Ford laid out plans for an EV future. The sceptics are getting it wrong

Ford Motor’s sceptics aren’t giving the motoring giant credit where it’s due – there’s still ‘a glimmer of hope’.

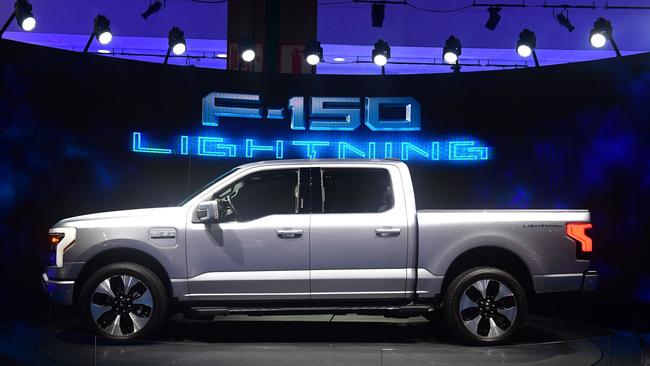

Ford Motor finally gave investors a peek at the electric-vehicle start-up it’s been incubating inside its 119-year-old self. While the stock’s decline suggests disappointment, there’s more to like than the market is giving it credit for.

In 2022, Ford announced that it was rearranging itself and would henceforth be reporting separate results for its traditional car business, its commercial business, and its EV business. Those segments are now referred to as Ford Blue, Ford Pro, and Ford Model e. On March 23, Ford showed analysts and investors how each business was doing, restating results for 2021 and 2022 while giving some guidance for 2023.

The EV business got most of the attention. In 2022, Model e lost about $US2.1bn ($3.12bn) on the operating line of the profit-and-loss statement after selling about 96,000 units, which generated about $5.3bn in sales. The operating-profit margin came in at about negative 40 per cent.

ELECTRIC VEHICLES SPECIAL REPORT

EVs get backing in Labor’s federal budget

The 2023 federal budget has been a landmark win for electric vehicle industry in Australia, but lobbyists say there is more to be done.

Cars get cheaper as key costs fall Cheaper cars as costs fall

The cost to buy an electric vehicle is beginning to come down, making EVs more accessible than ever, but what does this mean automotive brands?

Infrastructure a big budget winner

The 2023 budget included a huge win for EV infrastructure, with a national fast-charging network and an investment in alternative fuels on the forefront.

EVs are getting bigger and better

Large SUVs are loved by families around Australia, and the electric SUV market is expected to explode in response.

Luxury sits up high as sales boom

Electric vehicles are quickly becoming the favourite of the luxury buyer with 158 per cent boom in sales in the first quarter of the year.

Haters gonna hate but the market won’t stop moving

The electric vehicle market continues to boom, despite the naysayers.

How EVs are changing sports cars

Electric motors are defining the world of sports cars, with acceleration speeds that rival the likes of Formula One.

Audi gets room to grow with new platform

Audi’s Premium Platform Electric (PPE) will support Audi to release 10 new EVs in two years as they move towards phasing out internal-combustion engines in 2027.

The ultimate buy guide for EVs

The world of EVs is expanding so quickly it can be hard to keep up, so here’s what to look for when buying an electric vehicle.

The eight must-know EV facts

EVs can make motoring simpler, but there is a learning curve that it pays to get on top of. Here are eight things you may not know about electric cars.

New laws to stop ‘ICE-blocking’

‘ICE-blocking’, parking a combustion-engined car in an electric-vehicle charging spot, will soon land you in hot water with states across Australia introducing huge fines.

Holiday hotspots due for a jolt

State governments are pouring hundreds of millions into EV infrastructure, it’s about time they look towards the holiday hotspots that are being inundated with EV owners.

Tesla downloads new revenue model in over-the-air upgrades

Tesla rolls out a new model that allows owners to buy upgrades directly from their vehicle’s centre dash screen in a bid to increase revenue.

Would this EV tempt to you buy a Saab again?

Saab is back. Well, as NEVS, and they’re returning with a stunning electric concept car, The Emily GT but they need investors to bring it to life.

Can battery metals be sourced sustainably?

What are the environmental costs behind sourcing the metals for the batteries that power our electric vehicles?

Oil use down as EVs rise

New research from the International Energy Agency has found that demand for oil is down as EVs become the driving force behind the new global energy economy.

Are EVs really cleaner? It depends where you live

Are electric vehicles really the answer to the rising CO2 rates? Or are they not as clean as we thought? Well it depends where you live.

‘Blade’ battery to cut range anxiety

Development of EV batteries is advancing everyday, with batteries capable of more than 1000km of driving on a single charge soon to be hitting the roads.

Does hard driving mean hard wearing?

If you love driving hard and fast, your next supercar should be an EV, as electric motors are designed to last the life of the vehicle.

That’s a large loss for a company that has struggled to grow its earnings in recent years, and it doesn’t compare favourably to Tesla when it was a similar size. Around 2015 and 2016, Tesla was losing roughly $850m a year, net of its zero-emission regulatory credit sales, generating operating margins of about negative 15 per cent.

It also left observers less than thrilled. Navellier market strategist Louis Navellier commented that “Ford is struggling to reach profitability,” while Daiwa Capital Markets analyst Jairam Nathan, who rates Ford stock a sell, finds Ford’s long-term targets – including 8 per cent operating profit margins for Model e – “optimistic.” He expects “a more volatile transition to EVs where [traditional] vehicle prices and profitability decline sharply.” Ford stock fell almost 3 per cent, to $11.26, in the days following results for the new segments on March 23 and is off 33 per cent over the past 12 months, lagging the S & P 500’s 14 per cent drop.

Deutsche Bank analyst Emmanuel Rosner also has a sell rating on Ford stock. His price target is $11 a share. Still, he saw a glimmer of hope in the update, calling the losses at Model e less than expected. Ford’s margin shows the company spent roughly $7.4bn in the Model e business in 2022, while Rivian Automotive, which shipped about 20,000 units in 2022, spent about $8.6bn. Tesla was spending roughly $6bn a year when it was a similar size to Model e.

The difference between Ford and Tesla partly comes down to this: Ford is making most of its EVs at two factories, while Tesla was operating out of one. That means Ford needs to sell more cars to reach scale. Tesla wasn’t consistently profitable until it was shipping about 400,000 units a year.

There’s a good reason for Ford’s apparent profligacy. Benchmark analyst Mike Ward said Ford’s EV losses are “more than accounted for” by above-average spending on research and development and engineering, which positions the company to gain share in the EV market. He sees potential, pointing out that Ford’s EV goals imply annual sales of $100bn and operating profit of $8bn by the end of the decade. Ward has a Buy rating and a $19 price target on Ford stock.

Ford is still profitable, even with all its spending on EVs. It generated $10.4bn in operating profit in 2022 and expects to generate about $10bn in 2023, including roughly $13bn from its non-EV businesses.

If Ford can hang on to profits in its traditional businesses, which include credit and commercial units that aren’t affected by the EV transition, investors could be looking at $15bn to $20bn in annual operating earnings by the end of the decade.

Investors aren’t convinced yet. If Ford was expected to grow operating profit by 50 per cent to 100 per cent over the coming few years, its shares should trade for higher than the current seven times 2023 earnings estimates.

Given the potential, they should take another look under the hood.

THE WALL STREET JOURNAL

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout