US, China talk trade despite Huawei arrest

China has confirmed it plans to go ahead with trade talks with the US.

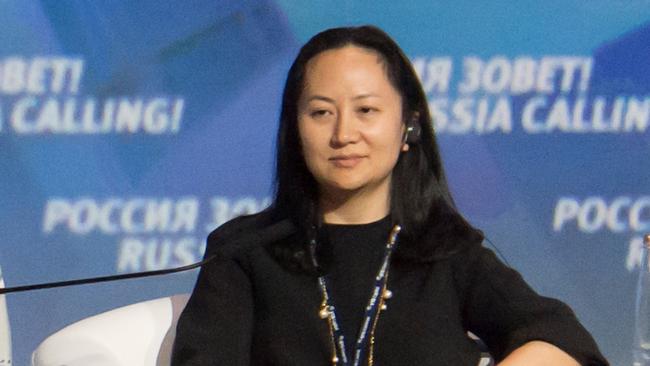

China has confirmed it plans to go ahead with trade talks with the US despite its anger over Canada’s arrest of Huawei chief financial officer Meng Wanzhou.

A phone call yesterday between Chinese Vice-Premier Liu He in Beijing and US Treasury Secretary Steven Mnuchin and US Trade Representative Robert Lighthizer in Washington was the first step in starting talks since the G20 dinner in Argentina between US President Donald Trump and Chinese President Xi Jinping.

“Both sides exchanged views on pushing forward the next step of the timetable and a road map for consensus made during the leadership meeting,” China’s Department of Commerce said.

China’s Ministry of Foreign Affairs also confirmed that Beijing was still committed to the talks despite its anger over Ms Meng’s arrest on December 1.

“We hope both sides can work together to achieve the consensus reached between our two countries’ leaders,” China’s Ministry of Foreign Affairs spokesman Lu Kang said.

The two leaders agreed on a 90-day truce for imposing new tariffs on each other’s goods until March 1 to provide time to reach a deal.

The main pressure is on China because of its $US200 billion-plus trade surplus with the US, making it the most vulnerable to higher US tariffs.

Mr Trump indicated he saw early announcements about Chinese purchases of US goods and a possible cut in tariffs on US car imports as part of a goodwill downpayment for the talks.

Expectations are that China could soon announce plans to buy more US soybeans, although they will go into official storage, and possible buy more US liquefied natural gas.

It could also announce plans to lower the 40 per cent tariff on US car imports it imposed earlier this year as part of China’s retaliation for higher US tariffs on some of its exports.

It is not clear when Mr Liu will visit the US.

Hardliner Mr Lighthizer said at the weekend that he regarded March 1 as a firm deadline for the negotiations to be concluded.

But Mr Trump, in his tweets, has indicated that the deadline could be extended. Mr Lighthizer said he believed Ms Meng’s arrest would not have much of an impact on the talks.

Ms Meng faces US fraud charges related to alleged sanctions-breaking dealings with Iran, and was due to hear a decision on her bail hearing this morning (AEDT).

While the arrest will not stop the trade talks, sources on the Chinese side say they will approach the talks with a more pragmatic view and will put Ms Meng’s arrest on the negotiating table.

“We still have to continue the trade talks,” Wu Xinbo, the director of the Centre for American Studies at Fudan University told the South China Morning Post yesterday.

“Meng’s arrest is an individual case. Trade is the bigger issue.”

He said China was likely to raise Ms Meng’s arrest in its talks with the US and it was now likely to be more “clear-eyed” about America’s desire to contain its technological rise.

Some sources speculated that China could focus its anger on Canada, which has been attacked by the Chinese Foreign Affairs Ministry and the media, while it continued the trade talks with the US.

Ms Meng’s arrest and worldwide pressure on Huawei as well as technology company ZTE will add to China’s determination to become more self-sufficient in core technology, including computer chips.

“China wants the US-China trade talks to continue,” US-based China watcher Bill Bishop wrote yesterday in his newsletter Sinocism. “For now, at least, it will not allow the arrest of Meng to derail negotiations.’’

But he said the talks might be clouded by more action from the US against Huawei, other Chinese technology companies and more pressure on China over its mass detention of Uygers in the western region of Xinjiang.

“At some point, Beijing may no longer be able to separate the trade talks from the broader deterioration in the US-China relationship,” Mr Bishop said.

He said the big fall in US stockmarkets over the past week could add pressure on Mr Trump to reach a deal to restore investor confidence.

“So long as US stockmarkets keep dropping, expect President Trump to be much more willing to take a softer approach in the trade talks at least,” Mr Bishop said.