Punishing company tax regime on par with Third World

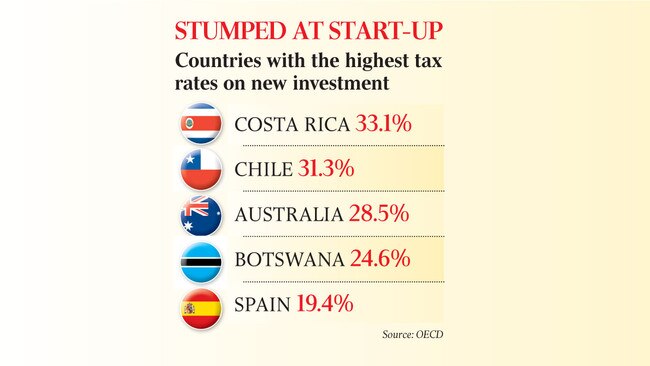

Australia’s tax treatment of new business investment is the third worst in the world.

Australia’s tax treatment of new business investment is the third worst in the world, imposing punishing effective tax rates that can rise above 50 per cent, an OECD report shows.

The report, released today, ranks Australia alongside a handful of African and South American countries for its treatment of company taxes, which are now much steeper than the advanced country average and include no incentives for investment.

The OECD shows the Australian budget is hooked on heavy company taxes, relying on them to deliver 16 per cent of budget revenue, which is the highest share in the advanced world and compares with an advanced nation average of 9 per cent.

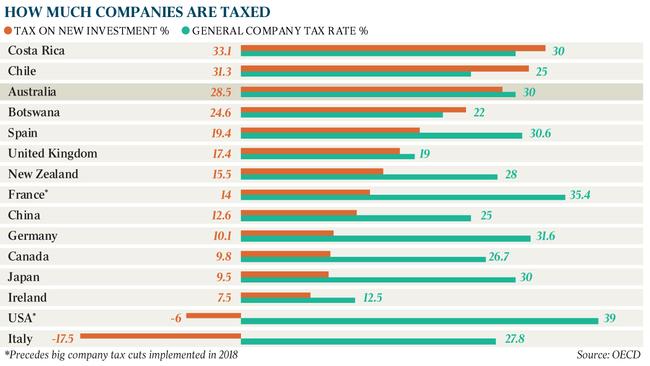

The failure of the Turnbull government to break the Senate gridlock last year to legislate a phased reduction in the company tax rate for big businesses to 25 per cent has left Australia among a group of 18 nations with a standard company tax rate of at least 30 per cent, nearly all of them developing nations.

France is the only advanced nation with a higher rate and it has legislated a cut to 28 per cent, while the US last year cut its company tax rate by 13 percentage points to 21 per cent.

The Australian company tax rate has stood at 30 per cent since 2000 but the average advanced country rate has come down from 32.2 per cent to 23.7 per cent in that time.

As well as its high company tax rate, Australia stands out for its heavy taxation of new investments. Most other countries, particularly those like Australia with relatively high standard company tax rates, offer tax breaks for new investments, usually by allowing companies to write off investment cost over a short period.

Nearly all Australia’s investment incentives were abolished by the Coalition government in 2000 to help pay for cutting our company tax rate from 36 per cent to 30 per cent.

The OECD report on the company tax regimes of 94 nations covering the advanced and most of the developing world, shows Australia has been left with the third-highest tax rate on new investment in the world. Only Costa Rica and Chile are taxed more.

The OECD calculates the effective tax rate on new investment in Australia is 28.5 per cent. The only other countries with effective marginal tax rates approaching this level are developing countries such as Argentina and Botswana. Australia’s rate is almost 10 percentage points higher than the next advanced country, Spain.

Tax rates on new investment are 10 per cent or less in Germany, Canada, Singapore, Japan and The Netherlands. Even before Donald Trump’s company tax cuts last year, investment incentives meant that there was an effective tax subsidy on new investment in the US equivalent to 6 per cent.

Josh Frydenberg last night said the OECD report showed Australia’s effective tax rate on new investment was “on the upper end” compared with other advanced countries. He said lower taxes were important for competitiveness.

“The Liberal National government introduced legislation to reduce Australia’s company tax rate and increase our competitiveness internationally, but Labor voted against this tax relief,” the Treasurer said.

He said the government had prioritised delivering tax relief for three million small businesses and unlike Labor would not impose new taxes.

While opposing a lower standard company tax rate, Labor is offering a tax break on investment, allowing companies to write off 20 per cent of investments in the first year, including purchases of intellectual property.

“There is no difference between the Labor Party and the Liberal Party when it comes to what the company tax rate should be.,’’ Labor Treasury spokesman Chris Bowen said yesterday.

“However, the Liberal Party will continue to make the argument for big businesses to get a cut in their company tax rate.”

Mr Bowen said Labor’s business tax break would deliver the best deal for business at this year’s election.

Australia’s treatment is particularly tough for investment in intellectual property such as patents, trademarks, software or goodwill. The OECD estimates the effective tax rate on new investment for such intangible assets is 52 per cent, putting Australia alongside developing countries like South Africa and Brazil.

KPMG tax partner Grant Wardell-Johnson said Australia’s tax treatment of intellectual property investment was a threat to the economy.

“For a long time in Australia’s history, investments in tangible assets — plant and equipment — have been the important driver of the economy but increasingly intangible assets like software, trademarks and goodwill on acquisition of businesses is important in a services based economy,” Mr Wardell-Johnson said.

Sydney start-up co-founder David McKeague said changes in the past year or two “have not been helpful” and were “going in the wrong direction”.

“I think the Australian Taxation Office was wanting to clamp down and they clamped down on start-ups as well as large companies,’’ he said. Mr McKeague is co-founder of Sydney start-up Curious Thing, which builds digital interviewer solutions using AI.

The founder of music start-up Muru Music, Nicc Johnson, said the R&D program was “absolutely crucial” to start-ups. “Without it, many start-ups would not survive and we would have been forced to create our IP overseas.”

Additional reporting: Chris Griffith