Your morning Briefing

Welcome to your morning roundup of what’s making news and the must-reads for today.

Hello readers. Here is your two-minute digest of what’s making news today.

Tax ‘Plan B’

Malcolm Turnbull’s sweeping corporate tax cuts are heading for defeat in the Senate, opening the door for the government to prioritise personal income tax cuts as a major selling point in the May budget. While Scott Morrison vowed last night the government would continue to fight for the company tax cuts, One Nation and the Nick Xenophon Team are lining up to oppose the package, estimated to cost $35.6 billion over the decade. They argue the reduction is unaffordable and are pushing for more immediate action to ease cost-of-living pressures for households. Plan B would not be so taxing, suggests Simon Benson.

-

The Albo show

Bill Shorten’s inner-circle is resigned to Anthony Albanese’s public positioning as an alternative Labor leader, saying they understand he has to do it “in case Bill gets hit by a bus”. A senior Labor figure and Shorten ally said there was no question Mr Albanese had been parading his leadership credentials. “We all know Anthony is doing this. He has to do it in case Bill gets hit by a bus,” the Labor MP said. An analysis of Mr Albanese’s comments stretching back to the May budget shows the frontbencher contradicting the Opposition Leader, or embarrassing him by promoting his own policies and political arguments.

“Albo knows he needs to position himself in case anything happens to Bill. We understand that. But the party is behind Bill. He’s doing a good job against (Malcolm) Turnbull, and there is no appetite to change the leader now. We’ve been there, we don’t want to go back.”

Labor MP

-

Airbnb time bomb

The summer holiday season has lifted the lid on a potential capital gains tax time bomb for thousands of budding Airbnb and Stayz entrepreneurs, with the Australian Taxation Office revealing that a burgeoning number of homeowners are “unwittingly” opening themselves to tax liabilities by renting out their homes on sharing sites. The home has long been seen as the great tax perk for the average Australian because of the capital gains tax exemption. But the ATO’s deputy commissioner in charge of small business, Deborah Jenkins, told The Australian that the ATO had been made aware of many people who were potentially exposing themselves to future capital gains headaches — oblivious to the implications of renting out their homes.

“While renting out your home may bring in extra income in the short term, we are finding that people are also, unwittingly, opening themselves up to capital gains tax liabilities.”

Deborah Jenkins, ATO deputy commissioner

-

Dow dives again

The Dow Jones Industrial Average has shed up to 680 points overnight as government bond yields touched multi-year highs, and investors continued to grapple with a recent pick-up in volatility. The Dow was most recently off more than 500 points, or 2.3 per cent, with all 30 of its components trading firmly in negative territory, led by a 3.8 per cent decline in Boeing, the price-weighted benchmark’s most influential component. Since its January 26 peak, the Dow has shed about 2,300 points, bringing it perilously close to correction territory, which it had slipped into in the early moments of trade on Tuesday before rebounding. A correction is defined as a decline of at least 10 per cent from a recent peak. The Dow stands down about 9.3 per cent from its all-time high. Keep up with all the latest developments in our live rolling blog, Trading Day.

-

NRL ‘not broke’

The NRL has dismissed suggestions it is under financial duress, despite revealing yesterday it had recorded its third consecutive loss, with a $3.7 million deficit. Chief executive Todd Greenberg predicted the NRL would return to profitability for the next five years, starting with a $40 million surplus in 2018, after releasing the code’s financial results for last year.

For the past few months the NRL has been plagued by rumours of financial problems, with the innuendo reaching a peak when the code was forced to seek a bank loan during the 2017 season.

“Any suggestion that we are broke could not be further from the truth.”

Todd Greenberg, NRL chief executive

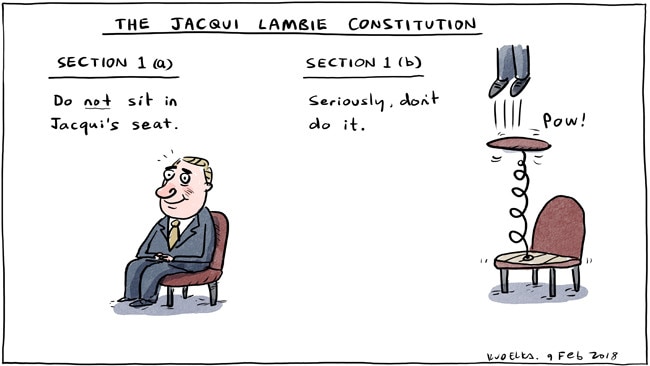

- Kudelka’s view