Is Beyonce about to bomb?

Renaissance, which arrived on Friday, is the most talked-about release of the year. But you wouldn’t know it by looking at her lead single.

Renaissance, which arrived on Friday, is the most talked-about release of the year. But you wouldn’t know it by looking at her lead single.

That song, “Break My Soul,” was released amid a torrent of social-media attention, but just a few weeks later, it has largely fallen flat.

The clubby dance-pop track on Wednesday was No. 47 on Spotify’s daily U.S. top 50 chart. Last week, it was the 34th most-streamed song in the U.S. across streaming services, according to data tracker Luminate. While the song is No. 7 on the Billboard Hot 100 singles chart, thanks to U.S. radio play, it’s lagging behind hits by Lizzo, Harry Styles and Kate Bush. That’s an unexpected outcome for one of the most celebrated music stars of the 21st century.

Beyoncé isn’t the only superstar who’s struggling to make a hit with staying power. The past year has seen superstars release new music to weaker-than-expected sales or reviews.

Post Malone’s new album Twelve Carat Toothache, released last month, peaked at No. 2 on the Billboard 200 album chart, instead of No. 1 like its predecessor; it has since slipped to No. 14. Drake’s latest record, Honestly, Nevermind, also released last month, generated a third of the first-week numbers of his previous record. Kendrick Lamar’s Mr. Morale and the Big Steppers, from May, earned the Pulitzer Prize-winning rapper one of his lowest ratings on Metacritic, a website that aggregates critics’ reviews. Adele’s 30, which was released back in November, largely came and went, compared with her past albums.

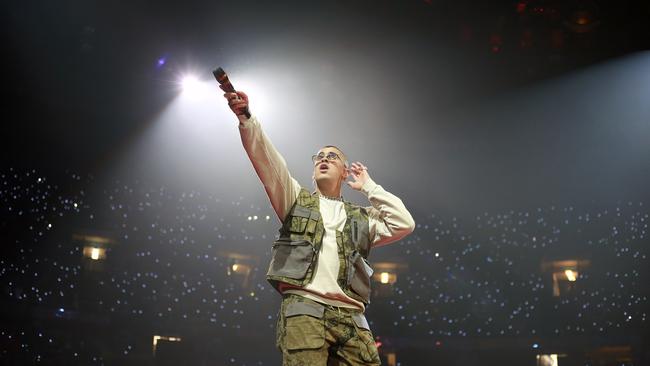

Fans’ weak response to new music is fueling concerns in the music business. Some of the biggest stars of the 2010s could simply be losing their creative momentum, critics say, replaced by relative newcomers like Olivia Rodrigo, Lil Nas X, Morgan Wallen and Bad Bunny, who has the No. 1 album in America.

Of course, if Beyoncé’s album wins over fans, it could soar. And her sales and streaming figures and number of chart-topping hits have long lagged behind her cultural relevance. But some music analysts suggest the problem is that even the biggest artists are losing the ability to score ubiquitous hits in an overcrowded marketplace.

A spokeswoman for Beyoncé couldn’t be reached for comment.

Total consumption of current music in the U.S.—album sales, track purchases and online streams of music that is less than 18 months old—shrunk by 1.4% in the first half of 2022, according to a new report by Luminate. The decline is especially worrying for music executives because Americans are actually consuming 9.3% more music than last year. (Such an increase would typically lift both new and old music.) Consumption of catalog music—music 18 months or older—grew 14% compared with last year.

“We’re talking about ‘current’ music actually getting less popular,” Tim Ingham of industry tracker Music Business Worldwide wrote in a recent analysis. “For whatever reason, ‘new’ music—be it a temporary trend, or a pattern with more permanence—is officially losing ground.”

The trend has been gathering steam. In 2021, streaming of new music declined for the first time. Major stars like Adele and Ed Sheeran arrived with marquee albums whose numbers and cultural impact didn’t match prior efforts. The most-streamed artist on Spotify last year was Bad Bunny, who didn’t even release a new album that year. The top four songs on Billboard’s 2021 year-end singles chart were songs from 2020.

It’s not that consumers have switched to decades-old music, analysts say. While 1990s and 1980s music is a sizable share of catalog streaming, 1970s and 1960s music is minimal. The resurgence of Kate Bush’s 1985 song “Running Up That Hill (A Deal With God),” for example, stems primarily from its repeated use in the popular Netflix show “Stranger Things.” In fact, 64% of catalog streaming in the U.S. is titles from 2010 to 2019, according to data provided by Luminate.

Instead, the bigger factor is that it is getting more difficult for music superstars to cut through the noise, analysts say. Hit-making appears to take longer, and even the biggest hits may have reduced reach, they say.

Today’s streaming-era listeners are more fragmented than they were when music was ruled by Top-40 radio or MTV. Streamers are also becoming a more diversified group in terms of their tastes. After Spotify launched in the U.S. in 2011, many of the early adopters were hip-hop fans. Now, more streamers listen to rock, country and Latin music and older music from the 2010s and 2000s. TikTok, meanwhile, turns songs—some decades old, others just a few years old—into new hits in seemingly random fashion. Then there’s the sheer volume of new songs uploaded every month. These factors could mean fewer successful blockbusters, analysts say.

According to Luminate, in the first half of 2021, there were 126 high-impact releases that debuted on the Billboard 200 album chart. By the end of the second quarter of 2022, there were only 102, Luminate says.

A notable exception is Bad Bunny, the Puerto Rican superstar rapper and singer. His popularity on streaming this year evokes the colossal units moved by Drake and Adele in the mid-2010s, analysts say.

Beyoncé, whose business tactics are pored over in the music industry, has taken a different approach with her first studio album since 2016’s “Lemonade.”

The 40-year-old R&B and pop singer has undertaken a conventional album rollout with weeks of advance promotion—a departure from the surprise-release method she popularized. She also belatedly joined TikTok, a launchpad for today’s hits, to promote “Break My Soul.” Musically, Beyoncé’s lead single leverages nostalgia with a nod to club and house music. This week, her team teased “Club Renaissance” listening parties ahead of the album, which reportedly leaked Wednesday.

Will Beyoncé buck the new music trend?

She has a record of reinventing herself, critics say.

So far, her traditional rollout has succeeded in generating buzz. According to Chartmetric, a music-analytics firm that compiles data from streaming and social media, Beyoncé’s career is experiencing “explosive growth”—the highest ranking on Chartmetric’s five-level gauge (“explosive growth,” “high growth,” “growth,” “steady” and “decline”).

But another metric, her ranking on Chartmetric relative to other artists, was losing some steam as of Wednesday, after spiking in late June and early July. That may suggest that even Beyoncé is not immune to the challenges facing new releases.