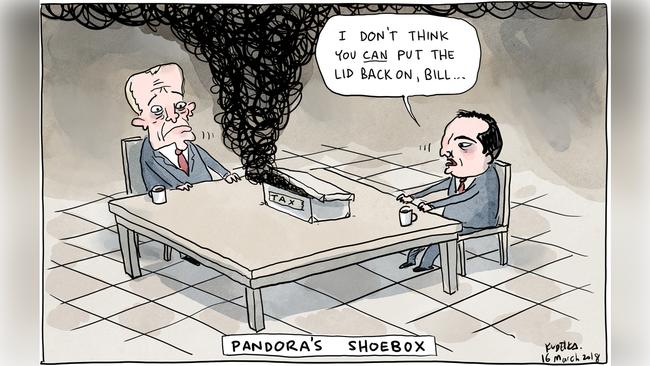

“There are as many opinions as there are experts.” Franklin D. Roosevelt’s observation held true this week, as Bill Shorten revealed his grand tax grab. Depending on who you read, the Opposition Leader’s proposed ban on cash refunds of franking credits would hit low income earners, wealthy retired types, or the middle class. Confused? You will be. Welcome to a very taxing edition of the Readers’ Comments column. Let’s engage.

—

Janet Albrechtsen weighed in on Labor’s plan to raise $59 billion over 10 years by partially reimposing the old system of double taxation of company profits paid to self-funded retirees, saying Mr Shorten was throwing them to the wolves. Otalp wasn’t buying Mr Shorten’s bill of goods:

“This, from the party that wrecked the economy in the first place. Curious, isn’t it: Shorten says this action is necessary to fix the economic mess. Voters need to remember which political party created the mess after inheriting a massive surplus and turning it into a catastrophic deficit.”

Denis was indignant:

“Does smarmy Bill ever stop to think beyond class warfare? This tax grab is the most stupid idea I have heard in 50 years. The retired politicians, unions and current politicians will love it — they will never be impacted by it”

Sonny summoned the school of hard knocks and snatched Comment of the Week:

“I’m sick of the criticisms of the Baby Boomers. My mum and dad like most everyone worked on the basic wage, and we lived in housing commission after being evicted as squatters in the vacated US barracks in Brissy after WWII. It was a joke to even think about asking Mum for money to go to the pictures.

“I collected manure and sold it in the neighbourhood at 6p a sugar bag to get to the pics then collected the coke bottles for the return deposit. Yes I am a self-funded retiree who worked his bum off and understands the relationship of effort to wealth from childhood, so don’t whinge over your latte’s about my good fortune! Get off your bum and make a life!”

Thomas tittered:

“One of Labor’s dumbest proposals ever. And there is a long list to choose from.”

Rob raged:

“After this effort, it wouldn’t surprise me if Labor, egged on by the Greens, will at some time attempt to reimpose death duties. We are now seriously considering cashing in our SMSF and giving the bulk, including the house (but with a lifetime right of occupancy), to our adult children, retain a small portfolio of privately held shares plus @ $100,000 in cash to top us up for the next five years, after which we’d draw a part government pension. This would still allow us to live in what the spruikers like to call ‘modest comfort’ and, while our living standards would be marginally reduced, it would reassured us that our children have what is their due and that there is not much left that can be stolen from us by a rapacious government.”

John praised Janet:

“Yesterday I was talking to a widowed friend. She is a pensioner but has approximately $7000 in franked dividends left to her by her partner. She was crying as the loss of the $3000 in franking credits will mean she will have to sell her house as she feels she will be unable to keep it.

“She is not wealthy. She is not a rorter. She is a lovely honest Australian. “

A fine mess, said Macavity:

“The trouble is that the tax system — especially to do with SMSFs — is so complicated people just tune out. They just read the headlines — ‘the rich have to pay more’ — and think ‘what’s wrong with that?’”

Kathleen was concerned about collateral damage:

“These are the same mum and dad investors who used their meagre savings to buy Telstra and Commonwealth Bank shares 20 or 30 years ago. Surely not even a unionist or hard leftie likes to see grandma and grandpa ripped off.”

John D was damning:

“I don’t think this is a thought bubble as some comments suggest. It is a calculated cynical attack on self funded retirees who in the main don’t vote for Labor. I hope it backfires, since those affected also have families and friends who vote and will see the blatant injustice involved.

“I retired based on knowledge that I could support myself and my wife utilising in part franking credits. I now find that I have received a 20pc cut in income and it’s now too late for me to get back into the workforce.”

Knocks from Nick:

“Seems the ALP hates anyone who wants to look after themselves and not rely on government. Envy politics at its worst. Sadly it will result in less investment in Australian companies and (fewer) jobs and taxes paid in Australia. Talk about stupidity.”

Arthur added:

“As one that has a SMSF of a modest amount, receives no benefits other than say access to Medicare and has paid his way for over 44 years (and that of others) I find this latest effort a huge slap in the face. I don’t expect and am not entitled to any favours. I am happy to pay my way but for God sake let me work at maintaining my independence.

“It is not just the income loss but the potential for the investment market to mutate that worries me as I lose income as well as growth.”

William wondered:

“And where is the mediocre Turnbull? Sitting on the deck chairs with Lucy cruising on the HMAS Titanic? Why isn’t he on every media outlet day and night debunking this scheme!”

Maree mooted:

“Next on the list are wealth tax, estate duty, death tax.”

Bah, said Bill:

“Another easy way of explaining what this greedy grubby proposed tax change means is that every Australian individual including those on lower incomes will pay at least 30 per cent tax on franked dividends received from public companies.

“The change would make no difference for middle or high income earners because their existing marginal tax rate exceeds 30pc or in the case of small private companies, 27pc. The change will punish Australians in and out of super on lower incomes. “

More like it, said Mark:

“It’s the first time the Labor Party has acted like a Labor party in ages. The gap between rich and poor must be addressed and the fools pretending the poor are poor by their own fault must be spoken to in the harshest possible terms and led out of their ignorance.”

Laurie looked back in anger:

“To its eternal credit the Hawke government introduced dividend imputation. But Bowen relied on Keating’s advice when coming up with the Labor policy and Keating was after all the Treasurer in the Hawke government. But then Keating is on a life pension of $272,000, greatly more than we punters could ever dream of and it won’t be affected. Bowen is looking forward to a life pension of $199,000 and Shorten will be on the gravy train as well. All funded by taxpayers who will be hit again.”

Janet loves Janet:

“This article shows yet again why The Australian is worth buying. A wonderfully clear explanation of the imputation system.”

Monty meddled:

“Great article Janet as usual. A minor error in your example, the $100 (pre-tax amount) not the $70 is used to calculate the taxpayer’s liability with the $30 paid to the ATO on behalf of the investor deducted from the gross tax liability.”

-

Adam Creighton, ace explainer of the dismal science, did his bit to demystify things, suggesting Australia’s tax system is shockingly tilted in favour of older, wealthier people, with little justification. Creighton would support Mr Shorten’s scheme if it meant the company tax rate could be cut. But businesses, he notes, don’t vote. Jason put his beer goggles on to earn runner-up Comment of the Week.

“Suppose that every day, 10 men go out for beer and the bill comes to $100. If they paid their bill the way we pay our taxes, it would go something like this:

“The first four men (the poorest) would pay nothing. The fifth would pay $1. The sixth would pay $3. The seventh would pay $7. The eighth would pay $12. The ninth would pay $18. The tenth man (the richest) would pay $59.

“The 10 men drank in the bar every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve ball.

“Since you are all such good customers,” he said, “I’m going to reduce the cost of your daily beer by $20”. Drinks for the men would now cost just $80. The group still wanted to pay their bill the way we pay our taxes. So the first four men were unaffected. They would still drink for free. But what about the other six men? The paying customers?

“They realised that $20 divided by six is $3.33. But if they subtracted that from everybody’s share, then the fifth man and the sixth man would each end up being paid to drink their beer. So, the bar owner suggested that it would be fair to reduce each man’s bill by a higher percentage the poorer he was, to follow the principle of the tax system they had been using.

“ ‘Wait a minute,’ yelled the first four men, ‘this new tax system exploits the poor!’ The nine men surrounded the tenth and beat him up. The next night the tenth man didn’t show up for drinks, so the nine sat down and had their beers without him. But when it came time to pay the bill, they discovered something important. They didn’t have enough money between all of them for even half of the bill!”

citizen44 caned Creighton:

“ ‘Australia’s tax system is shockingly tilted in favour of older, wealthier people, with little justification.’ Socialist fantasy, a further exposition of the all-consuming ‘equality’ mantra.

“Of course older people are wealthier than younger people. Arguably any human society is skewed towards older, wealthier people for the simple reason older people have had the time to amass wealth and have the experience (knowledge) that enables them to avoid the mistakes that young people are prone to making.”

Fred figured:

“Time the debate changed. It should be:

“1. Why do public servants have different superannuation schemes to the rest of the population?

“2. What can we do to reduce spending, so tax payers get to keep more of their own money?

“3. If more tax revenue is needed, why are unions and companies owned by unions exempt from paying tax?”

Deborah declared:

“The couple with the $2m house and the max in super do not pay any tax because they are drawing down their SAVINGS. All that money in super was earned and taxed on the way in at 15pc so that they could be off the ledgers of the old age pension.

“So long as they are not drawing that then the value of their house is irrelevant. (You could argue against the exemption from CGT when that is sold, but that’s another story).”

Don’t diss the dotards, said David:

“Adam you have a history of anti-old people commentary. Realise that the reason you have the soft life you now enjoy is because we ‘oldies’ did the hard yards for all our working lives and deserve some extra consideration in our declining years.”

Jason S spoke sense:

“Adam, you need to emphasise that retirement planning is not done on a whim. It takes decades. Suddenly changing rules no matter how fair or unfair needs to be transitioned gradually otherwise you can throw long term retirement plants into chaos and the people impacted have no time to adjust.”

Richard’s prediction:

“Another barrage in the coming war of the ages. A civil war where Young Have Nots gang up to plunder the Old Haves. Daniel Andrews brings us home invasions, Bill Shorten brings us financial invasions and this journalist envies some oldies who were more successful then he has been to date.”

Geoffrey M mediated:

“Generally I appreciate Adam’s contributions. And again today, his point of view is worth considering rationally. But, thinking about what Shorten proposes this is how it will affect me and my wife:

“We have a combined total of just under $1.5m in our SMSF. Income is about $73k gross. Adviser fees about $12k and tax return about $3k: thus, net of about $60k. The tax refund last year was $16k giving us a disposable income of $76k.

“Therefore, post-Shorten our income will drop back to $60k.OK, we can live on that but it’s not how we planned things. Changes continually occur and you simply cannot plan and then, when changes are imposed, at our age you cannot respond.”

“For the record, I paid tax on the way into the fund, tax on the income, adviser and accountant fees. It was hard yakka to generate a decent size fund and it was achieved by going without. “

Richard reasoned:

“I have been waiting all day for Adam’s views because I believe he has no axe to grind other than that of an economist. Not surprisingly, therefore, I think he has hit the nail on the head — it is not good economics for well-heeled retirees to be free of tax.

“However, the proposed change means that my wife and I lose, literally, 30pc of our income (because we are fully invested in our super in shares in companies that pay fully franked dividends).

“I accept the need for change but believe that a 30pc reduction in one go to last for our lifetimes when we have little opportunity to make up the shortfall is intrinsically unfair.”

Bill’s blast:

“Could not have said it better. Baby Boomers have no self awareness, and only think about their wallets, not the health of the nation.”

Rolf reflected:

“Marie Antoinette became rather famous. Problem is, with a tax code that takes up, printed off and stacked, over two metres of shelf space, we can’t be sure what will happen with some of the mooted changes or how not to become a modern day version of headless Marie.”

-

When news of Bill Shorten’s plan first broke on Tuesday, you the readers notched up an impressive 1600 or so comments on the main news story in a single afternoon. So at least for this column, the Shorten tax grab is paying dividends. Define rich, said Bob:

“Bill’s idea of a rich man is anybody not on centerlink!”

Terry was terse:

“Typical Labour. Take from the lifters and give to the leaners.

Lawrence lamented:

“Some of us worked and I am not talking about just turning up to work, to scrimp and save for our retirement. We bought a house and paid for it by foregoing holidays and new cars and our reward is Bill Shorten taking some of it to buy votes from the less than industrious.”

TIM B asked:

“Who writes Shorten’s speeches — Trotsky, Lenin or Marx?”

Henry 1 had nothing to offer but blood, toil, sweat and tears:

“Let’s hear from Churchill: ‘The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of socialism is the equal sharing of miseries.’ House of Commons, 22 October 1945.”

Where’s Mal, asked James:

“In a world where we had a Liberal leader who defended liberal values this would be a free kick. But we have Mal, who will run a waffling, half-arsed simpering rebuttal. BS knows this, he’s emboldened by it.”

William, it was really nothing:

“I have already asked my stock broker to place a further 25pc of our fund overseas, where we will have access to a bigger market and higher return. This country does not care about me, why should I care about investing here?”

-

Each Friday the cream of your views on the news rises and we honour the voices that made the debate great. To boost your chances of being featured, please be pertinent, pithy and preferably make a point. Solid arguments, original ideas, sparkling prose, rapier wit and rhetorical flourishes may count in your favour. Civility is essential. Comments may be edited for length.