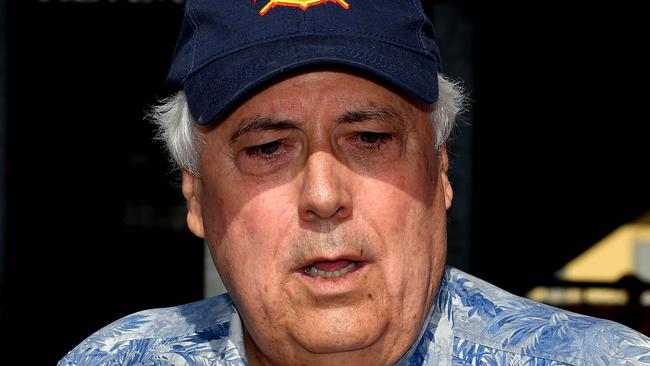

Palmer may have breached law before QN collapse: liquidator

Clive Palmer may have breached corporations law in the lead-up to the collapse of Queensland Nickel, liquidators say.

Clive Palmer may have breached Australia’s corporations law in the lead-up to the collapse of his Queensland Nickel company, taxpayer-funded liquidators allege.

In his first public statement since the lodgement of a mammoth Queensland Supreme Court case against Mr Palmer and 20 other defendants on June 30, PPB Advisory’s Stephen Parbery said his investigations showed the former federal MP might be liable to pay damages to QN.

“Accordingly, the (special purpose liquidators PPB Advisory) have commenced legal action to recover substantial funds for the benefit of creditors,” he said. “The claims against the various parties total in excess of $200 million.”

Mr Palmer is travelling in Europe and has not filed a formal defence to the PPB claim. The liquidators began serving the documents this week, but will face international law hurdles to serve four overseas-based defendants.

Mr Palmer did not respond to questions from The Weekend Australian yesterday, but last week said the claim was politically motivated. “No cause of action, just a political stunt by a desperate prime minister,” he has said previously.

Queensland Supreme Court documents filed by PPB Advisory allege Mr Palmer acted as a shadow director and allowed the company to trade insolvent before its collapse into administration on January 18 last year.

“The (civil) claims allege that Mr Palmer was a director of Queensland Nickel (whether duly appointed or as a shadow director) from 31 July, 2009, up until the time administrators were appointed to Queensland Nickel on 18 January, 2016,” Mr Parbery’s statement reads.

“Mr Palmer and (his nephew Clive) Mensink are personally liable for damages in excess of $13m for insolvent trading.

“Mr Palmer, Mr Mensink and (former managing director Ian) Ferguson are personally liable for breaches of directors’ duties at common law and under the Corporations Act ... Mr Palmer is indebted to Queensland Nickel for amounts in excess of $70m.”

Queensland Nickel owes more than $300m to creditors. Almost 800 workers lost their jobs when the Townsville refinery was mothballed. The sole registered director at the time was Mr Mensink.

The Federal Court this year issued arrest warrants for contempt of court against Mr Mensink because he has not returned from an overseas holiday to testify about the company’s collapse. He is also being sued by PPB Advisory.

“He is a defendant to these proceedings and a key witness to the events leading to the company’s insolvency,” Mr Parbery said.

The Weekend Australian understands corporate watchdog ASIC is monitoring the liquidators’ pursuit of Mr Palmer and Mr Mensink closely, but is unlikely to launch any action until the civil litigation has finished.