Battlers sink as Clive Palmer cruises the Mediterranean

The workers Clive Palmer reckons aren’t owed a cent.

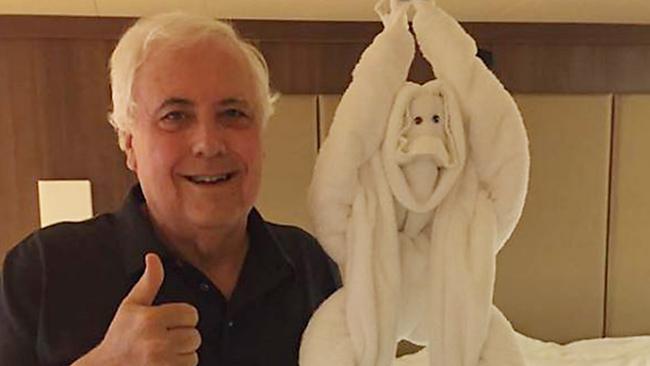

Stepping off a lengthy Mediterranean cruise into the Venetian sunshine at the weekend, Clive Palmer was pugnacious and prepared. When approached by The Australian’s European correspondent, Jacquelin Magnay, with questions about the $300 million failure of his Queensland Nickel venture, Palmer swung into a conspiracy-filled rant about biased media, Chinese spies and Malcolm Turnbull.

As his staff member James McDonald filmed the exchange, which the former federal MP later posted on Twitter and as a paid ad on Facebook, Palmer snapped when asked about the QN workers still out of pocket.

“There’s nobody waiting for money about anything; that’s just a lie,” said Palmer, dressed in a Hawaiian shirt and pink trousers, and jabbing his finger to emphasise his point.

“More of the fake news by Rupert Murdoch’s (News Corp) conglomerate. But it’s really about controlling Australian public thought.”

Despite his vehemence, Palmer is wrong.

Hundreds of his former employees are still owed redundancy entitlements, even after the federal government’s Fair Entitlements Guarantee safety net scheme paid out a record $66.8m to 759 of Palmer’s sacked staff.

Fresh figures released to The Australian by the federal Department of Employment show that 455 workers have not been paid entitlements worth about $6m because they are not covered by the taxpayer-funded program. Liquidators say workers also are due $1.1m in superannuation that was not paid.

As Palmer enjoys his summer jaunt through Europe accompanied by his friends, relatives, lawyers and staff, The Australian has checked in with some of his former refinery workers 18 months after north Queensland’s largest private employer was plunged into administration.

Some have only just found work, many are struggling to pay their basic household bills and others have been forced to leave Townsville in search of new jobs.

And while Palmer repeatedly has denied any wrongdoing, there’s palpable anger at his refusal to take any responsibility for the corporate collapse.

QN’s liquidators allege the refinery would still be operating had Palmer not used the business as a cash cow. Their forensic analysis of the company’s books found Palmer allegedly ripped money out of QN to pour into his political party, prop up other arms of his ailing corporate empire, maintain his Bora Bora resort and buy his Sunshine Coast golf course.

The failed company owes more than $300m to creditors, including nearly $70m to taxpayers and $6m to sacked staff. Two sets of liquidators have launched many-fronted legal claims against Palmer and his empire to claw back the cash, but any recovery of money will not be swift.

Joe Collocott is not holding his breath. The crane operator was made redundant from QN along with 236 of his colleagues on January 15 last year. Two months later, the remaining 550 workers were sacked and the plant was mothballed.

Collocott is $13,000 out of pocket but he’s not hopeful of ever seeing the rest of his hard-earned entitlements. Following the refinery’s closure, Collocott and his wife Carol ran a volunteer food bank out of their suburban garage, supplying his former workmates with essentials. The couple talked some out of suicide.

For Collocott, seeing Palmer living it up in Europe is maddening. “It turns my stomach, that’s the sad part about it,” he says. “It’s the flamboyant way in which he does things, and then he goes and spends even more money.”

Collocott was out of work for six months but now has a good job at Townsville port, working on the expansion of a berth. For the 65-year-old, retirement is further away than he’d like it to be.

Since Angie Bramwell’s husband Shaun was made redundant from the refinery she has become the heart of the unofficial operation to find his workmates new jobs to help rebuild their lives.

Shaun Bramwell has found seasonal work at a sugar-crushing mill in the lush cane fields south of Townsville and his wife has helped dozens more into new jobs.

But things are still tough.

“In the last 12 months we haven’t had a holiday,” Angie tells The Australian. “We have three kids and normally we would find a cheap deal somewhere and have a week away. But in this new world of seasonal work or contracts we just can’t do it.

“Shaun is still owed $3000 (of his redundancy entitlements) and that $3000 would pay half of our council rates. That’s our hardest bill to pay at the moment. It’s not the flash stuff of life that people are struggling with, it’s the real-world costs.

“People have been either treading water or their heads are actually going under.”

Former process operator David Barrett knows all too well about mounting bills.

The father of three was made redundant from Palmer’s operation in March last year after 11 years at the refinery.

It was only this week that he managed to find another job, moving tyres at a tyre wholesale warehouse.

“Things have been very tough,” Barrett tells The Australian. He was paid out the $95,000 in redundancy entitlements he was owed under the FEG halfway through last year. But the payout was quickly eaten up by bills and he was not eligible to apply for Centrelink assistance.

Barrett has just applied to his bank for another pause on his mortgage repayments, after it agreed to give him a six-month reprieve last year.

“Clive’s cruise, I read (in The Courier-Mail) it was $10,000 a head and that he took 20 people,” Barrett says. “That’s $200,000. I think it would have been better for him to spend that paying people what they are owed (by Queensland Nickel).”

But relief for creditors is unlikely to be quick.

The two sets of liquidators — general purpose liquidators FTI Consulting, financially backed by private litigation funder Vannin Capital, and special purpose liquidators PPB Advisory, funded by the federal government — have launched huge lawsuits in an attempt to claw back more than $300m owed to creditors.

The most recent claim, by PPB Advisory, sues Palmer and 20 other defendants — including two mysterious foreign women to whom Palmer paid $5.5m in November 2012 — for hundreds of millions of dollars. It alleges Palmer acted as a shadow director and recklessly allowed QN to trade while insolvent, after siphoning cash from its coffers.

A legal source told The Australian that the PPB claim alone could take at least five years to litigate given its complexity and the large number of defendants, including at least four international parties.

FTI’s main claim, a $106m Supreme Court action against Palmer’s flagship company Mineralogy, probably will be heard more quickly, with a trial possible early next year.

FTI Consulting’s John Park and his colleagues were selected by QN’s sole registered director, Palmer’s nephew Clive Mensink, as voluntary administrators in January last year.

But that hasn’t stopped Palmer from publicly attacking Park personally and from attempting to stymie the liquidators’ pursuit at every turn.

In an interview with The Australian, Park says the liquidators remained committed to clawing back creditors’ cash.

“That is our fundamental strategy — we want to focus in on available recovery actions to maximise creditor returns in the short term and not get distracted by sideshow litigation,” Park says.

“We’ve got a fiduciary duty to prosecute those claims diligently, for the benefit of priority and unsecured creditors of Queensland Nickel, who are owed about $300m.

“We’re committed to the recovery actions that are on-foot. They will be pursued diligently to bring them to fruition as quickly as possible for the benefit of Queensland Nickel’s creditors, including ex-workers, the federal government and — people have to remember — the normal trade creditors of the company.”

The liquidators’ claims, if successful, could drain Palmer’s personal fortune, recently estimated by The Australian Financial Review to be $344m.

But all eyes will be on the outcome of Mineralogy’s separate litigation with Chinese miner Citic in Western Australia. If Palmer does well in that legal action, it could result in tens of millions of dollars a year in extra royalties flowing into Mineralogy’s accounts. The extra cash would mean the Palmer empire would be able to discharge the QN liabilities, if ordered to do so by a court.

But if the Citic dollars do not flow, Palmer and Mensink could theoretically be bankrupted by QN liquidators.

And in the background the corporate watchdog, the Australian Securities & Investments Commission, continues its watching brief on the QN collapse.

Among other issues, it is looking into whether Palmer acted as a shadow director of QN, pulling the company’s strings behind the scenes, despite publicly claiming to have retired from business when he was elected as the federal MP for the Sunshine Coast seat of Fairfax in 2013.

As revealed by The Australian last year, and confirmed by Palmer himself in Federal Court public examinations, he used the email alias “Terry Smith” to approve expenditure at the refinery and issue instructions to its executives.

Palmer — understood to be enjoying a few days in Rome before heading to Bulgaria to visit his wife Anna’s family — did not respond to The Australian’s questions this week.

But he did post a pointed tweet yesterday: “Is it true or did you read it in The Australian.”

He has been adamant that he did nothing wrong before QN’s collapse. Palmer, an enthusiastic and prolific litigant, so far has defended all of the liquidators’ legal assaults.

He has not yet filed a defence to PPB’s Supreme Court claim but in a text message to Inquirer last week he indicated he would.

“No cause of action just a political stunt by a desperate prime minister,” Palmer said. “Who appointed ppy (PPB) to oversee the liberal party not a valid claim will be struck out if ever they serve it abuse process done for improper purpose (sic).”

In Townsville, the unemployment rate has improved slightly in recent months, but at 10.1 per cent it is still nearly twice the national average.

Mayor Jenny Hill does not mince words when it comes to Palmer and the devastating impact the refinery’s closure had on the local economy. QN’s failure deepened the pain already caused to the north Queensland city by the end of the mining boom.

Hill is urging Palmer to sell the mouldering refinery “for $1” to a new owner who could restart the business and hire locals.

“This is a man who claimed to be the worker’s friend,” Hill says. “But it was all talk. If he really was the battler’s friend, he’d sell it for $1 to someone else so we can get our jobs back.

“There are still a lot of people in our community struggling to pay day-to-day bills. And at the same time we see Clive Palmer on a luxury world cruise after he’s wreaked havoc on our city.

“It’s an insult.”