IF governments want to earn the trust of voters they need to provide policy certainty, especially in areas where people invest their own money.

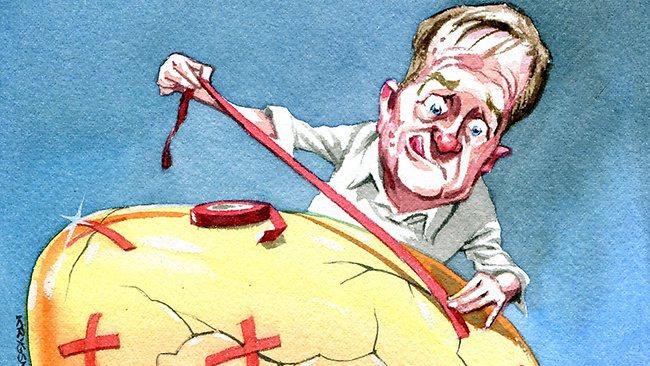

That is why Labor's shifting sands policies to do with superannuation are unacceptable. It is why Bill Shorten, as the relevant minister, is to be condemned for seeking out short-term budget savings via yet more tax adjustments to superannuation so that Wayne Swan can avoid the embarrassment of delivering another deficit.

I can accept the Treasurer is scrambling to find budget savings, but I cannot accept Shorten helping out his Australian Workers Union mate by selling out the certainty of a stable and consistent superannuation system: one on which we can all rely to make an investment in for our retirement.

Translation: Shorten is compromising long-term super investments for Labor's short-term political objectives. The tax grab in the super space is all the more galling when you consider the genuine fiscal challenges of the ageing of the population.

Labor has a proud history when it comes to enacting and growing the compulsory superannuation system in this country. Paul Keating - in conjunction with trade unions - started the process, and the present government has put in place legislation to lift the superannuation guarantee from 9 per cent to 12 per cent in the coming years. That came after more than a decade of policy neglect during the Howard years. Despite the political weaknesses of the Gillard government, it managed to shame the Coalition in opposition into backing the rise.

Compulsory super is good policy if you believe people should be self-sufficient when it comes to paying for their retirement. Certainly if you don't think that people left to their own devices will adequately save.

However, most industry experts predict superannuation of at least 18 per cent across a lifetime of work is necessary for citizens to maintain their work-life living standards during retirement. The required percentage may prove to be even higher given the outlook of lower growth in coming decades compared with decades gone by. Which is why policies that encourage people to top up their super are essential, at least until such time as the compulsory rate rises to 18 per cent or more.

Labor has slowly but surely reduced incentives to top up super during its two terms in power, creating underlying uncertainty about the rules of the super game. And despite the numerous changes already foisted on the super industry, now we see media speculation about the further changes that are under review in the lead-up to next year's federal budget.

This is why the former secretary of the ACTU during the heady days of the Hawke government, Bill Kelty, has added his voice to a growing chorus of observers concerned that Labor is losing its edge as the champion of superannuation. A historical lead over the Coalition in this important policy area is being eroded because of short-term budget fiddling. As a consequence, confidence in the super system is diminishing, which is a very bad thing given how vital it will be to manage the fiscal challenges of an ageing population.

There is now bipartisan shame when it comes to superannuation policies in this country: Labor is good at jacking up the rate, Liberals aren't. Liberals are good at voluntary incentives to top up the compulsory rate, Labor has proved itself unable to match such incentives. That's despite a commitment from Labor before it was elected that it would not tamper with superannuation. Just days before the 2007 election, Kevin Rudd told a Queensland radio audience: "There will be no change to the superannuation laws, not one jot, not one tiddle." Despite that unequivocal commitment, the following changes have been made since Labor came to office:

2008:

The government reduced the concessional contributions cap on super from $50,000 to $25,000 and indexed it. For people 50 and older (in other words, working Australians trying to catch up on under-investment in super before it was compulsory) it was reduced from $100,000 to $50,000, and will reduce to the $25,000 rate used for everyone else this financial year.

Salary sacrificing contributions to superannuation included as income for means testing.

2009:

The government's super co-contribution scheme was reduced, both in terms of the percentage of the government's contribution and the maximum to which the government would match the payments of workers. At first it was announced to be temporary; the following year the changes were made permanent.

2010:

Automatic indexation of the threshold at which remaining co-contributions by government applied to superannuation were suspended.

2011:

Capital gains tax exemptions for traded superannuation stocks were limited, creating investment uncertainty for a minimal budget windfall of just $15 million.

2012:

Labor has reduced tax concessions for high income earners contributing to super from 30 per cent to just 15 per cent.

When the government announced plans to institute SuperStream reforms as recommended by the Cooper review, it also announceda SuperStream levy, to be paid for by super funds regulated by the Australian Prudential Regulation Authority.

While it easily could be argued that changing the nature of voluntary super rules can be justified when the compulsory rate is being amended, it's the piecemeal nature of the changes listed that frustrates the sector (and no doubt individual investors, too).

Few could argue with a government enacting changes recommended by the Cooper review. But changes should be announced in one organised grouping, not rolled out sporadically only when the budget bottom line needs a little help.

It's no wonder Andrea Slattery, chief executive of the peak industry body representing self-managed super funds, has attacked the government for policy changes designed to meet short-term fiscal needs. And she is not alone in making such criticisms.

Just this week we have seen speculation about even more tinkering to the super system, again to help Swan achieve a short-term budget fix. Removing tax breaks and even preventing lump-sum collection of super once people hit retirement age are reforms being looked at. There is no better disincentive to invest in super than uncertainty that the rules will stay consistent.

All of the above, in a context of Labor using super "reforms" to find budget savings, is precisely the wrong way to approach a policy area where Labor traditionally has held the moral high ground. And the minister failing this important policy test is one of the members of "generation next" within the parliamentary Labor Party, a genuine candidate for the leadership in the aftermath of what looks likely to be a crushing defeat at the polls next year (notwithstanding some campaign wobbles by Tony Abbott and the Coalition lately).

Off the back of similar policy failures by that other leadership hopeful for the future - Tony Burke - in relation to his last-minute backflip to ban the super-trawler from fishing in Australian waters, it seems that generation next within the parliamentary Labor Party may have as many policy implementation problems as their older colleagues, who so comprehensively butchered their opportunity to run a competent progressive government in the aftermath of the Howard years.

Peter van Onselen is a professor at the University of Western Australia.