Tax cuts to kill any benefit from surplus, says Deloitte

The budget’s return to surplus will be a ‘flash in the pan’ as windfalls are recycled into personal income tax cuts, analysis says.

The federal budget’s return to surplus will prove to be a “flash in the pan”, with economic forecaster Deloitte Access Economics raising the alarm that temporary revenue windfalls are in danger of being recycled into permanent personal income tax cuts.

The firm’s latest review of the economy, released today, says the Coalition government can look forward to good conditions through this year despite the continuing slide in house prices.

But it warns that the boost to company tax revenue that has powered the improvement in the budget is not sustainable.

Company tax revenue showed no growth in the seven years after the global financial crisis but has surged almost 50 per cent since 2015-16, boosted by the impact of soaring coal and iron ore prices on mining company profits.

“Treasury’s methodologies essentially assume that the bulk of the recent boost to the budget from a stronger Australian economy will linger.

“We doubt that will prove to be true,’’ the report prepared by Deloitte partner Chris Richardson said.

“In fact, the main reason why the Australian budget is improving is because the Chinese economy is worsening.’’

China is responding to a slowing economy by rolling out stimulus programs centred on the construction sector, which is boosting steel consumption and iron ore and coal prices.

“China knows that its stimulus worsens its existing imbalances around debt and over- building.

“So it can’t and won’t keep its pedal to the stimulus metal forever,’’ the report said.

“The good news evident of late in the budget will ebb once again.”

The analysis adds that the other major source of company tax revenue — the banking sector — is also under pressure with profits squeezed by rising global interest rates and tighter lending criteria.

“Australia risks repeating a version of our oldest budgetary mistake: between now and the federal election, both sides of politics will be busily making permanent promises off the back of temporary good news.’’

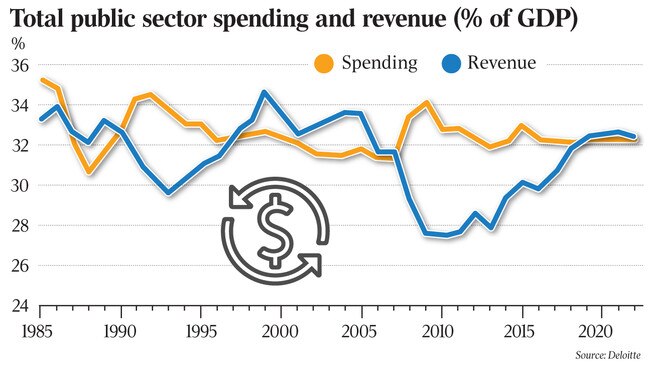

The firm notes that the tax system outperforms during economic upturns, such as Australia has been enjoying. Both unemployment and economic growth have been at their best levels since 2012.

In normal times, the federal government takes about a quarter of total national income in tax revenue, but this year it will collect 47 per cent of the entire increase in national income in taxes.

The government has already started spending some of that bounty.

The mid-year budget update last month showed the stronger economy had added $31 billion to budget revenue over the four-year forward estimate period, of which the government promised an extra $16bn in spending and personal income tax cuts.

These included extra spending on schools, aged care, drought assistance and a top-up of Western Australia’s share of GST revenue.

It also earmarked $10bn for further personal income tax cuts, which are expected to be unveiled ahead of the federal election.

The tax cuts announced last year are expected to reduce average personal income tax rates from 24.5 per cent of income to 23.5 per cent over the next three years, with the next round of cuts expected to further lower rates, which have been rising steeply since the last of the tax cuts financed from the resources boom were distributed in 2009-10.