Labor to decide: yes to tax cuts or poll backlash

The Labor caucus will today decide whether to support the government’s $144 billion personal tax cuts.

The Labor caucus will today decide whether to support the government’s $144 billion personal tax cuts, or fight five by-elections and the next federal election as the party that denied tax relief to 95 per cent of Australian workers.

Scott Morrison yesterday declared the government would not blink in the face of Labor demands to split its income tax bill to allow a vote only on immediate tax relief for low and middle-income earners. “We are not splitting the bill, we are putting our entire personal tax plan to the Australian parliament and there’s a choice for the Labor Party to make,” the Treasurer said. “Are they for higher taxes or are they for lower taxes?”

Opposition Treasury spokesman Chris Bowen was last night due to recommend a position to shadow cabinet, setting out what Labor should do if it is forced to vote on the full tax plan.

The shadow cabinet position will be put before Labor MPs for their endorsement this morning.

Mr Bowen said Labor’s position would soon be “crystal clear”.

“Obviously, this issue is coming to a conclusion,” he said. “I will be making a recommendation to my colleagues about how to handle the personal income tax measures through the parliament.”

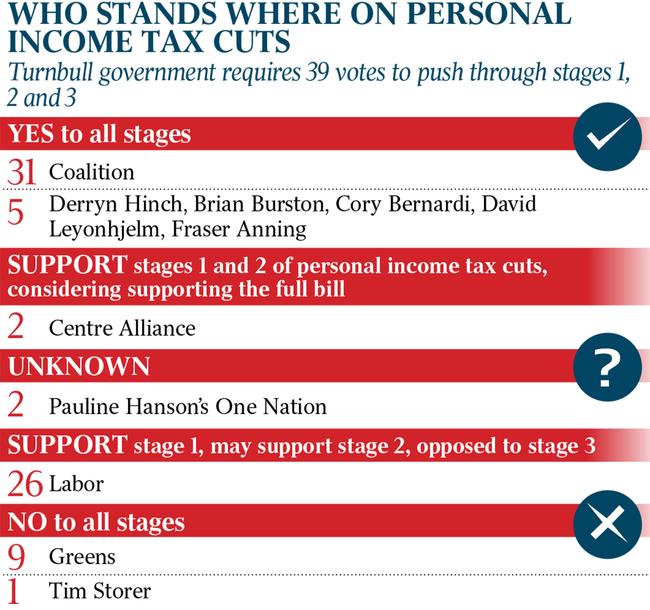

While seeking to extract maximum damage on Labor, or force it into a backdown, the Coalition remained hopeful yesterday it would get its income tax cuts through parliament even without opposition support.

The government needs three more crossbench votes in the Senate, and believes Pauline Hanson’s One Nation, and South Australia’s Centre Alliance, will ultimately provide them.

One Nation said it was analysing the bill and discussing it with crossbenchers and Labor. Centre Alliance said it had meetings scheduled with government and opposition representatives.

Labor supports the first phase of the planned tax relief, which would deliver an offset worth $530 to 10 million workers from July 1, together with an increase in the 32.5 per cent threshold from $87,000 to $90,000.

It has expressed concerns about stage-two cuts from 2022 to address bracket creep for the 19 per cent and 32.5 per cent rates; and a “high degree of scepticism” over stage-three cuts to extend the 32.5 per cent bracket from $41,000 to $200,000.

Labor hopes to secure the support of the Greens and at least four Senate crossbenchers to amend the bill to allow a vote only on the stage-one cuts. But even if such a move was successful, the government would use its numbers in the House of Representatives to block the amended bill, leaving Labor back where it started.

Mr Morrison warned there would be “a lot of games from the Labor Party in the Senate”, but “we won’t apologise or step back from plans we believe are good for the country”.

The government wants to get the tax package passed by the end of this sitting fortnight — the last before the stage-one tax cuts are due to take effect.

But the Treasurer said the cuts could “potentially” be backdated if they were passed at a later date.

Meanwhile, Labor yesterday rejected Treasury modelling showing a $10bn blackhole in its key savings plan to axe franking credit refunds for retirees.

The modelling, based on a two-month review of the policy, revealed that the behavioural shift expected from the impact of the policy on investors and retirees would be $1bn less over the budget forward estimates than the opposition had banked on.

Mr Bowen branded the analysis “a desperate stunt” from the government.