Marginals pain for Labor as tax grab hits thousands of voters in key electorates

Bill Shorten has risked igniting a backlash in key election battlegrounds over the policy of scrapping refundable tax credits.

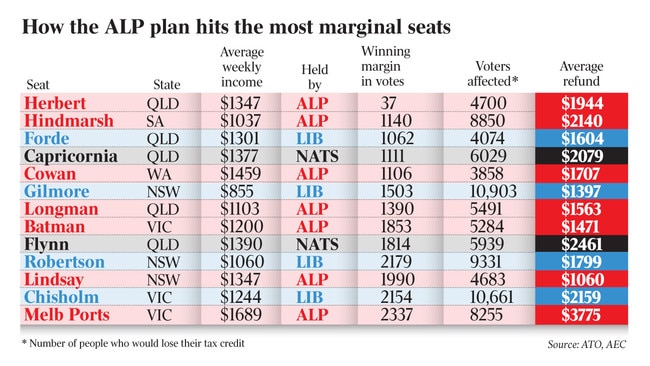

Bill Shorten has risked igniting a backlash in key election battlegrounds, with official data revealing that almost 90,000 voters across 13 of the most marginal seats in the country would lose an average $2000 a year in refundable tax credits under his policy.

As the Labor leader yesterday defended the $59 billion tax grab amid pressure from pensioner and retiree lobby groups, Treasury analysis of tax office data reveals seven marginal Labor seats could be vulnerable at an election.

Those seats have an average of almost 6000 voters who would lose thousands of dollars of income a year under the Labor plan.

In the country’s most marginal seat of Herbert in north Queensland, which Labor won at the 2016 election by only 37 votes, there are 4700 people who on average receive $1994 a year in refunds on tax credits from share dividends.

The ATO data suggests that the issue could also be a deciding factor in tomorrow’s by-election in the suburban Melbourne seat of Batman, which Labor is at risk of losing to the Greens, with 5284 voters receiving an average of $1471 a year in refunds. The same scenario could play out in the Queensland seat of Longman if Labor were forced to a by-election over questions about ALP MP Susan Lamb’s citizenship, with 5491 people collecting $1563 annually. Labor won the seat by just 1390 votes.

Treasurer Scott Morrison told The Australian: “Labor were hoping they would get away with it and try and slide this past hundreds and thousands of pensioners who depend on their tax refund to pay everything from their power bill to their grocery bill.

“Either Bill Shorten didn’t know, or he didn’t care. But either way he is going to pocket the tax refunds of pensioners and retirees.”

Mr Shorten and his Treasury spokesman Chris Bowen yesterday briefed opposition MPs about the details of the policy shake-up in a 30-minute phone hook-up of the Labor caucus after MPs were inundated with feedback from concerned constituents. The Australian understands that no one spoke out against the shake-up, but some were drawing up case studies to help explain the impact of the policy. “They went through the policy and we all had a chat,” a Labor MP said. “We have to explain it to the community and what the benefits are ... there were a number of people who were asking questions.”

Mr Shorten, speaking in Melbourne with the Labor candidate for Batman, former ACTU president Ged Kearney, branded government attacks on Labor’s plan a “ hysterical scare campaign”. But Ms Kearney was forced to back away from earlier comments that the plan could be reviewed, instead attempting to talk down the tax grab’s impact.

Greens leader Richard Di Natale moved to exploit Labor’s confusion ahead of the Batman by-election, saying the proposals “look like they could have a range of very serious unintended consequences”.

“It’s very clear here that we have a situation with Bill Shorten who is quite rightly raising the issue of inequality,” Senator Di Natale said.

“The Greens are very concerned that these changes could hit struggling pensioners — pensioners with low income, low assets — and make their lives harder.

“The Greens will do everything that we can using our power in the Senate and our numbers in the House to ensure that we scrutinise every aspect of Labor’s policy.”

In Batman, the ATO data shows it is home to 1052 pensioners receiving tax refunds.

Mr Morrison took aim at Mr Shorten after the Opposition Leader denied that he would seek to provide additional compensation to low-income pensioners who lose their refunds, following a report in The Australian revealing it was being considered.

“We’ve seen the circus of yesterday. They (Labor) are saying, ‘we’ll be compensating pensioners’. And today they say they won’t be compensating pensioners. They have no clue,” Mr Morrison said.

Tony Shepherd, who headed the Abbott government’s National Commission of Audit and is a former president of the Business Council of Australia, also spoke out against the dangers of making one-off alternations to the tax and superannuation systems. “There is considerable room in Australia for taxation reform but that must be done on a comprehensive basis with a thorough examination of the consequences,” Mr Shepherd told The Australian.

The ATO data shows about 84,000 NSW pensioners stand to lose money. Nearly 8000 of them are in the marginal seats of Gilmore, Robertson and Page, and 40,000 live in ALP seats.

More than 20,000 pensioners living in Labor seats in Victoria and almost 10,000 in Labor-held seats in Queensland would also lose out, according to the data.

The data shows that six Liberal and LNP-held marginal seats, which the government would likely lose in an election based on current polling, had similar numbers to the Labor marginal seats of pensioners and retirees who would be affected.

In the Queensland seat of Forde, which the LNP won by 1062 votes, there are 4074 voters receiving an average refund of $1604 while, in the central Queensland LNP seat of Capricornia that the Nationals’ Michelle Landry won by 1111 votes, there are 6209 voters receiving an average refund of $2079.

Mr Morrison will today visit the NSW south coast seat of Gilmore — won by Liberal MP Ann Sudmalis by 1503 votes — where there are 10,903 voters who receive an average refund of $1397.

The other marginal Liberal seats most affected by the policy include the central Queensland seat of Flynn — where there are 5939 voters receiving an average refund of $2461 — and the NSW central coast seat of Robertson where there are 9331 voters receiving an average refund of $1799.

The second-most marginal seat in the country — the Labor-held Adelaide electorate of Hindmarsh — has 8850 voters who receive an average refund of $2140.

Labor has warned that the value of the refunds at $6bn a year is unsustainable and will claw back $59bn in revenue over the decade by scrapping the measure initially introduced by the Howard government in 2001.