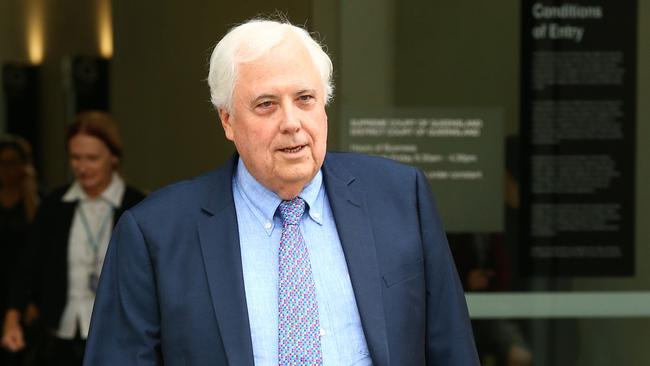

Clive Palmer faces $1m claim for unpaid harbour fees

Clive Palmer may be forced to pay more than $1m in port fees if he wants to get his Townsville refinery up and running.

Clive Palmer may be forced to pay more than $1 million in outstanding port fees if he wants to get his Townsville nickel refinery up and running again.

The Queensland Supreme Court is hearing a stoush between mining giant Mount Isa Mines and Mr Palmer’s Queensland Nickel Sales, which is managing the mothballed Townsville operation.

Mr Palmer’s separate former company, Queensland Nickel, collapsed under debts of $300m in January last year, costing 800 workers their jobs. MIM cancelled QN’s lease in March 2016 for a berth at the Townsville port — which it used to import and export ore and nickel to and from the refinery — because of more than $1m in unpaid harbour fees.

A new company, Queensland Nickel Sales, also owned by Mr Palmer, took over the running of the refinery in March last year, but the operation has been inactive since then — despite the former federal MP’s insistence he wants to restart the plant and re-employ north Queenslanders.

Now, MIM has applied to the Queensland Supreme Court for permission to remove, sell or scrap Mr Palmer’s equipment from the disused berth. The disputed inventory includes a ute, truck, excavators, a wharf conveyor system, and two 80-tonne pieces of equipment.

But lawyers for Mr Palmer’s Queensland Nickel Sales yesterday argued before judge Roslyn Atkinson that his company should still be allowed to use the berth. Justice Atkinson said at the very least QNS should pay the outstanding bill of more than $1m in harbour fees, before it could operate the berth again.

“The first thing is an offer to pay outstanding fees,” Justice Atkinson said, adding that a court was not likely to exercise its discretion when a party had not paid, or offered to pay, outstanding debts.

Dominic O’Sullivan QC, for Queensland Nickel Sales, said “no offer is made (today)”.

At the start of the proceedings, Justice Atkinson disclosed that “in about 1989, I acted for a company associated with Mr Clive Palmer. Does anyone have any objections to (me) hearing this matter?”

Neither side raised an objection.

The legal stoush is one of a slew of lawsuits stemming from the collapse of Queensland Nickel, which was north Queensland’s largest private employer.

Queensland Supreme Court judge John Bond will next week hear a dispute between Mr Palmer and FTI Consulting, Queensland Nickel’s general purpose liquidator, over the ownership of a Cessna plane.

The parties want Justice Bond to decide whether Mr Palmer owns the plane, or whether his liquidated company Queensland Nickel does, in order to work out by whom it can be sold, and by whom maintenance fees can be paid.

Mr Palmer — the founder of the now-dormant Palmer United Party — has denied any wrongdoing in relation to Queensland Nickel. Despite being the ultimate shareholder of the company, he claims he was retired from business and removed from the company’s day-to-day running when it collapsed.

However, liquidators allege Mr Palmer was pulling the strings as a shadow director, and should be held liable for some of the company’s debts.