If you are on the same page with goals, you might want to again ask: ‘Is this moving us closer to or further away from our goals?”

If all else is failing

If your partner is still burning through their cash and you’ve pulled out all stops, James invites you to consider where their erratic approach to money is stemming from.

“Often issues of trust, secrecy and a lack of communication can present themselves as a money issues, as that is a tangible object.”

There could also be historical issues at play. Did your partner grow up with the sense money was always tight? Were their parents big spenders? Was money a big, taboo secret for their childhood family?

Sometimes the best advice for couples struggling with money is to head to relationship counselling.

As James cautions, “Often money issues aren’t actually about money issues".

Still, if you’ve tried and failed to get your partner on board with basic goal setting – even some input or agreement of some common boundaries – it’s probably time for some relationship counselling.

“If you can’t get your partner to go with you, go yourself,” recommends James.

Still in doubt? “Ask your best friend if they think it’s a money problem or a relationship problem. Our best friends often have very good insights into our own lives. They can provide some great perspective.”

If relationship counselling doesn’t provide you with any breakthroughs and your bestie reports back with hesitations, it’s time to get honest with yourself and analyse how important money – and the relationship – is to you. Money can’t buy happiness. But in some cases, the way a person uses and abuses it can be a symptom of deeper unhappiness. And that’s worth thinking about it.

Glen James is the host of My Millennial Money podcast and the author of Sort Your Money Out and Get Invested.