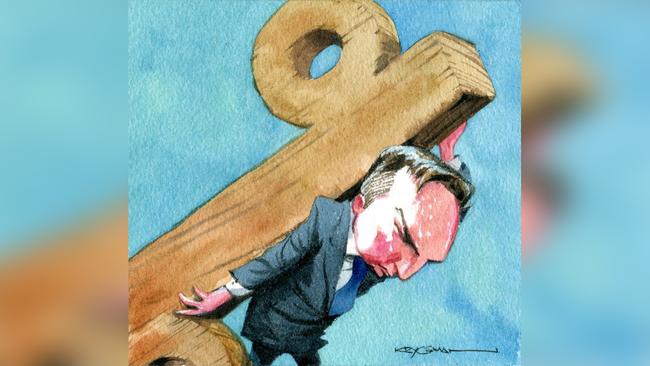

Labor Treasury spokesman Chris Bowen is in an impenetrable policy maze and seemingly unable to escape. He should have read the sign: Wrong way, go back.

While trying to establish differentiation from the Coalition, he’s pushing a radical high-taxation barrow unlikely to find favour and which provides a valuable wedge for the government.

It started with his proposal to eliminate negative gearing for all asset classes (not just residential real estate), albeit on a grandfathered basis. It’s never been clear why he floated this; short-term revenue gains are small and Labor has gone to incredible lengths to downplay the impact on house prices.

If the policy had something to do with housing affordability, Bowen would have been talking up the impact on house prices. Who brings in such a radical change without figuring out what it is that’s going to be achieved?

No doubt Bowen will try to weave the elimination of negative gearing into a fairness story but, on his own admission, taxpayers with substantial investment income — say, from owning lots of rental properties — will be able to continue to deduct the costs of investments from that income.

So the well-to-do will not be affected, but nurses, teachers, ambos and the like will be unable to deduct the costs of their modest investments from their salaries.

Then there’s the capital gains tax proposal, which will put Australia second behind Denmark in terms of having the highest rate in the world. You might think that would give Bowen cause to pause.

The way capital gains tax is assessed has two rationales: it allows for inflation and it provides for the fact capital gains are brought to book in one year but often accrued over many years. Given the rate is applied at an individual’s marginal income tax rates, it is only reasonable there should be a substantial discount.

Again, Labor has proposed grandfathering this change and capital gains accrued within superannuation will continue to be given concessional treatment — no surprise there, given Labor’s close links with the industry super funds. But no consideration has been given to the impact on investment of a much higher capital gains tax.

What drove this plan was that the elimination of negative gearing yields very little additional revenue in the short term whereas the change to the capital gains tax could fill a large fiscal hole caused by Labor’s ambitious spending.

Recall, however, that during the 2016 election campaign this didn’t go to plan, with Bowen forced to concede Labor would run budget deficits that were more than $16.5 billion higher in total than the Coalition’s plans.

With Labor having lost the 2016 election, it was Bowen’s chance to rethink the strategy, including supporting a cut in company tax rates to 25 per cent, along the lines that he outlined in his book Hearts and Mind: A Blueprint for Modern Labor. (The book also champions the roles of aspiration and small business, a tad embarrassing now.)

But he has dug the party into an even bigger hole by refusing to support the government’s Enterprise Tax Plan (to cut company taxes) as well as the three-stage reforms to the income tax schedule. As a result, Labor is in the invidious position of proposing various rollbacks, by taking back cuts to the rates of tax paid by companies and individuals already enacted. We all remember how well the rollback concept worked politically for Kim Beazley.

Bowen seems to have forgotten the economics he once understood. He must know that the low and middle-income tax offsets Labor is proposing to use to outbid the Coalition’s first-round income tax cuts are highly distorting.

These offsets are entirely the wrong way to go because they impose very high effective marginal tax rates when the income limits are reached. They are especially harmful for secondary breadwinners — overwhelmingly working mothers — who are forced not only to pay steeply higher income tax rates as they increase their hours of work but some of their welfare benefits are also withdrawn. They are very bad policy.

At least with the Coalition’s plan, the significance of the offsets is reduced over time, although not entirely eliminated.

But Bowen’s attraction to the offset mechanism relates to his mistaken ambition to make the income tax schedule even more progressive and to ensure that only those on the lowest incomes ever receive any tax relief. According to him, everyone earning more than $90,000 a year is rich and they should be forced to bear the burden of bracket creep because that’s “fair”.

Let’s face it, Paul Keating would never have embraced this fantasy. After all, he was the treasurer who reduced the top marginal tax rate from 67 per cent to 47 per cent three decades ago. And he has also called a top marginal tax rate of 49 per cent too high. (Recall that part of Bowen’s grab bag of higher tax measures is also the reinstatement of the temporary 2 per cent budget repair levy.

And then there is Bowen’s bizarre proposal to eliminate cash refunds for franking credits while retaining the benefits of franking credits for those paying tax. Mind you, age pensioners, who don’t pay tax will also retain the benefit after Labor was forced into a rethink. What this means is that a self-funded retiree who just misses out on the Age Pension will be worse off than someone on the Age Pension, but Bowen doesn’t have a problem with this.

No doubt Bowen will be sitting with his abacus adding up the billions of dollars that his economically irresponsible package of higher taxes might generate. Mind you, these estimates are based on dubious assumptions, with the errors growing larger the further into the future you go.

What he seems to have forgotten is that care must always be exercised when altering policy settings in order to minimise the damage to the incentives people face to undertake education and training, to work hard, to make investments and to save.

Malcolm Turnbull is absolutely correct to say that providing tax relief is not about giving anything away; it’s about individuals and companies keeping more of the money they earn. And in doing so, we can sharpen incentives to produce enduring economic benefits.

Australia already has the most progressive income and transfer systems in the world — even more so than Scandinavia. While we generate less tax as a percentage of GDP than many developed economies, this is entirely due to our relatively low consumption tax (GST) and the absence of social insurance (to fund unemployment and retirement benefits, principally).

Maybe Bowen will be advocating a higher rate of the GST next. That would be interesting.