Fund official gains from poor investment

A UNION superannuation fund for meatworkers owns almost 22 million shares in a speculative biotechnology company.

A UNION superannuation fund for meatworkers owns almost 22 million shares in a speculative biotechnology company that has lost more than half its value and pays no dividend, fuelling concerns over how the retirement funds for some of Australia's lowest-paid are managed.

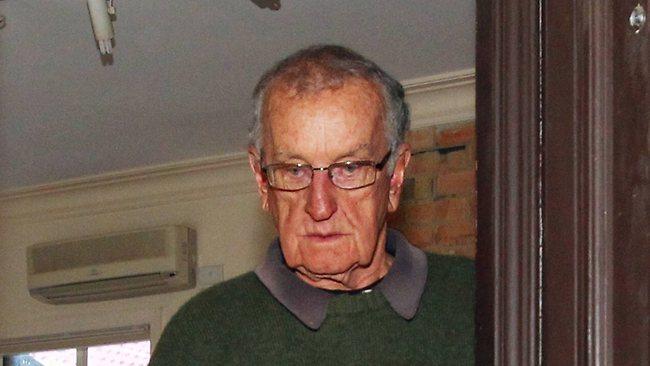

But a beneficiary of the high-risk investment has been the former chief executive of the Meat Industry Employees Superannuation Fund, Jon Addison, who was subsequently elevated to non-executive chairman of biotech company Phosphagenics.

Annual reports for Phosphagenics, which is listed on the Australian Securities Exchange and closed yesterday at 15c, shows Mr Addison receives almost $40,000 a year for the biotech role. Mr Addison has continued as a fund manager for MIESF since stepping down as its head.

The union-controlled superannuation fund was being reviewed by industry watchdog the Australian Prudential Regulation Authority as part of a preliminary probe into risk management and corporate governance, sources told The Weekend Australian yesterday.

The scrutiny comes after it was revealed tens of thousands of dollars were paid by property developer Austcorp to the fund's founder, former meatworkers' union heavyweight Wally Curran, who still helps run the fund and influences its investments.

Austcorp made payments to Mr Curran as well as Mr Addison, and Marek Petrovs, a special adviser to the fund, amid investments of about $30 million by the fund in cash-starved Austcorp - which subsequently collapsed with $900m in liabilities.

The three men have described the Austcorp payments they received as fair and appropriate remuneration for work they performed, including "property consulting" by Mr Curran and board roles by Mr Petrovs and Mr Addison.

They reject any suggestion that the payments they received influenced the fund's high-risk investment in Austcorp of about $30m, which has been lost.

A senior Austcorp employee said yesterday Austcorp desperately needed funds from MIESF.

Former senior Austcorp employees have described the relationships between the company and the union fund as highly unusual and detrimental for poorly paid employees of the meat industry.

A superannuation industry leader said yesterday that it was imperative for a fund as relatively small as MIESF, with an average member balance of less than $18,000, to avoid highly speculative investments because the strategy should be capital preservation with steady solid returns.

The union fund's investment in Phosphagenics at a significantly higher share price than now is regarded by other fund managers as impossible to justify because of the inherent risk of speculative biotech ventures.

Mr Addison said he strove to do the best for the union fund. He described his roles as a paid board member for companies that had benefited from the union fund's investment cash as important, as "it gives me the ability to see what's going on and to participate in the decisions".

Mr Petrovs said Austcorp's payments to himself and Mr Curran were legitimate.

"Wally is an honourable man and he would not be party to anything (untoward). I'm not putting a figure on how much Wally received, but it was modest. It's not up to me to welcome an investigation - people can do what they like. All I'm saying is that everything is above board."

Examination of the union fund's structure shows it lacks an external investment committee, meaning that an important barrier to unwise investments is not in place.

External investment committees vet proposals to spend members' money and are standard in super funds with strong corporate governance. However, union funds such as MIESF have avoided the oversight.