Company tax cuts: Hinch backs away from bank exemption

Derryn Hinch will instead lobby the government for an increase to the bank levy in exchange for his support of company tax cuts.

Victorian senator Derryn Hinch will lobby the government for an increase to the bank levy rather than ask that the major banks be exempt from proposed company tax cuts.

UPDATE: Derryn Hinch is seeking seeking new concessions for pensioners and and measures to address housing affordability in return for his support for the government’s company tax cuts.

The Australian understands Senator Hinch will withdraw his demand for the banks to be exempt from the government’s plan if he is to support it in the Senate, after Malcolm Turnbull yesterday ruled out supporting such an exemption.

Senator Hinch will instead ask the government to increase the 0.06 per cent bank levy, which began in July.

Earlier today the Prime Minister said there would be too many complexities added to the tax system if the government adopted Senator Hinch’s proposal to exempt the major banks.

Mr Turnbull said the government was “working on” securing enough crossbench support to pass its enterprise tax plan but warned Senator Hinch’s proposal would not be adopted.

“With company tax rates they have got to be uniform across the system because otherwise you get into problems of definition, if you say ‘we are going to have a different tax rate on one sector or another’, how do you define it?” Mr Turnbull told 2SM radio.

“Then you have got companies that are in two sectors, as many are.”

Mr Turnbull added that the government had already hit the banks with a bank levy in last year’s budget.

“We felt that given the support they have from government, the implicit guarantee that they have, we felt it was fair to pay an extra amount to support the government, and they did through the major bank levy, so we have already been there and raised that money from them,” he said.

He would not “speculate” over whether he believed the government would secure the Senate numbers to pass the reform.

“I never like to speculate other than to say we just keep on making our case; it is a compelling case I believe and it is all about being competitive,” he said.

“But we will just keep on working with the crossbench to persuade them to support the company tax cuts, we have seen some strong support from a number of crossbenchers but we obviously have to get enough to get it passed and we need nine votes.”

Finance Minister Mathias Cormann hit out at “ignorance” being peddled in the company tax rate, including the argument that many large Australian companies did not pay any tax last year.

Senator Cormann said business paid tax on profit.

“Now various socialists and various misguided commentators are trying to fudge this proposition and they are trying to imply that businesses somehow should be paying tax on their turnover,” Senator Cormann said.

“Businesses do not pay tax on their turnover. They should not pay tax on their turnover. There is a very good policy rationale as to why you apply tax on profits. If we were to go down to the logical conclusion of some of these arguments, it would be disastrous for the Australian economy. “

Senator Cormann said the government wanted pass the policy “in full” and there would be no further increments in the rollout of the enterprise tax plan.

“If we do not act now and if we do not give business certainty now about the pathway to a more competitive business tax rate now, we will be putting our economy and jobs at risk and quite frankly Bill Shorten should reflect on that,” he said.

Earlier today cabinet minister Christopher Pyne said the government was “hopeful” of passing its company tax cuts through the Senate as early as next week.

Mr Pyne said the government was on track to secure support to reduce the company tax rate to 25 per cent for all businesses.

Mr Pyne said the government would continue to negotiate with Senator Hinch.

“It would be an unusual tax system ... to tax certain businesses more than other businesses more than other businesses simply based on the fact that they might not be so popular with the public,” Mr Pyne told Nine Network.

“It would be certainly unorthodox but let’s wait and see how things turn out. I am sure we will get there.

“It is really important for our country that we have these tax cuts for companies. If we want to grow jobs and wages.”

Labor frontbencher Anthony Albanese would not say if Labor would roll back the tax breaks if it won power.

“We’ll announce our policies at the appropriate time,” he said.

Earlier: Turnbull on verge of tax victory

The Turnbull government is on the brink of securing a historic deal with Senate crossbenchers to cut the company tax rate for all businesses, with independent Derryn Hinch looming as an eleventh-hour stumbling block.

But Labor is eyeing an election campaign battleplan to roll back Malcolm Turnbull’s cut in the company tax rate from 30 to 25 per cent if it wins office.

Senator Hinch yesterday demanded the government exclude the big four banks from company tax cuts in exchange for his vote — a measure Liberal Democrat crossbencher David Leyonhjelm deemed unacceptable.

The government yesterday won the support of One Nation by agreeing to roll out a $60 million national apprenticeship pilot program that will prioritise regional Australia, securing three of the five remaining votes it needs to pass the tax cuts.

The Coalition is yet to convince new South Australian independent Tim Storer but faces a larger task in coming to terms with Senator Hinch.

The Victorian senator dashed hopes that a vote could be brought on last night with the declaration that his support would be contingent on the big banks being excluded from the deal, despite the banks already paying a higher tax rate due to the levy imposed on them in last year’s budget.

The Prime Minister yesterday rejected Senator Hinch’s proposal, saying the company tax rate should be uniform across all businesses or risk causing “incredible problems about defining which businesses are in and which are out”.

“We’ve just hit the big banks with a major banks levy,” Mr Turnbull told 2GB radio.

“Derryn could not, or no one could accuse us of not raising revenue from the banks.”

Finance Minister Mathias Cormann and other members of the crossbench yesterday lobbied Senator Hinch, urging him to join them in supporting the $36.5bn second round of company tax breaks for larger companies.

With the opposition conceding that the government may succeed, Bill Shorten will consider going to the polls on a platform of reversing the tax plan for larger companies, arguing that they would not be due to come into effect until 2022-23, at least three years after the next election.

The Opposition Leader is set to raise a warchest of $210bn over the next decade through Labor’s proposed tax measures, including his crackdown on refundable tax credits.

Senator Cormann, the government’s Senate leader, labelled any move by the opposition to raise taxes on businesses as an attack on workers and families.

“If Bill Shorten got to be prime minister, his socialist anti-business agenda would seriously damage our economy and kill jobs,” Senator Cormann said. “If Labor decided to put our businesses at a significant competitive tax disadvantage again with the businesses they compete with in other parts of the world there is no doubt that would send investment, wealth and jobs overseas.

“Our agenda is deliberately pro-business, because it is business which creates the jobs we need for about nine out of 10 working Australians and which pay their wages. Higher taxes means less-successful, less-profitable businesses, means less investment, fewer jobs, leading to higher unemployment and therefore lower wages.”

Senator Hinch yesterday told Sky News the government faced a “big problem’’. “They’ve got to try and justify how you can give a 5 per cent tax cut to the big banks when there’s a royal commission going on at the same time, investigating allegations that they took dirty money and ruined the mortgages of working Australians,” Senator Hinch said.

This prompted a swift rebuke from Senator Leyonhjelm, a Liberal Democrat, who was joined by independent Fraser Anning in warning that the government would lose their support for the tax package if it caved into Senator Hinch’s demands.

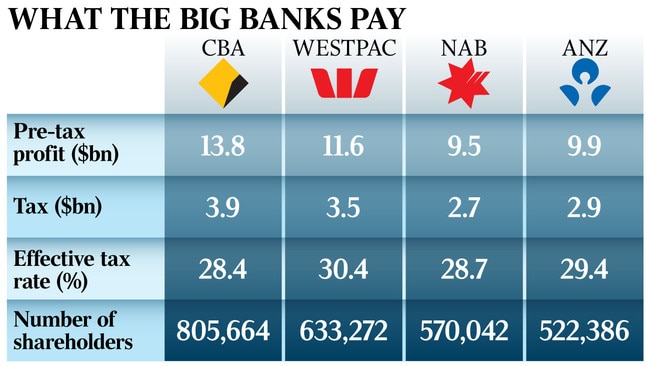

“I will never vote for legislation that does that,” Senator Leyonhjelm said. “I’m afraid Derryn must have dropped out of economics 101 with a fail ... Honestly, he’s got no idea. Who does he think owns the banks? It’s Australians. It’s Australian shareholders … so a company tax cut that doesn’t include the banks would mean all of those shareholders have to pay more tax via their ownership of the banks than other Australians who own other companies. It’s absurd.”

NSW Nationals senator John Williams, who pushed for the establishment of the banking royal commission, questioned Senator Hinch’s proposal to quarantine the banks from the government’s tax cuts. “I disagree with it,” he said. “The fact is, for Hinch to say ‘look don’t give them the tax cuts’ I think is unfair given we’ve already put a big levy on them.”

The bank levy, introduced by the government last year, will impose a 0.06 per cent tax on banks with liabilities greater than $100bn, raising $6bn over four years. The industry paid nearly $14bn in tax last year.

Debate on the full enterprise tax plan that would have locked in the remaining $35.6bn in company tax concessions will continue into next week before parliament rises for a six-week break leading in to the May budget.

The government last year successfully secured $30bn in cuts for businesses with turnover of $50 million or less. The remainder of the plan is to be phased in, with the next tranche planned to come into effect next year for businesses with turnover of up to $100m. The final round for all companies falls due by 2026.

Mr Shorten and Labor Treasury spokesman Chris Bowen have described the proposed tax cuts as a “$65bn budget wrecking ball” without a guarantee for Australian investment or wage rises. Mr Bowen accused the Coalition of “pretending their tax relief starts tomorrow”. He said the Coalition’s “$65bn company tax glide path only hits big businesses with turnover of over $1 billion by 2022-23”.

Labor is now expecting a deal on the business tax cuts will be secured in the Senate. It will not finalise its position until details of any side-deal with the independents are released.

ACTU secretary Sally McManus urged Senate crossbenchers to oppose the company tax cuts, describing business claims the cuts would deliver stronger wages growth as a “con”. In a letter to crossbenchers today, Ms McManus said the cuts were a taxpayer- funded hand out to some of the most profitable companies.

Additional reporting: Dennis Shanahan, Joe Kelly