Don’t put all our eggs in China’s mysterious basket

Australia’s core relationship with China has entered a strange no man’s land, where everyone seems to be jumping at shadows.

Australia’s core relationship with China — our economic ties — has entered a strange no man’s land where everyone seems to be jumping at shadows.

Are we losing our mojo in our biggest market?

If so, could that be because Beijing is punishing our country and others because our governments are concerned the party state has a link — or could choose to activate one — with privately owned Huawei?

Might it be because Huang Xiangmo, the most prominent torchbearer for Beijing in Australia, has lost his permanent residency?

Or because Beijing identifies itself as the “sophisticated state actor” reported by Scott Morrison as responsible for the recent cyber attack on Australian political parties?

Ships laden with coal are being held off the ports administered through Dalian in the north, for reasons still not spelled out.

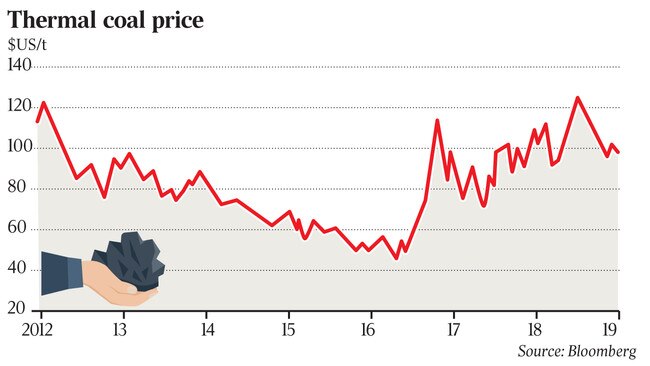

In the last financial year we sold $13 billion worth of coal to China, second only to iron ore. So, even though coal cargoes are traversing other ports without problems, this is a significant concern.

What does this issue, and the lack of official information, say about China risk?

Other Australian export sectors have encountered unexpected and unexplained challenges at the Chinese border, but these have been overcome, mostly through patient diplomatic persistence, and through channels developed over long periods with Chinese buyers.

The immense opportunities in China justify maintaining the relationships despite such risks.

But — especially since the principal risks appear political, unconnected to the industries affected, and therefore beyond normal business management — hedging by serving a range of markets is important.

Thus it is handy that Australia also sells even more coal — $17bn last year — to Japan, as well as $10bn to India and $7bn to South Korea.

The many critics in Australia of coal — our biggest export — including now one of the biggest producers, Glencore, as well as NSW’s Land Court, may be pleased to see Beijing starting to put a hold on the flow.

They seem to view coal as an undifferentiated product,

But of course, most of Australia’s sales — more than 60 per cent — are of metallurgical or coking coal, required for steelmaking, while a minority comprises thermal coal used for power generation.

Ships, trains and cars, skyscrapers and bridges made with steel are generally safer and more efficient than those made from wood.

And China is set to use more steel this year. It has been running its economy on stop-go lines for a dozen years and — anxious about slowing in the 70th year of the People’s Republic and on the verge of achieving Xi’s goal of doubling the economy by 2020 — is now entering a new stimulus phase despite the debt risks.

Thus the sudden rise in its stockmarkets, which slumped 27 per cent in 2018 as debt and default concerns triggered tightening.

China’s best financial media house, Caixin, explained after equities reached an 11-month high last week that this was because “another set of weak economic data”, including news that the current account surplus plunged 70 per cent in 2018, “made monetary easing almost a certainty”.

The Chinese markets — and many Western institutions focused on China too — thus seem to relish a downturn in the real economy, since the governmental response of relaxing credit controls and injecting yet more stimulus spending has become so predictable.

This ratchets up the dangers for the economy as a whole, but also increases demand for Australia’s dominant exports — iron ore and coking coal — to make steel.

Another issue raising questions about Australia-China relations is the 58 per cent decline in property sales reported recently by the Foreign Investment Review Board for 2018, with Chinese buyers the chief source of investment in housing.

While the party-state can — albeit not without some little effort — pull the levers to keep coal cargoes offshore for a few days or even weeks, its inclination and indeed capacity to control the appetites of its growing middle class, are less clear.

The ultimate failure of Chinese state attempts to force South Korea, through selected business sanctions, to banish its Terminal High Altitude Area Defence antimissile shield, points to Beijing’s challenges in persuading its middle class to punish such popular sources of products and services.

Australian financial imposts may have played a small part in reducing the appetite for Chinese real estate purchases, but most countries attracting significant Chinese investments have also introduced such charges.

Capital controls may have been tightened — but Chinese buyers have proven remarkably adept in skipping around these.

Political distaste with Canberra is unlikely to have played a part — some at least who want to own Australian property do so because they want to get away from such campaigns, such constant politicising.

A more likely reason, is simply that a growing proportion of those with the inclination, the money, and the means to buy property here or elsewhere abroad, have already done so. They have set up themselves and their families for an alternative base, to use now or at some future stage if needed. China’s new tax rules are also playing a role. The Common Reporting Standard, requiring full disclosure of global assets and incomes, is making inroads — helped by the grim example of the public shaming for avoidance of top movie star Fan Bingbing, charged $140m. Some with shallower pockets and limited nerve may be deciding to stay home.

But while there’s some uncertainty about coal at a substantial port, and property sales are tailing off — in part now also spooked by seeing prices fall, something China’s real estate market has not prepared them for — China remains an enormous, diverse market with a sustained appetite for products and services Australia can and sometimes does supply.

Parts of our higher education sector have reached saturation point with Chinese students, but overall attraction remains high, and like tourism is benefiting from this year’s dollar fall against the yuan.

Much of Australia’s recent growth in trade with China has come from sales to households with comparatively high disposable income, and while hanging fire on some big-ticket items — car sales fell 3 per cent last year — they’ll continue to buy the quality protein foods, from cheese to beef, and the wines from Australia that they enjoy.

No need, then, for any panic. But in these uncertain times even allies like America might swiftly cut a political deal with China that undercuts Australian exporters. So, best not to depend on any one market, including China’s.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout