Are island dreams more a nightmare of paradise lost?

For many entrepreneurs, owning a resort island is the ultimate prize. But an idyllic location can host a litany of problems.

For many wealthy businesspeople, owning a Queensland resort island represents the next de rigueur purchase after the Toorak mansion, the Gold Coast penthouse, the super yacht and the private jet.

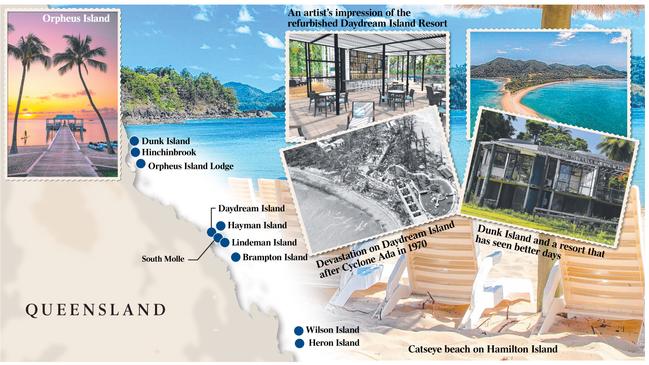

Think aviation pioneer Reg Ansett’s investment in Hayman Island; mining entrepreneur Peter Bond’s bargain buy of Dunk Island; and the last of the white-shoe brigade, Gold Coast developer Keith Williams, who owned Hamilton Island and Hinchinbrook, north of Townsville.

But down the track, when they cop the huge maintenance, staff labour, insurance, planning and development bills associated with island ownership, many of these self-made entrepreneurs end up losing millions of dollars on their prized island investments, particularly if they take the tough decision to sell. Repeated reports of shark attacks, such as the three recent maulings in the Whitsundays’ notorious Cid Harbour, do not help.

Rich lister Chris Morris stands out from the pack. He has learned something fast: how to make money from Queensland’s island resorts. The owner of luxury Orpheus Island Lodge, just south of Hinchinbrook, he says the secret to keeping a resort island financially viable is to keep guest numbers down to a minimum, given the excessive infrastructure costs associated with operating in the Great Barrier Reef.

Morris, the founder of Computershare, is relatively new to the tourism game, despite amassing a $350 million portfolio of pubs, island resorts and a casino.

“The days of the big development of resorts on islands (may be over), I don’t think they are sustainable,” he tells The Australian. “The cost of running resorts on islands is at least double the cost of running a resort on the mainland.”

Most of Queensland’s resort islands have been closed for years because of a combination of events, such as cyclones and excessive running and infrastructure costs. These include Brampton, Lindeman, Daydream, Hayman, South Molle and Dunk islands. But Morris says the Oatley family’s Hamilton Island stands out from the pack and is doing fine. “Hamilton is a different thing … it’s got its own townships. That is why I am aiming for the smaller islands,” he says.

But it’s not just infrastructure costs that can dampen profits. High labour costs and excessive staff turnover also can reduce profits, along with the need for huge insurance premiums against cyclone damage.

In recent years, cyclones Larry, Ita, Nathan, Yasi and Debbie have devastated many Queensland islands. And if island owners can secure an insurance premium — that’s “if” — some are paying premiums as much as $2m a year, says one seasoned island executive.

“Buying an island is like a return on ego,” says another senior hospitality executive.

“People fall in love with the location. The Whitsundays are incredibly beautiful. But it’s incredibly challenging to make money in Australia with labour costs so high.”

US hospitality giant Delaware North’s Lizard Island, about 240km north of Cairns, was hit by Cyclone Ita in April 2014 and was extensively renovated to the tune of $45m. Days after the opulent resort reopened it was hit again — by Cyclone Nathan in March 2015.

Delaware North, having failed to sell Lizard Island’s sublease, was forced to rebuild once again. The US group, ranked by Forbes magazine as one of the world’s largest privately held companies, has a large exposure to Queensland islands, having bought Heron Island and Wilson Island in 2009 along with the El Questro Wilderness Park in the West Australian Kimberley from the GPT group.

The once internationally famous Dunk Island, about 20 minutes from Mission Beach in far north Queensland, also has been twice devastated by cyclones and has languished in ruins since Cyclone Yasi in January 2011.

It also had been damaged by Cyclone Larry in 2005-06 and was picked up by Bond, founder of the failed Linc Energy, in 2012.

An international crypto-currency consortium that recently attempted to buy Great Keppel Island now apparently is eyeing off Dunk Island, Brampton Island and a New Zealand ski resort.

Sydney-based Tim Sommers, co-founder of Property Bay, revealed his plans for Dunk Island this month. He foreshadows a $500m redevelopment, building and selling villas, a glamping site, renovating the island’s 160-room hotel and adding an 18-hole golf course — if he can raise the funds and gain council approval.

The tropical paradise of Hamilton Island also has had its setbacks.

Its owner, Bob Oatley, cashed up from his $1.49 billion sale of Rosemount Wines in 2010, was running the resort when the 22km power cable linking the island to the mainland was severed.

‘Unless you can charge $1500 a night, it’s not viable. Keep your numbers down to 28 guests’

The lack of power cost the billionaire millions of dollars to keep the island running with generators in the months it took to repair it.

Sources estimated that Oatley, who bought the 650ha piece of paradise for about $200m, had a power bill of up to $1m a day.

The Oatley family recently has invested $30m upgrading the power house.

It hasn’t been cheap on the development front either, with the Oatleys forking out $100m to build the marina precinct and luxury resort Qualia, as well as the $45m it cost to develop an 18-hole golf course on neighbouring Dent Island.

About $16m is spent annually on the maintenance of the island’s roads, utilities and infrastructure. Nearly 10 years ago the Oatleys spent more than $1m on a glass-crushing machine, allowing Hamilton Island Enterprises to recycle by-products and reduce the volume going to landfill.

In comparison, Chinese group White Horse’s plan to redevelop Lindeman Island seem relatively mild. It has just appointed ASX-listed builder Watpac as preferred contractor on the project to reconstruct the island once controlled by French group Club Med under a $600m contract.

That will entail the development of a five-star beach resort and a six-star spa resort to be managed by the Accor-owned Banyan Tree, in its first Australian resort management contract. White Horse paid $12m for Lindeman Island in 2012 and has come under fire for the slowness of its redevelopment plans. Brampton Island off Mackay is on the market, with the owners, Melbourne’s United Petroleum, having done little to fix the property they bought for a bargain $5.9m about six years ago.

The leasehold for Brampton Island, 32km northeast of Mackay, was recently valued by the selling agent’s website at $20m. It went on the market last year. United Petroleum once had plans to build a seven-star resort on the island.

Daydream Island’s Chinese owners, China Capital Investment Group, are taking bookings for a soft opening from April 10 following a major renovation of the island they bought from vitamin entrepreneur Vaughan Bullivant. The Brisbane-based Bullivant had pumped millions into renovating the resort and had long tried to sell it. The resort closed in March last year.

Since its purchase, the Shanghai-based firm has pumped at least $100m into repairing and redeveloping the 4.5-star, 277-room Daydream Island, with major cost overruns.

The island’s food and beverage offerings also have been expanded to include four new restaurants. Three new bars will open, including a revitalised pool landscape with sweeping views over the Whitsundays. CCIG also owns the nearby South Molle Island resort.

Meanwhile, Hayman Island’s owner, Malaysian conglomerate Mulpha, confirmed last week that it had spent more than $120m on redevelopment.

Mulpha Australia chief executive Greg Shaw says Hayman Island “was always recognised as an iconic resort — we have taken it to the next level”.

Bookings are being taken for Hayman Island from July 1 but Shaw hopes it will open earlier.

British hotelier InterContinental Hotel Group will manage the resort following the exit of the Middle East-based One&Only from Hayman after it was extensively damaged by Cyclone Debbie in April last year.

Mulpha initially planned to sell Hayman but the sales campaign was abandoned. “What is clear to us is the Australian market is looking for a true five-star resort experience in Australia,” says Shaw. “Hayman Island will be a very unique product. We have completely refurbished and repositioned and refreshed it. It’s been a complete renovation of its food and beverage outlets and accommodation.”

As for Great Keppel Island, Sydney property developer Terry Agnew has just sold it for about $70m to a joint Singaporean- Taiwanese group after his failure to get the Queensland government to agree to developing a casino on the island off Yeppoon.

Agnew’s Tower Holdings sunk millions into planning developments including hotels, resorts and a Greg Norman-designed golf course. But it could not secure a joint venture partner to stump up funding for the estimated $600m redevelopment.

CBRE senior director Wayne Bunz says the Whitsundays offer some of the most magnificent locations in the world. “We will launch the sale of Queensland’s Long Island next March or April to coincide with the relaunch of Daydream Island,” says Bunz, who has been involved in some of the more spectacular Queensland island sales.

Bunz sold Daydream to CCIG for a hefty $33.5m and Lindeman Island to White Horse for $12m.

Meanwhile, Morris’s Orpheus Island deliberately accommodates fewer than 30 guests, and he is warning other owners to keep numbers down to that level because of the costs of providing power and water to the islands.

“You have to have a desalination plant — even at Orpheus we have an application in for a big solar plant. You have no mains to power an island,” he says.

“Unless you can charge $1500 a night, it’s not viable. Keep your numbers down to 28 guests.”