WILL he, won't he? Will she, won't she? Maybe only her hairdresser knows for sure. But regardless of whether Labor's soap opera ends with a bang or a whimper, one thing seems a sure bet - the carbon tax, a year old next week, won't survive to a second birthday.

Nor should any tears be shed at its demise. The tax's premise was that the world was moving to binding agreement on emissions reduction, with Treasury assuming a "co-ordinated international regime" would ensure "a harmonised world carbon price" by 2016. Scarcely believable when it was made, that assumption is now plainly delusional.

With the first commitment period under the Kyoto Protocol over, not one of the world's five largest emitters (China, the US, India, Russia and Japan) has enforceable abatement commitments in place, and there is no prospect of any such commitments being given.

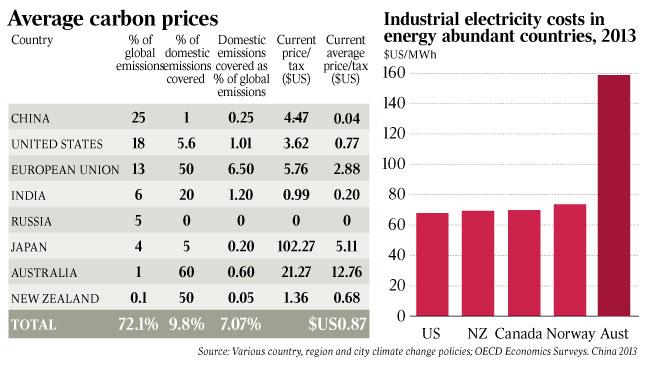

As for emissions trading schemes, they cover barely 7 per cent of global emissions. And with the European Union's scheme in tatters, they are no healthier than the international regime.

Meanwhile, as global emissions continue to increase by about 3 per cent annually, carbon stabilisation is implausible any time soon.

On the contrary, changes in energy supply and demand are set to make the world economy ever more reliant on fossil fuels, further impeding credible agreement on emissions reduction.

Much attention has focused on the spectacular growth of shale gas extraction in the US, with total production rising from 85 million cubic metres a day in 2007 to more than 700 million cubic metres a day this year; but according to the US Department of Energy, China's resources of "technically recoverable" shale gas are more than twice those of the US.

And though there are concerns about extraction's environmental impacts, they are unlikely to slow shale's onward march: a 2012 study by the International Energy Agency concludes that addressing those concerns would add a mere 7 per cent to falling well construction costs, leaving shale's economics virtually unchanged.

But it is not only gas production that is being revolutionised. Applied to oil extraction, the technologies used for shale resulted in US crude-oil production growing by more than one million barrels a day last year, the largest increase in the world and the largest in US history.

And with President Barack Obama's Commission on the Deepwater Horizon Oil Spill concluding that "drilling in deepwater can be done safely", advanced offshore extraction technologies will also add substantially to world oil production.

Greatly expanded supply will reshape energy markets. As shale gas displaces thermal coal in US electricity generation, pushing American coal into export markets, lower prices will entrench coal-based generation elsewhere. And in the longer run, natural gas markets will become better integrated internationally, reducing gas prices in Europe and Asia and increasing their energy use.

No less importantly, competitive pressures from gas and from new sources of crude will also transform crude oil markets. The International Monetary Fund recently estimated that a 5 per cent increase in world oil supplies would ultimately halve oil prices. While that will take time, the prospect of lower, less volatile oil prices will encourage fuel-using innovations.

We are therefore on the cusp of a new age of fossil fuels. As its opportunities emerge, the likelihood of countries committing to "decarbonisation" will become ever more remote. And Australia's abundant endowments of coal and natural gas should allow us to benefit enormously, both as energy exporters and by putting our fossil fuel resources to work.

But the carbon tax militates against those adjustments occurring. For instance, as world natural gas markets integrate, LNG prices on Australia's east coast will rise to export parity levels. That ought to shift our electricity generation mix to coal, and especially to cheap Victorian brown coal, with a study by the US Department of Energy finding that each doubling in LNG prices should increase coal-powered generation by 10 times more than it increases output from renewables. Yet that is unlikely to happen for so long as brown coal is subject to crippling penalties.

It would be foolish, however, to blame the carbon tax alone. Rather, other "green" schemes now add about as much to electricity prices in Queensland as the carbon tax, and nearly two-thirds as much in NSW. Moreover, those schemes are even more distorting than the carbon tax, and their interaction with the carbon tax increases efficiency losses more than proportionately.

With those "green" schemes remaining in place alongside the carbon tax, it is unsurprising that our electricity costs to industrial users are up to double those in comparable energy-abundant economies. Nor is it surprising that electricity bills account for more than 60 per cent of the cost increases that have hit manufacturing since 2008. And the economic harm that causes is borne for no environmental gain, as any reductions in Australia's emissions are swamped by growing emissions overseas.

Retaining these policies is therefore indefensible. Of course, that doesn't imply the risks of climate change should be ignored. But it is increasingly unrealistic to think those risks will be avoided through abatement.

As the Climate Commission's just-released report on "The Critical Decade" recognises, "if (global) emissions rise through the rest of this decade", which is surely certain, achieving required abatement will be "a virtually impossible task".

That means we need the capability to adapt should dangerous climate change occur. But the hodgepodge of distorting taxes, shameful handouts, Gosplan-inspired central planning and Kafkaesque enforcement that is our climate policy does nothing to achieve that goal.

A costly detour, it takes a doubtful track towards an illusory destination. Gillard and Rudd may pursue each other until the planet runs out of carbon, but the days of the government's climate policy deserve to be numbered.