FIRST they needed a deficit to spread the boom. Now they need a deficit to spread the bust. If General Macarthur were running Treasury, he'd declare failure as the "Keating Line" had been breached: in real terms, commonwealth net debt is back to where it was in 1996, and climbing.

It's enough to drive you to drink: alcopops anyone? Or even better, to smoke: a pack a day would help Chris Bowen, who hopes to extract $5.8 billion from tax increases on cigarettes.

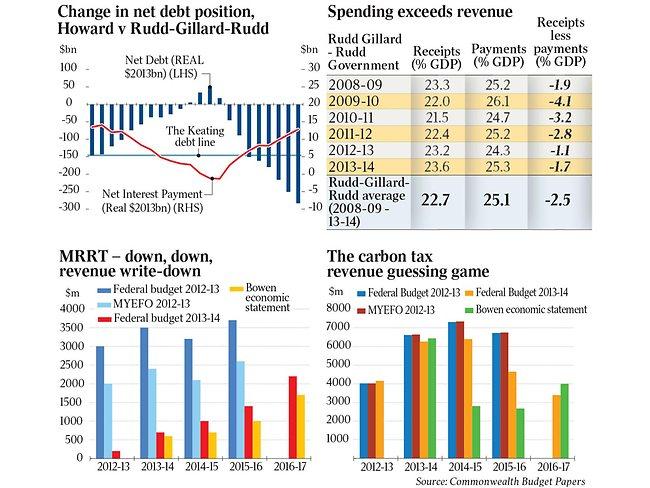

According to Bowen, the source of our woes is a "massive" writedown in revenues. In reality, receipts are higher as a proportion of GDP than at any time since Labor was elected.

But while commonwealth receipts as a percentage of GDP are expected to be 0.4 per higher this financial year than last, spending as a percentage of GDP has risen two and a half times that: an even larger rise than at the height of Kevin Rudd's stimulus.

Moreover, the longer term pressures for further increases in spending have been left unaddressed or even accentuated.

CHARTS: Labor's spending and revenue

The government continues to broaden the scope of the NDIS; uncounted billions have been committed to get Gonski over the line; health remains seriously underfunded; and were defence to ever acquire all the materiel it has been promised, it would probably need another $50 billion. But instead of genuine spending reform, the government has imposed yet another round of arbitrary "efficiency dividends" on the public service, with no attempt to ensure cuts are targeted to programs whose benefits fall short of their costs.

Almost invariably, the result is that departments, instead of doing more with less, simply spend less by doing less; then, as the effects come home to roost, the cuts are all too often reversed in ways that add to the waste.

Claimed improvements in public spending are therefore illusory. And Bowen's revenue changes are, if anything, even more doubtful.

By far the largest source of greater receipts is the higher cigarette excise; but it is risible to make Australia's public finances rest on plundering ever more from a shrinking pool of desperately low-income smokers. As for the Fringe Benefits Tax changes, they have all the hallmarks of this government's approach: a complete absence of consultation; a startling lack of concern for entirely predictable consequences; and then a rushed remedy - increased handouts to the car industry - far more distorting than the FBT itself.

The levy on bank deposits is scarcely better. But even if it were justified, if the government is right that it will merely compensate for the risk of bank bailouts, then it cannot improve the fiscal position. Rather, the levy's expected revenues will simply offset expected payments; the only change is that while the commonwealth previously recovered the costs of any bailouts after the fact, it now covers them before bailouts occur.

But least believable of all is the assertion that giving the ATO an additional $99 million to spend on enforcement will yield $827 million in revenues. That multiplier is even greater than claimed in previous rounds of increased ATO funding, as if the law of diminishing returns had been abolished.

Yet lamentable as all that may be, it pales relative to Labor's enduring legacy: the shredding of the credibility of the budget process. Labor's budgets are not forecasts; they are slogans. And even before their ink is dry, the past is rewritten and the future with it.

Illogical in formulation, implausible in application, the assumptions on which they are based cannot be taken seriously. The projections for the Minerals Resource Rent Tax mimic the Coles jingle "down, down, prices are down'.

As for the cost of illegal boat arrivals, each economic statement since 2008 has promised they will plateau: they never do.

But the carbon tax beats them all, for Treasury's forecasts have performed no better than random guesses. And those forecasts are incredible: if European carbon prices really will more than quadruple over the next 4 years, investing in EU permits should yield an annual real return of 41 per cent and the government ought to invest in those permits and pay off the national debt.

Nor are the budget aggregates more solid than the component parts. If there is a method in their derivation, it bears the same relationship to economics as astrology bears to astronomy.

When needed, the return to surplus miraculously nears, as in the lead-up to the 2010 election; when that is no longer tenable, the surplus recedes, due to the economy being too strong (so that high investment reduces company tax), too weak (also reducing revenues) or who knows, both.

Moreover, errors and revisions have accelerated to unprecedented rates. From last year's mid-year update to this year's budget, the expected budget bottom line deteriorated by $693 million each week; from then to now, the deterioration galloped to over $1 billion weekly. Sure, we still have a AAA-credit rating; but so had France, Italy, Ireland and Spain until their economies collapsed. And were debt accumulation to continue at the current rate, we would probably lose it by the end of next year.

None of that has prevented Bowen howling about "black holes" in the Coalition's costings. But his claims highlight ignorance almost beyond belief: Bowen manages to get even the savings from reducing public service numbers wrong.

Of course, those mistakes may reflect not ignorance but bad faith. Bowen would do well, however, to remember that the words "trust" and "truth", "trustworthiness" and "truthfulness", come from the same root. With the election now called, Friday's economic statement was a missed opportunity to show Labor had learned anything at all from its fiscal chaos of the last five years.