‘Real surprise packet’: State surges up the national rankings

An interest rate cut has seen a surprising Aussie state surge up the national rankings, new figures show.

Resource-rich Western Australia remains the best-performing state in the country, but it’s Victoria that has surprisingly moved up the rankings.

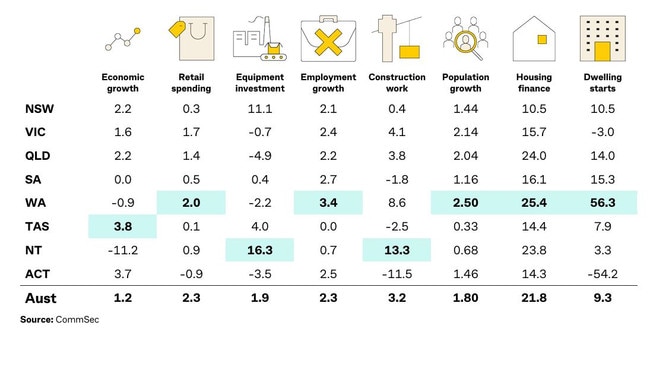

The latest CommSec report - which ranks each state and territory on eight key indicators including economic growth, retail spending, housing and employment - shows improvement for a number of interest-rate sensitive states.

Western Australia topped the list for the third straight quarter, boosted on the back of a strong labour and housing market, which is encouraging people to spend.

CommSec chief economist Ryan Felsman told NewsWire that while WA continued to outperform, Victoria had become the “real surprise packet”.

“The reason why it’s lifted is due to benefiting from solid retail spending and inbound overseas migration,” he said.

“But also, when you look at the decade averages, Victoria leads on construction work done, it’s second on retail spending and third on relative population compared with a decade ago.”

Mr Feldman said while the full impact of a rate cut would take some time to flow through the economy, it had acted as a stabiliser for states, especially in the housing sector.

“The interest-rate sensitive cities of Melbourne and Sydney are showing some signs of improvement on the back of that interest rate cut,” he said.

“Going forward, we could see a better momentum for both Victoria and NSW with likely interest rate cuts, given the household sensitivity to borrowing costs.”

Victoria’s rise comes after the Reserve Bank of Australia slashed the official cash rate in February, with CommSec saying states such as Victoria, NSW and ACT are usually the most impacted by interest rates.

The RBA chose to hold the cash rate after its April meeting, but is widely expected to reduce interest rates after its May 19-20 meeting.

“Looking ahead, an expected reduction in interest rates could boost economic sentiment in the mortgage-sensitive states of NSW and Victoria, while the interplay between interest rate cuts, federal election outcomes, and global trade dynamics will be crucial in shaping the economic landscape,” Mr Felsman said.

Mr Felsman said his bank was forecasting potentially three interest rate cuts - taking the official cash rate to 3.35 per cent - which could lift growth for states including Victoria, NSW and the ACT due to them being more heavily indebted.

“Of course, that’s been supplemented by solid population growth, and we have seen home prices in Brisbane and also Perth lead the nation, along with Adelaide, in better affordability,” he said.

“They have propped up the weaker states which have been hit by higher interest rates and higher borrowing costs - which are NSW, the ACT, Tasmania and also Victoria - so certainly we could see rate cuts support those interest-rate sensitive states.”

Mr Felsman said despite Victoria’s overall strength, it was held back by a softening job market.

“There have been almost 88,000 jobs created over the year to March, but the unemployment rate has crept up from 4.1 per cent a year ago to 4.5 per cent,” he explained.

“That’s the highest nationally, so we have seen the uplift in labour supply with that strong population growth and rising participation putting upward pressure on the unemployment rate.”

WA remains number one in the latest CommSec rankings, leading five of the eight economic indicators.

Previously holding equal second place, Queensland and South Australia have slipped to third and fourth respectively.

Tasmania is steady in fifth place but is joined by NSW, which has also seen a boost in the wake of interest rate cuts.

The two territories round out the pack, with the ACT remaining seventh and the Northern Territory in eighth.

However, CommSec concedes the decade-average method of assessing economic performance disadvantages the NT, which is held back by significant LNG construction from 2012-18 inflating a range of economic indicators.

Commsec also compiles rankings of economic momentum — that is, the annual growth rates for the eight indicators.