Treasury in warning on household savings raid

Treasury has warned that Australians will be forced to use their savings to counter record-low wage growth and rising living costs.

Treasury has warned that Australians will be forced to raid their savings accounts over the coming year to counter record-low wage growth and rising costs of living, leaving them more vulnerable to economic shocks.

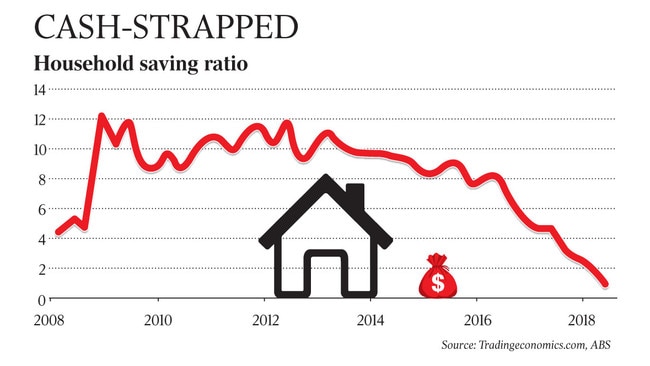

New Treasury secretary Phil Gaetjens yesterday predicted that Australia’s household savings rate, which has already hit a 10-year low of just 1 per cent, had even further to fall.

The warning from Mr Gaetjens sparked concerns from economists that the Morrison government’s growth forecasts are too reliant on strong consumer spending expectations.

Appearing before the Senate economics committee for the first time since his appointment in August, Mr Gaetjens gave an upbeat appraisal of the economy, highlighting the end of the mining bust, a jobless rate that has fallen to a 6½-year low and a budget on track to return to surplus in 2019-20.

But Mr Gaetjens — who served as chief of staff to former treasurers Peter Costello and Scott Morrison — said the economic outlook was complicated by the prolonged drought in the eastern states and the growing risk of a credit crunch if banks excessively tightened lending in the wake of the banking royal commission.

He said consumer confidence was picking up alongside the strengthening labour market.

“With income growth expected to pick up gradually, household consumption is expected to continue to support economic growth,” Mr Gaetjens said.

However, because consumer spending was forecast to outstrip increases in wages, the household saving rate was also “expected to decline further”, despite already reaching extremely low levels.

The household savings rate, which measures the amount of income people put aside after spending, dropped to a 10-year low in June. That was down from 1.6 per cent in the three months to March and 2.5 per cent from the June quarter last year.

While the falling savings rate is a boon for economic growth, because it means people are opening their wallets for retailers and helping job creation, economists warned that actual consumer spending was likely to be significantly weaker than Treasury forecasts. National Australia Bank chief economist Alan Oster said: “We think the consumer is probably weaker than what the official statistics are saying.”

Mr Oster said NAB’s internal data, which measures three million electronic transactions each day, showed consumers weren’t spending anywhere near as much as what the Australian Bureau of Statistics reckoned.

“We don’t believe the consumer can keep spending forever,” he said, raising doubts about Treasury’s economic growth forecasts.

Economist Saul Eslake said now that house prices across Australia were falling and superannuation returns were being crimped by sliding stockmarkets, consumers were likely to respond by closing their wallets. “The household savings rate is likely to trend up from here,” Mr Eslake said. “When asset prices are going up, people tend to save a smaller share of their income. But when asset prices are falling, people tend to be a bit more cautious and save more of their income. Household wealth has fallen for the last two quarters. If it continues to decline, which seems likely, you would expect fairly soon the household savings rate to go up.”

The most recent official figures showed the economy had grown at its fastest pace in nearly six years, expanding by 3.4 per cent. The jobless rate also tumbled last month to 5 per cent, historically the point where the Reserve Bank considers the economy to have reached “full employment”.

Mr Gaetjens warned that consumption could suffer if banks cut back too heavily on lending if standards were tightened dramatically following Kenneth Hayne’s financial services royal commission.

“Another key risk to the domestic economy is the apparent tightening of credit conditions, which could constrain consumption and investment growth,” Mr Gaetjens told senators.

He said there was already evidence of borrowers who had previously been able to borrow being turned away from lenders.

Treasury has established a taskforce to tackle the work stemming from the year-long royal commission, to be steered by financial system division adviser James Kelly.

Mr Gaetjens was yesterday forced to defend his record of advising on government policy, amid an onslaught of questions from Labor senators after he revealed that he didn’t supply a CV to the Department of Prime Minister and Cabinet during the nomination process.

Finance Minister Mathias Cormann batted away Labor attacks on the government’s selection of Mr Gaetjens, arguing the Coalition had appointed many former staffers to Labor ministers as departmental secretaries. “The CV of Mr Gaetjens is well known,” he said.

Under questioning from Labor senator Kristina Keneally, Mr Gaetjens said he was only marginally involved in the political aspects of his staffing roles.

“With respect to media releases and the political aspects of questions on notice, I took a very minimal approach,” he said.